Gold SWOT: Canaccord Sees Gold Setting New Record Highs in 2024

Strengths

- The best performing precious metal for the past week was gold, but still down 0.80%. MAG Silver provided its second-quarter attributable silver production of 2.19 million ounces, above CIBC’s expectations of 1.82 million ounces due to a combination of higher total tons processed, higher-than-expected grades, and recoveries.

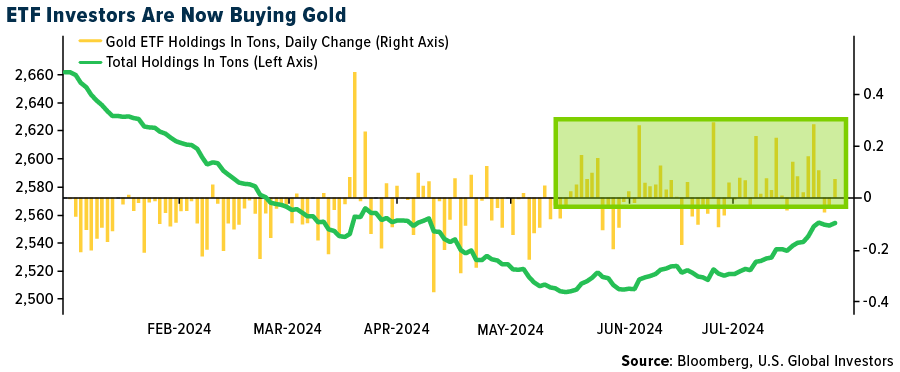

- According to Bloomberg, holdings in exchange-traded funds (ETFs) backed by gold are starting to inch higher. The last time they set a new low was in mid-May, suggesting that an enormous run of outflows that started (with some interruptions) late in 2020 may finally be ending.

- Vizsla Silver’s inaugural Preliminary Economic Assessment (PEA) for the Panuco gold-silver project in Mexico confirmed Stifel’s investment thesis that this mine will be an extremely high-margin mining operation. The economics are extremely robust, and the project quality continues to stand head and shoulders above peers, according to Stifel.

Weaknesses

- The worst performing precious metal for the past week was silver, down 5.70%. According to Bloomberg, China’s gold imports plunged last month for retail consumption, a sign that the nation’s buyers are deterred by the precious metal’s elevated prices amid a sluggish economy. Purchases from overseas by the world’s biggest bullion consumer fell nearly 60% to 58.9 tons, the lowest since May 2022, according to official data released Sunday.

- Artemis Gold announced it had responded to a wildfire evacuation order issued across a region including its Blackwater Mine. The company proactively removed all non-essential staff and contractors from the site and took precautions to safeguard assets, with essential staff remaining on site. Management expects to resume full-scale construction activities in the short term, according to Canaccord.

- The gold premium on physical gold on the Shanghai Stock Exchange, which it has held since late last year, has now flipped to a discount, indicating a waning in demand. China’s central bank paused purchases last April.

Opportunities

- Goldman finds that fear (measured as low consumer confidence), income (i.e., their China Current Activity Indicator), low China interest rates, and especially low gold prices all boost China gold demand. They estimate that a 10% drop in the Shanghai gold price boosts physical China gold demand by 16%.

- Canaccord shows that past Federal Reserve easing cycles over the last 20+ years have corresponded with higher gold prices, and they expect to see gold continue to set new record highs in 2024. The market is now pricing in a 98% probability of a first Fed cut in September. Another supporting factor for gold, in their view, is rapidly rising debt levels. The CBO recently increased its forecast for the U.S. deficit to $2 trillion for 2024, 7% of GDP, and for deficits to average 6.3% of GDP over the next decade.

- Announcing the Union Budget, India’s Finance Minister Nirmala Sitharaman announced a cut in gold and silver import duties from 15% to 6% “to enhance domestic value addition in gold and precious metal jewelry in the country.”

Threats

- Chow Tai Fook’s shares slid to the lowest since June 2020, after the gold seller reported a 20% on-year retail sales drop in the first quarter. Analysts attribute the decline to soft gold demand amid historically high gold prices and weak macroeconomic conditions, according to Bloomberg.

- Gold Royalty announced preliminary second-quarter Total Revenue, Land Agreement Proceeds and Interest a bit below BMO’s expectations. Given recent acquisitions and the ramp-up of portfolio assets, timing could potentially be off until the assets achieve a steady run-rate.

- Fresnillo’s second-quarter gold production was -13% versus JPMorgan’s estimate, and silver output was 6% higher than JPMorgan’s estimate. The beat on silver was largely due to stronger output at Cienega, Juanicipio and San Julian, despite lower output at Fresnillo. In gold, the miss is largely due to rain-related disruption at Herradura.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of