Gold SWOT: Gold Erased Some of Friday’s Losses as the Dollar Weakened

Strengths

- The best performing precious metal for the week was palladium, up 5.23%, perhaps in response to Sibanye Stillwater’s announcement of curtailing production unless the price improves. The amount of gold reserves parked overseas by the Reserve Bank of India dropped to the lowest level in six years at the end of March--47% of the total—since it started accumulating the precious metal in December 2017, according to Bloomberg.

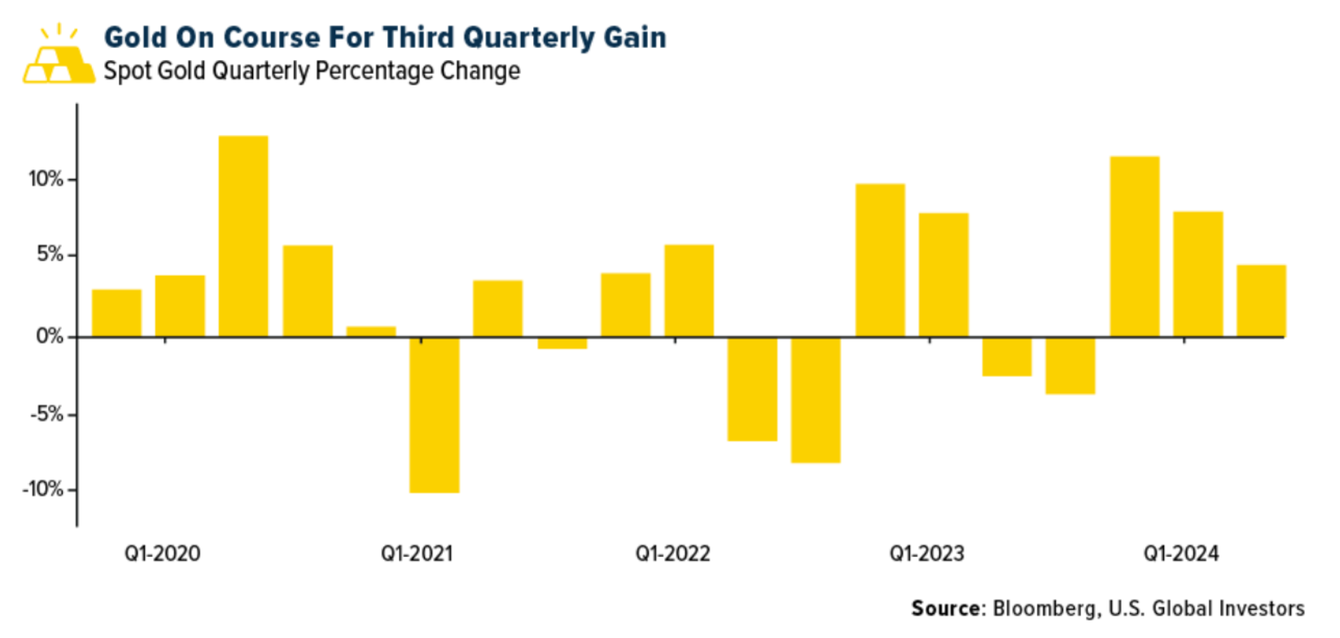

Gold erased some of Friday’s losses as the dollar weakened. The precious metal edged up to trade above $2,320 an ounce. Prices fell the most in two weeks after strong U.S. services activity highlighted the potential challenges in cutting interest rates. Higher rates are generally bearish for non-interest-bearing gold, according to Bloomberg.

- Exchange-traded funds (ETFs) added 231,696 troy ounces of gold to their holdings in the last trading session, bringing this year's net sales to 4.74 million ounces, according to data compiled by Bloomberg.

Weaknesses

- The worst performing precious metal for the week was silver, down 1.69%. Several indicators point to cooling gold demand from the Chinese jewelry sector in the last two months. Withdrawals by wholesalers from the SGE fell to 82 tons in May. The latest reporting from large jewelry retailer Chow Tai Fook showed no quarter-on-quarter growth in “gold jewelry and products” from mainland stores to date in the second quarter, according to Bank of America.

- Platinum jewelry demand has been in decline despite platinum’s growing discount to gold in the last few years. Headwinds for Chinese platinum jewelry demand is three-pronged. A relatively sluggish economy, an aging population and high youth unemployment have resulted in a shift in jewelry sales patterns, according to Bank of America.

- According to Bloomberg, shares of Victoria Gold plunged the most on record after suspending operations at its flagship mine in Canada’s Yukon following a heap leach failure. Its stock fell as much as 87% to $1 a share, its lowest since December 2002, in Toronto on Tuesday, a day after the Canadian bullion producer disclosed the incident at its Eagle Gold Mine. Victoria Gold has about C$235 million of outstanding debt relative to its C$75 market capitalization.

Opportunities

- Snowline Gold provided a maiden resource with details on the different zones by grade and tonnage. Notably, Scotia thinks the near surface high-grade comprising 39 million tons at 2.35 grams per ton (g/t) gold could sustain production for 10 years under a 10K tons/day scenario or four years under a 25K tons/day scenario. The total resources identified was 7.3 million ounces at a grade of 1.45 g/t gold, which is an attractive target for development of a larger scale mine at 300,000 plus ounces per year.

- Bank of America believes gold can hit $3,000/ounce over the next 12-18 months, although flows do not justify that price level right now. Achieving this would require non-commercial demand to pick up from current levels, which in turn needs a Federal Reserve rate cut to happen. Ongoing central bank purchases are also important, and a push to reduce the share of USD in foreign exchange portfolios will likely prompt more central bank gold buying. BNP Paribas’s David Wilson, senior commodity strategist at the bank, noted that long term, growing demand for silver for use in the energy transition will help it “partially delink from being a cheap gold proxy,” with few primary silver mines around the world to meet a growing demand for the metal.

- According to Bank of America, with respect to the non-core asset sale process at Newmont, both Akyem and Telfer are expected to be concluded, with proceeds paid-out, in the second half of 2024. The Akyem process was described as “competitive” and expected to be paid all in cash; Telfer might be a mix of cash and equity. The non-core North American asset sales are more likely to conclude in early 2025, with cash payment preferred, though NEM might consider equity.

Threats

- Evolution Mining provided a growth capex outlook for Cowal of $1 billion over the next five years, double Bank of America's prior estimate. Additionally, mining cost guidance was provided, highlighting that all-in sustaining cost (AISC) will rebase higher at A$1,700/ounce. Consensus estimates for AISC at Cowal sit at $1,550/ounce over FY25/26 and are yet to fully incorporate the higher cost base.

- To interest-rate strategists at Barclays watching the presidential debate Thursday night, the trade was clear: Buy inflation hedges in the U.S. Treasury market. With former President Donald Trump appearing more likely to unseat Joe Biden in the

- November 5 election, the market should "be pricing in a considerable risk of higher-than-target inflation in the coming years," Barclays strategists Michael Pond and Jonathan Hill said in a note. They suggest investors consider five-year Treasury inflation protected securities, or TIPS, that should outperform a straight five-year Treasury note. Outside of Barclays' recommendation, hard assets versus financial assets may also complement your portfolio.

- Sibanye Stillwater will put the Stillwater palladium mine in the U.S. on care and maintenance if “there’s no correction in the price,” Chief Executive Officer Neal Froneman said at a conference in London.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of