Gold SWOT: Holdings in Gold ETFs Expanded Again in August

Strengths

- The best performing precious metal for the week was gold, off just 0.07%. According to CIBC, Lundin Gold had produced 245,000 ounces gold, tracking in line with full-year production guidance of 450,000-500,000 ounces. First half of 2024 AISC of $872 per ounce compared well to guidance of $820-$890 per ounce.

- Harmony Gold Mining Co. said its profit in the last fiscal year likely rose 78% after it increased output as bullion prices notched successive records. The company expects to post earnings per share (EPS) of as much as 13.88 rand ($0.78) for the 12 months through June, up from 7.80 rand in the same period a year earlier, according to a statement released on Monday. However, Harmony warned that costs could rise in the double-digits range in the current year, which took the wind out of the share price.

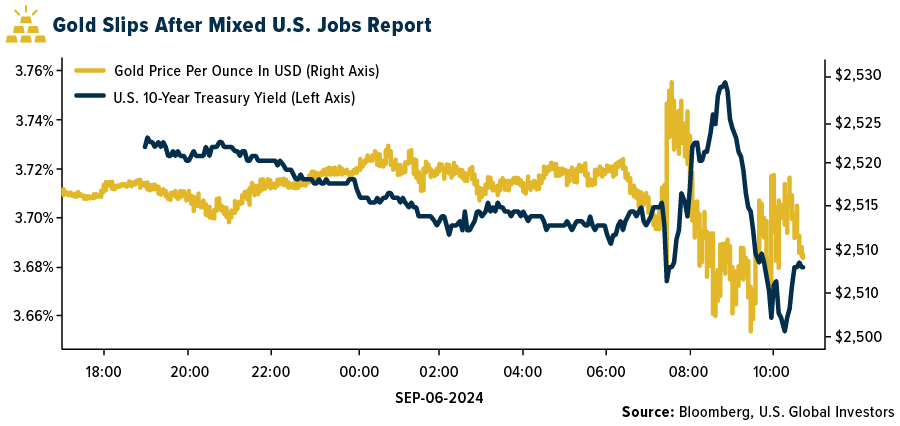

- Gold has held steady in the $2,500 an ounce range, plus or minus, for the last month. The Federal Reserve is expected to lower interest rates at the September meeting, but it’s debatable whether the Fed would cut a full 50 basis points (bps) versus a more gradual 25 bps pace. Lower rates are often seen as bullish for non-interest-bearing gold, according to Bloomberg. Holdings in gold ETFs expanded again in August.

Weaknesses

- The worst performing precious metal for the week was palladium, down 6.16%, on no specific headlines other than perhaps the weaker employment data as of late. The U.S. Mint says American Eagle gold coin sales totaled 10,500 ounces in August, according to figures on its website. Sales compare with 22,500 oz in July and 94,500 oz in August 2023, according to previously released data.

- UBS sees increased risk for further potential value erosion at Sibanye Stillwater. The group believes management is likely to embark on further capital raising exercises, capacity closures and/or project capex deferrals to try and reduce debt levels and limit the cash burn.

- The sudden collapse of Victoria Gold Corp.’s Eagle Mine is part of a long and ugly history in northern Canada. To this day, Canada’s federal government is still cleaning up arsenic and cyanide spills from mines that were abandoned by their owners decades ago. Victoria Gold’s Eagle Mine, which closed in June after its gold-processing facility collapsed and spilled cyanide into the surrounding rivers, will cost about C$150 million ($111 million) to restore, according to Bloomberg.

Opportunities

- First Majestic Silver Corp. agreed to buy all the issued and outstanding common shares of Gatos Silver Inc., a silver dominant producer with a 70% interest in Chihuahua, Mexico mine. Gatos shareholders will receive 2.550 common shares of First Majestic for each share held; consideration implies a total offer value of $13.49 per share based on the September 4 closing price, reports Bloomberg.

- Goldman’s preferred near-term long is gold. It remains the bank’s preferred hedge against geopolitical and financial risks, with additional support from imminent Fed rate cuts and ongoing EM central bank buying. The group, therefore, has a long gold trade recommendation.

- Allied Gold disclosed it was in the process of arranging a $225-$275 million funding package for its Kurmuk development project in Ethiopia, with terms scheduled to be formalized this month. Funding consists of a $125-$175 million stream plus a $75-$100 million gold prepay agreement. Ethiopia is a less common jurisdiction for foreign mining investment in Africa, and the project lies on the border with Sudan. RBC expects geopolitical risk factors to limit the breadth of potential buyers.

Threats

- Sibanye Stillwater is guiding group FY25 unit costs +7 to +11% year-over-year. This guidance stood out, not only as it sits above SA mining inflation, but in contrast to key peers who have actively driven cost savings initiatives given marginal sector economics, according to JPMorgan.

- Gold prices are near a record high above $2,500 an ounce, marking a stellar year for gold bugs. But one top investment strategist believes that gold's epic run may soon be coming to an end, Bloomberg reports. Jim Paulsen, a 40-year market veteran who worked for two decades with Wells Fargo and was most recently chief investment strategist at The Leuthold Group before retiring, argues that gold prices will fall even as the Fed cuts rates because gold has already rallied, and recession fears are fading.

- UBS maintains its “sell” rating on Northam Platinum as Northam's valuation metrics are not yet supportive and could see further derating given the poor cash conversion and potential for value erosion if spot PGM prices prevail. The absence of material restructuring initiatives versus peers implies potential for deteriorating efficiency metrics on a relative basis, with limited further medium-term growth potential on offer from the current base.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of