Gold SWOT: China’s Central Bank Topped Up Its Gold Reserves For An 18th Straight Month

Strengths

- The best performing precious metal for the week was silver, up 6.56%, which can be an indicator of speculative interest being revived in the precious metal trade. Gold consolidated early in the week between $2,340 to nearly $2,310, but the weaker than expected initial jobless claims came in higher than expectations, which launched gold higher, and the momentum continued Friday with the weaker than expected preliminary survey of consumer sentiment by the University of Michigan.

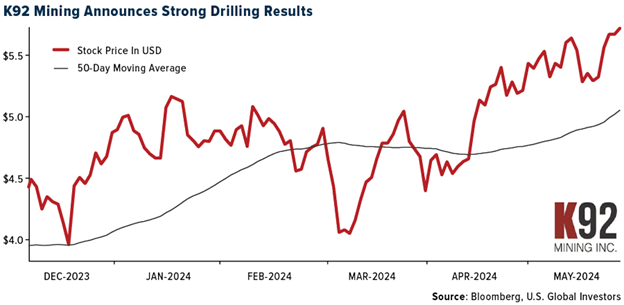

- K92 Mining reported drilling results from the Kainantu gold mine in Papua New Guinea that extended multiple high-grade zones and included a new dilatant zone discovery. At the Kora South deposit, a new dilatant zone was discovered with intercepts of 78.50 meters at 27.03 grams per ton gold equivalent and 34 meters at 8.14 grams per ton gold equivalent.

- Kinross reported operating results that surpassed RBC and consensus expectations with 4% higher production and 5% lower costs. This supported higher adjusted earnings per share (EPS) ($0.10 versus RBC $0.09). KGC reiterated annual guidance—in their view 1Q positions the company favorably to achieve annual targets.

Weaknesses

- The worst performing precious metal for the week was gold, but still up 2.66%. Gold Fields reported its Q1/24 operational results. While BMO had incorporated the softer quarter, costs came in significantly higher than expected. However, with backend-weighted production in H2/24, the company has kept overall guidance unchanged.

- Following a strong start to 2024, SA PGM exports for the month of March declined 13% year-over-year (YoY) and 12% month-over-month (MoM) to 504,000 ounces to the lowest levels since 2020. However, SA PGM exports year-to-date are still up 12% YoY and UBS continues to see increased exports for these metals to the West.

- Gatos' Q1 EPS of $0.04 compared with BMO’s $0.06 estimate, which included revenue of $72 million versus their $79 million. Notably, the JV continued to make strong capital distributions increasing Gatos' cash balance to $85.4M. All-in sustaining costs (AISC) of $14.36/ounce silver was at the low end of guidance and below their estimate.

Opportunities

- Data dating back to 2010 shows that in times of buoyant gold prices, exploration spend has typically followed. However, since 2019, exploration spend and the gold price have decoupled, Canaccord thinks driven by M&A. Over the last 10 years, periods of sustained exploration spend have typically been followed by several world-class discoveries.

- China’s central bank topped up its gold reserves for an 18th straight month in April, although the pace of buying slowed in the face of record prices. The People’s Bank of China has long been one of the market’s largest buyers, steadily growing its bullion holdings since 2022. However, the precious metal’s record-breaking rally since mid-February — with successive all-time-highs reached last month — seems to have dented demand, according to Bloomberg.

- A booming solar-power industry is driving a surge in the demand for silver, which is needed in large quantities to make photovoltaic panels. Silver is integral to the production of solar photovoltaic -- or solar PV -- panels because of its high electrical conductivity, thermal efficiency and optical reflectivity, as reported by the Wall Street Journal.

Threats

- JPMorgan summarized rainfall data for the April month for a selection of Australian projects, utilizing Bureau of Meteorology data. Rainfall 25%+ above the monthly mean was recorded at 11 sites, with East Coast assets in New South Wales and Queensland bearing the brunt coming out of the wet season.

- Gold’s 12% rally this year has put major bond and stock markets in the shade, but it does look to be losing momentum. That happens to coincide with a slowdown in the Chinese central bank’s purchases of the precious metal, according to Bloomberg.

- The Pan American Silver Escobal mine in Guatemala remains on care and maintenance as the ILO 169 consultations continue with the Xinka indigenous representatives and as a new government gains familiarity with the project. Management notes that the ILO 169 consultation process has experienced delays since the new government in Guatemala took office in January 2024, according to Canaccord.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of