Gold SWOT: China’s Central Bank Expanded Its Gold Reserves for a Second Month

Strengths

- Platinum was the best-performing precious metal of the past week, rising 5.08%. K92 Mining reported record quarterly production for Q4 2024, with 53,401 ounces of gold, significantly surpassing RBC’s estimate of 29,404 ounces. The company also achieved record annual production of 149,515 ounces, a 27% year-over-year increase. Following the production beat, K92’s share price closed 15.58% higher.

- The World Gold Council (WGC) reports that global physically backed gold ETFs saw net inflows in December, reversing previous trends with an addition of $778 million. Asia and Europe led the inflows, while North America experienced modest outflows. Notably, 2024 marked the first positive December for global gold ETFs since 2019, with collective holdings increasing by four tons to a total of 3,219 tons.

- China’s central bank expanded its gold reserves for a second straight month in December, signaling renewed appetite after temporarily pausing purchases last year as prices soared. Bullion held by the People’s Bank of China rose to 73.29 million fine troy ounces in December, from 72.96 million in the previous month, according to Bloomberg.

Weaknesses

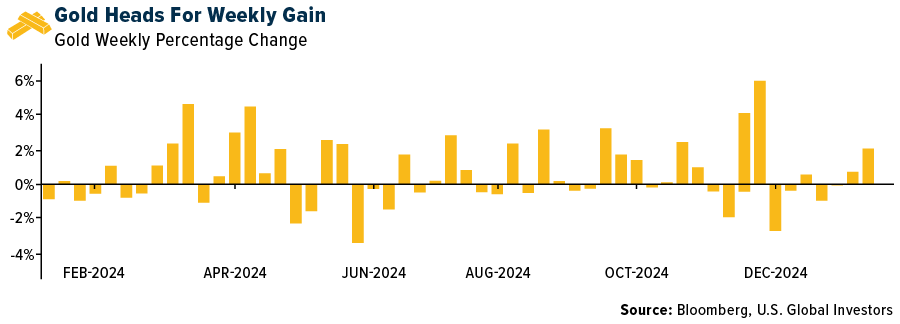

- Gold was the worst-performing precious metal of the past week, though it still posted a gain of 2.45%. According to Canaccord, Bellevue Gold reported Q4 2024 sales of 26.2K ounces, falling short of the consensus estimate of 38K ounces—a 30% miss. All-in sustaining costs (AISCs) were not disclosed. Following the announcement, Bellevue’s share price dropped 13.54%.

- Goldman Sachs said it no longer sees gold reaching $3,000 an ounce by the end of the year, pushing the forecast to mid-2026 on expectations the Federal Reserve will make fewer rate cuts. Slower monetary easing in 2025 is set to crimp demand for bullion-backed exchange-traded funds, causing analysts to project prices to hit $2,910 an ounce by year-end, according to Bloomberg.

- The U.S. Mint says American Eagle gold coin sales totaled 412,500 ounces in 2024, compared to 1,092,000 ounces in 2023, according to Bloomberg.

Opportunities

- For those looking to use historical trends as an investment guide to start out the year, very few assets have done better than gold in January. Data going back 30 years show spot gold gains on average 2.23%. That is five times the historical monthly average for the other 11 calendar months and nearly a full percentage point above the 1.4% average gain for August, the second-best month, according to Bloomberg.

- State Street, which oversees a portfolio valued at $4.73 trillion USD ($7.6 trillion AUD), highlighted growing concerns over the potential return of high inflation, rising government debt and escalating geopolitical tensions under a Trump administration. These factors are expected to drive increased gold buying as a means to protect wealth and hedge against uncertainty. State Street’s chief gold strategist, George Milling-Stanley, remarked, “We don’t see this changing and expect the secular demand trends supporting gold’s price and its status as a safe haven to continue bolstering its appeal as a core portfolio asset, even if capital markets adopt a risk-on tone in 2025.”

- Money managers are seeing plenty of reasons to remain bullish on gold, following a stellar 2024 that saw the precious metal post its biggest annual gain since 2010. Bullion surged 27% last year, hitting record highs as it soared to almost $2,800 an ounce. Three main factors fueled the rally: large purchases by central banks, notably those in China and other emerging markets; the Fed’s monetary easing, which makes non-yielding gold more appealing; and the precious metal’s historical role as a haven amid ongoing geopolitical tensions, according to Bloomberg.

Threats

- Barrick remains restricted from shipping gold from its Loulo-Gounkoto mining complex in Mali. In addition, an interim attachment order has now been issued against the existing gold stock on site which prevents its export and disrupts normal operations. Barrick’s president and CEO Mark Bristow says the inability to ship gold not only affects operations but has broader implications for the local economy, the 8,000 employees and its many local service providers. If this issue is not resolved within the coming week, Barrick will have no choice but to temporarily suspend operations at Loulo-Gounkoto, according to Bloomberg.

- According to BMO, gold’s geopolitical risk premium could decline in 2025. A combination of the collapse of the Basha al-Assad regime, reduced influence of Iran and the suggestions of a possible deal between Russia and Ukraine all point to gold seeing less “safe haven” demand in 2025 compared to recent years.

- China’s 40% surge in electric vehicle sales in 2024, reaching nearly 11 million units, signals a steep decline in gasoline demand and threatens palladium usage in catalytic converters. As China’s oil demand peaks and rapidly declines, the shift toward EVs challenges both global oil markets and palladium producers.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of