Gold SWOT: Gold’s Record-Setting Rally Above $2,500 an Ounce Looks to Have Further to Run

Strengths

- The best performing precious metal for the week was palladium, up 1.67%, perhaps on Ford mentioning the scale back of its EV expansion program. According to Goldman, Zijin reported 1H24A recurring profit of Rmb15.7 billion, up 51% year-over-year, above the bank’s estimates due to operational improvement with higher realized ASP and lower-than-expected cost.

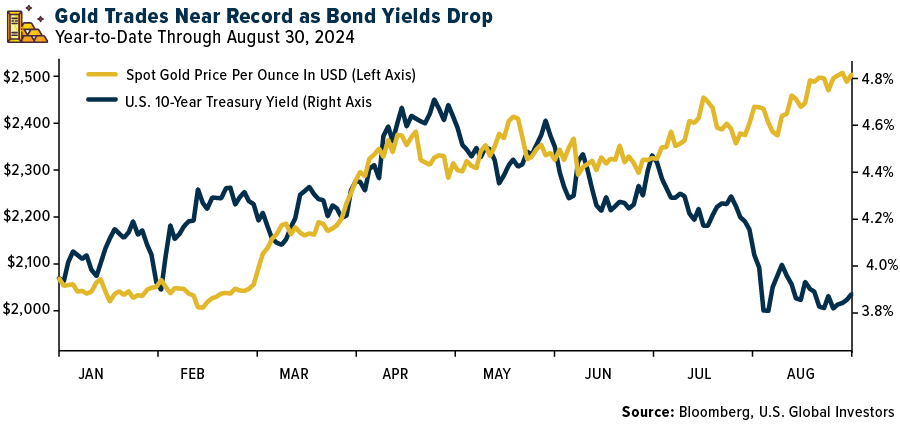

- Gold’s record-setting rally above $2,500 an ounce looks to have further to run as the Federal Reserve prepares to chop rates, traditional drivers such as lower yields return, and Western investors pile back in. “Everybody thought the Fed was going to be the last to cut, but now they’re getting in line,” said Jay Hatfield, chief executive officer of Infrastructure Capital Advisor.

- According to Scotia, Endeavour Mining announced that it has reached a settlement agreement with Lilium Mining with respect to the delayed payment and subsequent legal proceedings arising from the 2023 sale of Endeavour’s Boungou and Wahgnion mines in Burkina Faso. Pursuant to the settlement, Lilium will transfer the ownership of the Boungou and Wahgnion mines to the State of Burkina Faso, and Endeavour will receive upfront and deferred cash consideration totaling $60 million, plus a 3% royalty.

Weaknesses

- The worst performing precious metal for the week was platinum, down 3.64%, on little news. According to UBS, Zhaojin mining announced its H124 results, with net profit attributable to shareholders of Rmb553m (119% year-over-year) which missed expectations of Rmb700m.

- Gold Road reported its first half 2024 results with an underlying EBITDA of $94 million, 8% weaker year-over-year and lower than Bank of America’s expectations. The underlying net profit of $43 million was 15% lower than BofA’s expectations.

- According to UBS, at Hochschild Mining, the Mara Rosa mine achieved commercial production on May 13. However, mechanical availability issues and contractor delays have meant production is behind schedule. Although all issues are now resolved with production to increase in the second half of the year, production will be at the lower end of guidance and will be updated with third quarter results.

Opportunities

- Harmony Gold Mining beat its production target for fiscal 2024 on higher grades and said earnings jumped on surging gold prices. The South African miner of the precious metal expects to report earnings per share of at least 72 U.S. cents for the year ended June 30, which would be a 64% increase from fiscal 2023's 44 cents. This is driven by a 6% increase in gold production to 1.56 million ounces, according to Dow Jones.

- Opportunities for Torex Gold, according to Scotia, include nearing completion of the transformational $950 million Media Luna Au-Cu project for startup early next year, as well as free cash flow inflection in 2025. A capital return program could also be initiated next year.

- Bloomberg reported that Bitcoin has underperformed in August, stimmed by ebbing liquidity and lingering worries over the potential for governments to sell off their Bitcoin. Kaiko, a leading crypto industry data group, estimated the U.S. administration holds about 203,220 Bitcoin, followed by China’s 190,000, the UK’s 61,200 and 46,350 for Ukraine. Governments seize tokens in criminal cases, while Ukraine is thought to have received donations to help fund its defense against Russia’s invasion. Meanwhile, Mt. Gox has roughly 46,170 tokens left to distribute, Kaiko said. The trading backdrop has also become more challenging in the U.S. Bitcoin ETF sector, according to JPMorgan strategists. That’s based, in part, on a metric known as the Hui-Heubel ratio, which purports to provide insights into liquidity by measuring the number of trades it takes to move prices. “It is striking that this metric has been deteriorating for all spot-Bitcoin ETFs since March, pointing to overall deterioration of spot Bitcoin ETF liquidity over the past six months,” the JPMorgan team including Nikolaos Panigirtzoglou said. Any Bitcoin liquidation under these conditions could force money to flee to gold bullion.

Threats

- Major Chinese copper and gold producer Zijin Mining Group said a slowing global economy, geopolitical tensions, and resource nationalism could restrict its overseas deal-making ambitions. The company flagged negative factors in the future potentially impacting “the company’s revenue, profits, merger and acquisitions of new overseas projects,” according to Bloomberg.

- According to UBS, there is 8% downside risk to forward consensus earnings, on average, for South African gold producers. If spot commodity prices prevail, they calculate downside risk for the SA diversifieds (-5%), PGM miners (-19%) on an average market cap-weighted basis.

- Predictive Discovery’s share price dropped the most in three years with a surge in volume as the government of Guinea announced the suspending of permit applications and the processing of existing permits as they conduct a mining title review. Predictive Discovery finished the week down 15%.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of