Gold SWOT: Gold ETF Holdings Saw Their First Monthly Inflow in 12 Months, Totaling $529 Million

Strengths

- The best performing precious metal for the past week was gold, up 1.00%. The World Gold Council (WGC) published its gold ETF flow data for May this week. Gold ETF holdings saw their first monthly inflow in 12 months, totaling $529 million or 8.2 tons.

- Vizsla Silver highlighted results from 12 new drill holes targeting the Copala resource area at its Panuco silver-gold project in Mexico. CS-24-354 returned 1,503 grams per ton of silver equivalent over 13 meters true width, including 6,229 grams per ton of silver equivalent over 1.40 meters and 3,813 grams per ton of silver equivalent over 1.31 meters, reports Bloomberg.

- Exchange-traded funds (ETFs) added 2,447 troy ounces of gold to their holdings in the last trading session, bringing this year's net sales to 4.47 million ounces, according to data compiled by Bloomberg. This was the eighth straight day of growth, the longest winning streak since March 28, 2022.

Weaknesses

- The worst performing precious metal for the past week was palladium, down 3.20%. According to RBC, Evolution Mining had previously maintained fiscal year 2024 guidance, and a 26,000-ounce impact implies 218,000 ounces for the fourth quarter. This is 6% below RBC’s estimate. Accordingly, the company’s cash flow is tracking below its fourth quarter forecast.

- for Evolution, continues RBC, Cowal underground was not affected by the rainfall. Rainfall data from the Bureau of Meteorology and Elders Weather suggests that, while quarter-to-date rainfall has been higher than average at both sites, neither was substantially high versus peak months in the year. This creates some difficulty forecasting the quantum of impact at each site.

- A massive expansion in global solar manufacturing capacity is expected to suppress profits at least through the rest of this year even as demand for panels surges, reports Bloomberg. Prices for solar modules will remain near record lows in 2024 and some manufacturers will be forced to sell at a loss at times if they want to keep production lines running. Despite the current glut, more capacity to produce solar cells is still being added and this has helped keep silver demand firm.

Opportunities

- TriStar Gold announced this week they had received a favorable approval for their Preliminary License and the Environmental Impact Assessment for the Castelo de Sonhos gold project in Brazil. This was a major derisking event for TriStar, allowing the valuation to climb by over 50%. This puts TriStar to be able to engage in a more constructive manner with a mining company looking to take on a new project in a jurisdiction like mining friendly Brazil.

- Torex Gold Resources provided details on a multi-year exploration strategy for its highly prospective Morelos Property, designed to generate incremental additions to mineral resources in the near term, generate at least one new discovery in the mid-term, and extend the mine life at Morelos to deliver stable production and cash flow well beyond 2033, according to Bloomberg.

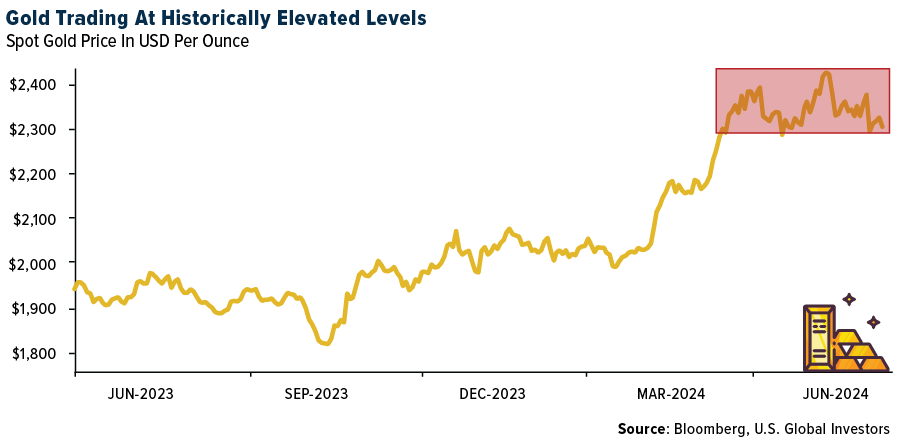

- Bloomberg reports that Asian retail gold buyers are still keen to acquire gold, even as prices hover at record highs. Participants at a precious metal conference in Singapore were enthusiastic about the future prospects for further gains in the price. With uncertainty regarding upcoming elections in more than 40 countries, the lack of traction in the Chinese economy, and less comfort in parking money in U.S. debt is giving gold an edge as a savings vehicle.

Threats

- Canaccord believes that SSR Mining will continue to assume an indefinite suspension at Çöpler. Çöpler is 80% owned by SSR Mining, 18.5% by Lidya Madencilik Sanayi ve Ticaret A.Ş. (Lidya), and a bank wholly owned by Çalık Holdings A.Ş. holds the remaining 1.5%.

- According to Canaccord, for SSR Mining remediation is estimated to cost $250-300 million at Copler, with an expected completion time frame of 24-36 months. SSR Mining remains fully financed for these efforts, in their view. The heap leach pad is expected to be permanently closed, and any future operations are contingent upon regulatory approvals.

- According to UBS, the ramp-up of Gold Fields’ Salares Norte project has been further impacted by adverse weather, affecting the volume and cost guidance for FY24. Although the overall 2024 group production guidance was only reduced by 5.5% and the all-in sustaining costs (AISC) increased by 4.5%, UBS believes that the additional delays in the Salares Norte ramp-up will likely diminish investor confidence in the project's medium-term potential.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of