Gold SWOT: Anglo American will list Anglo-American Platinum in London

Strengths

- The best performing precious metal for the week was palladium, up 0.56%. According to CIBC, Agnico highlighted operational improvements related to the recently commissioned Shaft 4, improvements related to mining methods, and high-grade opportunities in the South Mine Complex Zone. This has improved working conditions and operational efficiencies, which yielded increased production and reduced unit costs.

- Anglo American will list its 79% owned subsidiary Anglo-American Platinum (Amplats) in London to stem capital outflows when the group unbundles its shares. “What we would be looking to do is set up a listing on the UK stock exchange to help manage that potential flowback,” Anglo American CEO Duncan Wanblad told Business Live in an interview.

- According to UBS, gold equities look attractive into 2025 with their coverage trading on average <5x enterprise value-to-EBITDA (EV/EBITDA) and >10% free cash flow (FCF) yield. With 2025 gold consensus (US$2,183/oz) -7% vs spot, they look to earnings upgrades across the sector.

Weaknesses

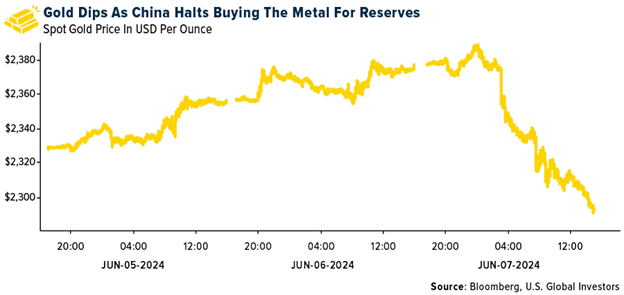

- The worst performing precious metal for the week was platinum, down 6.76%. Two factors hit the gold and precious metal prices on Friday, first data released by The Peoples Bank of China showed that China’s central bank didn’t buy any gold last month, ending a massive buying spree that ran for 18 months and helped drive the precious metal’s rally as reported by Bloomberg. This took about $40 of the spot gold price overnight.

- Further on Friday morning, the change in nonfarm payrolls data came in much stronger than expected, knocking anther $20 off the gold price and dashing hopes of any near-term interest rate cuts by the Fed. By the close of the day, spot gold had sunk close to $88 or 3.7%

- De Beers will ditch a controversial experiment to sell lab grown diamond jewelry, ending a six-year program that broke one of its oldest taboos. While the company long held the technology to make synthetic gems, it always refused to sell them as jewelry, fearing they would undercut the allure of natural stones, according to Bloomberg.

Opportunities

- Bank of America feels a competing asset class is not necessarily detrimental to gold: the rise of Bitcoin reinforces the investment case for gold, which could lead investors to view a mix of gold and Bitcoin as required in portfolios. The report noted 71% of U.S. financial advisors have little to no allocation in gold (1% or less). From our perspective as a gold fund manager, If the younger generation of Bitcoin investors start buying gold to diversify their investments, they will discover that it is very hard to hack a physical asset, insuring the safety of wealth from electronic threats.

- According to Bank of America, silver, a highly conductive and reflective metal, is an integral component in generating electricity through the photovoltaic effect in solar. The accelerated adoption of PV technology drove a 300% increase in PV related silver demand from 51 million ounces (Moz) in 2013 to 194 Moz in 2023.

- According to BMO, B2Gold announced that it has entered into an agreement to sell a portfolio of 10 precious and base metals royalties to Sandbox Royalties Corp (which has been renamed to Versamet following the transaction). In exchange for the royalty package, B2Gold will receive 153.2M common shares at a price of C$0.80/share.

Threats

- Botswana president Mokgweetsi Masisi wanted a quick separation from Anglo American in terms of the UK group’s plans to sell its 85% stake in the diamond miner. Botswana has a 15% stake in De Beers through a joint venture held with Anglo American which earlier this month outlined plans to sell its long-held diamond investment.

- According to RBC, for Sibanye, the current employment disagreement revolves around the entitlement to the employee share option scheme. Based on the existing agreement, employees would be entitled to this benefit once the Kroondal acquisition is completed. Although an agreement between the parties can likely be reached, this disruption adds another layer of complexity to the investment case amid still lagging PGM prices.

- Calibre Mining reports that a geotechnical incident occurred on the west wall of the Limon Norte open pit in Nicaragua on May 25 that did not impact personnel or equipment but requires a change to mine sequencing that will negatively impact Q2/24 gold production, according to Scotia.

Want more gold and precious metals content from CEO Frank Holmes? Sign up for the FREE Investor Alert by clicking here!

***********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of