Gold SWOT: China Gold ETFs Added $253 Million, Marking The Sixth Month Of Inflows

Strengths

- The best-performing precious metal for the week was platinum, up 3.94%, largely due to the declining demand trend for electric vehicles, which translates to more demand for platinum group metals in the short term. According to Bank of America, China gold ETFs continued to see inflows, adding $253 million and marking the sixth consecutive month of inflows. Gold ETF buying in China is driven by weak equities, a weakening local currency, and decreasing bond yields. Chinese gold ETF holdings are now at a record high.

- During fiscal Q1 2025, Asante Gold produced 53,379 gold equivalent ounces, compared to 51,372 gold equivalent ounces in fiscal Q1 2024. The increase in gold production was primarily the result of increased ore processed and gold recovery at Chirano, according to Bloomberg.

- Pan American Silver provided an exploration update that showcases the potential for meaningful resource growth at several assets. New drill results from Jacobina, El Peñon, La Colorada and Huaron continue to demonstrate the potential for resource replacement, with La Colorada and El Peñon showing particularly significant potential, according to Bank of America.

Weaknesses

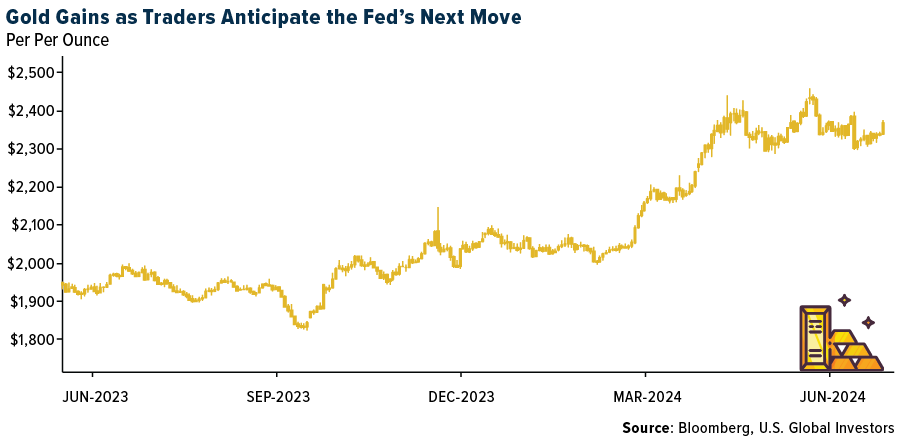

The worst-performing precious metal for the week was gold, down 0.58%. Stronger-than-expected manufacturing activity, expanding for a second month, and services data, at its highest level in two years, prompted a selloff in gold as we closed out the week. According to the World Gold Council (WGC), about 20 central banks surveyed expect to increase their bullion holdings over the coming year, so there still appears to be a strong floor being set by market forces.

- According to Bank of America, there is somewhat more subdued investor interest in gold. The price rally has run out of steam in recent weeks, and risk reversals show less interest in buying upside. This confirms that a Federal Reserve rate cut might well be necessary to trigger enough investor purchases for the yellow metal to move higher again.

- Polished natural diamonds are in a downward spiral, with prices still falling in June across all sizes. More importantly, Morgan Stanley sees little evidence that prices are at an inflection point, with the world's largest diamond jewelry retailer, Signet, stating that 1Q24/25 same-store sales fell by 9% year-over-year.

Opportunities

- According to BMO, Snowline Gold announced a maiden resource estimate at the Valley Gold Deposit located within the Rogue Project. This was highlighted by an indicated resource of 76 Mt at 1.66 g/t gold, resulting in 4.05 million ounces, and an inferred resource of 81 Mt at 1.25 g/t gold, resulting in 3.26 million ounces.

- Scotiabank initiated coverage of Snowline Gold with an Outperform rating and C$9 price target. The company's flagship project is Rogue, an exploration stage gold project in the Yukon, that the firm calls "one of the most exciting gold discoveries in recent years," citing long intervals of near-surface gold mineralization encountered over a large target area, multiple areas remaining open, and many nearby targets requiring follow-up exploration work.

- Harmony Gold's total group production for the year ended June 30 is expected to exceed the guidance of 1.55 million ounces, while all-in-sustaining costs will come in comfortably below 920,000 rand per kilogram as guided, according to Bloomberg.

Threats

- Scotia expects Agnico Eagle Mines to update costs and capital based on (1) a higher gold price, which impacts royalties, (2) FX USD/CAD previously at 1.30 (2024 guidance is 1.34), and (3) adjustments for inflationary pressures. It is important to note that costs will be impacted by changes in the gold price, exchange rate and inflation assumptions. They expect total cash costs to increase from the all-in sustaining cost (AISC) of $943 per ounce reported in 2022.

- According to Bank of America, China's physical markets are a bit subdued but remain supported overall, highlighting that jewelry sales keep hovering around seasonal highs. Similarly, China's domestic market keeps trading at a premium over international prices. Incidentally, China's silver market is well bid too, as domestic prices are trading at a premium. This is rare, and reversion to the mean is possible.

- Fitch affirmed the Kinross Gold issue-level rating on the senior unsecured credit facility, senior unsecured term loan and senior unsecured notes at BBB. The ratings and outlook reflect Fitch's view that Kinross will maintain an average mine life of at least 10 years, an average cost position in the second quartile of the global cost curve and an average annual production of at least 2 million gold equivalent ounces. Additionally, the ratings and outlook consider that the company will prioritize debt repayment while EBITDA net leverage is above 1.7x and generally manage EBITDA leverage below 2.3x. These could be aggressive assumptions.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of