Gold SWOT: Gold-backed ETFs attracted $1.4 billion in inflows during September Strengths

Strengths

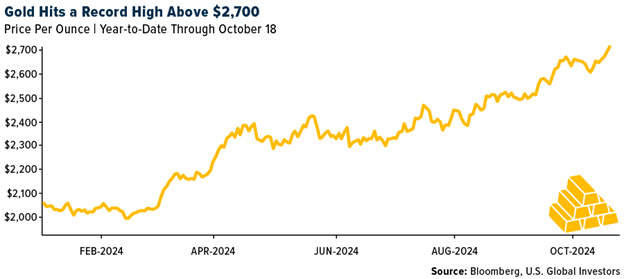

The best-performing precious metal for the week was silver, up 6.63%. A survey conducted during the London Bullion Market Association’s conference in Miami revealed that participants expect gold prices to increase by 10% over the next 12 months, with silver expected to gain over 40%, which indicates a stronger outlook for silver, according to Bloomberg. Gold hit a new record high on Friday, while silver is still significantly below its previous all-time high near $50 per ounce.

- Central bank gold purchases have been a key driver of the metal's record-breaking rally this year. In a rare move, central bank officials from Mexico, Mongolia and the Czech Republic openly praised the value of increasing gold holdings, signaling their growing interest in bullion, Bloomberg reported.

- The World Gold Council (WGC) noted that global physically backed gold ETFs attracted $1.4 billion in inflows during September. This marked a reversal of the outflow trend seen throughout 2024, with Europe being the only region still showing year-to-date outflows, according to Bank of America.

Weaknesses

- The worst performing precious metal for the week was palladium, but still up 1.37%. Silvercorp’s second quarter production for fiscal year 2024 was 1.66 million ounces, slightly below BMO’s forecast of 1.84 million ounces. Lower throughput at Ying and reduced silver grades, alongside weaker lead and zinc output due to lower grades, negatively impacted overall production, according to BMO.

- Equinox Gold reduced its 2024 production guidance for the Greenstone project from 175-205K ounces to 110-130K ounces. The company’s Q3 production of 42.5K ounces was well below CIBC’s estimate of 58.3K ounces, largely due to lower-than-expected average processed grades, according to CIBC.

- Calibre Mining’s share price took a hit, dropping as much as 13%, on Friday when they reported lower-than-expected gold production, due to higher-than-expected historical artisanal mining on the initial benches of the Volcan open pit. Calibre also lowered their production guidance for 2024.

Opportunities

- Spot gold prices are projected to hit all-time highs of approximately $3,000 per ounce by 2025. This bullish outlook is supported by potential interest rate cuts, growing geopolitical concerns and a rise in portfolio diversification, as suggested by a report by consultancy Metals Focus.

- According to RBC, silver has matched gold’s year-to-date gains of +30%, despite experiencing higher volatility. With the gold/silver ratio currently over 85:1—well above the 10-year average of 65:1—silver has room to rise further, potentially pushing the price over $40/oz if it reaches the 2020 ratio peak, according to RBC.

- Gold is expected to break out of its recent slump and move higher, fueled by central bank demand and increasing political uncertainty in the U.S. A 5.2% jump in September marked the largest monthly gain since March, largely due to the Federal Reserve's surprise 50-basis-point rate cut, Bloomberg reported.

Threats

- U.S. coin sales have been hovering near multi-year lows, with investors selling off coins as gold prices rise. This increased secondary supply during the rally is typical, but Bank of America believes that another catalyst may be needed to draw more investors into the gold market, although they remain optimistic about their $3,000 per ounce price forecast.

- Barrick Gold reported disappointing third quarter production figures, with 943,000 ounces of gold and 106 million pounds of copper. RBC noted that the company’s all-in sustaining cost (AISC) midpoint was 6% above consensus, and achieving full-year gold production guidance may prove difficult without significant Q4 output increases, according to RBC.

- China’s non-monetary gold imports dropped from an all-time high in Q1 2024 to multi-year lows over the summer. This decline followed government signals of another round of monetary and fiscal stimulus, which lifted equity markets and may limit gold’s near-term upside potential, according to Bank of America, though prices are still expected to hold above $2,000 per ounce.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of