Gold SWOT: Gold is Finding Momentum, Touching a New All-Time High of $2,470

Strengths

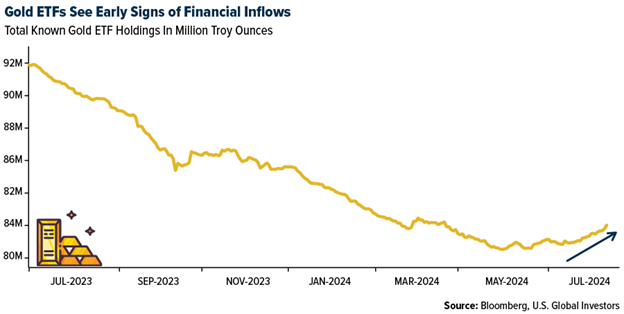

- The best performing precious metal for the week was gold, but still down 0.80%. Total known ETF holdings of gold bottomed out at 80 million troy ounces on May 13, 2024. Since then, investors have had a change in outlook regarding the precious metal, with ETF holdings of gold rising to 82 million troy ounces, a 2% increase. A 2% lift might seem trivial, but holdings have dropped 27% from their high set back in September 2020.

- RBC views Alamos Gold's elimination of over 50% of the inherited Argonaut hedge book favorably, increasing leverage to expected higher gold prices over the next several years as production from Island/Magino ramps up. They continue to see the acquisition of Magino positively, given the expected tangible capex and operating synergies at the new Island Gold complex, and see potential for further upside from resource growth and optimization during Magino's ramp-up.

- According to BMO, Franco-Nevada has acquired a gold stream on SolGold plc's Cascabel copper-gold project in Ecuador for $525 million. This stream provides Franco-Nevada with an attractive use of cash, further growth optionality and increased future exposure to gold and precious metals. They estimate the internal rate of return (IRR) of this stream (including staged payments) at 6% and with further upside.

Weaknesses

- The worst performing precious metal for the week was palladium, down 7.08%. According to Bank of America, Barrick's second-quarter gold production of 948,000 ounces was 1% to 4% below Bloomberg consensus at 983,000 ounces and Visible Alpha (VA) consensus at 971,000 ounces. Gold production was up a modest 1% quarter-over-quarter. Production in the first half and guidance for the second half are 2-2.4 million ounces.

- According to BMO, Petra Diamonds reported its fourth-quarter operating update with a miss on diamond production relative to their estimates. Annual production also came in slightly below the revised annual guidance. However, diamond sales, and therefore revenue, was in line as all the Tender results were already pre-released.

- According to BMO, Aris Mining reported Q2/24 gold production of 49,000 ounces, which missed expectations. This was due to the Segovia Operations processing relatively low-grade zones in the production schedule. The company reiterated 2024 production guidance (220-240 thousand ounces), noting that it will meet the lower end, and provided construction updates on the Segovia and Marmato expansions.

Opportunities

- According to Scotia, Calibre Mining announced a 100,000-meter expansion to its existing 60,000-meter drill program at the Valentine gold mine in Newfoundland and Labrador. The expanded diamond drill program will include high-definition property wide LiDAR geophysical surveying, till sampling and enhanced prospecting to assist with resource expansion and discovery drilling.

- Franco-Nevada announced its subsidiary has acquired a gold stream from SolGold plc with reference to production from the Cascabel project located in Ecuador. FNB has partnered with Osisko Gold Royalties' subsidiary to provide a syndicated financing package on a 70%/30% basis. FNB will provide a total of $525 million and Osisko a total of $225 million of funding for a total of $750 million.

- Gold is starting to find momentum, touching a new all-time high of $2,470 per ounce. So far, physical factors have driven the rally, but Morgan Stanley has argued financial flows will drive the next leg higher. This is starting to come through.

Threats

- According to Bank of America, while rising silver demand from solar PV manufacturers has contributed to the recent rally, operators are now looking to reduce silver loadings. This has been well flagged and is worth following, because solar panel manufacturers have been able to reduce silver loadings in the past.

- According to Morgan Stanley, Evolution Mining’s fiscal fourth quarter was pre-flagged for weaker production in which production of 212,000 ounces was in-line with consensus. Underperformance was driven by Red Lake and Mungari, offset by Cowal.

- Scotia ascribes a slight negative bias to First Majestic’s announcement. While second-quarter production results were in line, full-year cost guidance was weaker than previously guided. Following these updates, at spot metal prices, they forecast First Majestic could generate free cash flow (FCF) of $34 million ($0.12 per share) in 2024.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of