Gold SWOT: If Gold Is Poised To Move, Gold Stocks May Finally Be Back In Play

Strengths

- The best performing precious metal for the week was palladium, up 1.30%, perhaps on ETF purchases of the metal which shows the year-to-date rise in palladium ounces held in the ETFs climbed 27%, Bloomberg reports. It is still worth noting that AUM in physically backed ETFs have been trending higher in recent weeks, suggesting more involvement from investors trading in a pocket of the gold market that had been very quiet. Bank of America previously noted that a resumption of ETF buying may be necessary for a sustained increase in prices

- With $200 million of its term loan paid in the second quarter of this year, Kinross confirmed its plans to use its high free cash flow to continue to strengthen its balance sheet. CIBC modelled the remaining $800 million term loan to be fully paid down in the second quarter of 2025, which would reduce debt from $2.2 billion to $1.2 billion.

- Morgan Stanley says precious metals have been much more resilient in the recent pullback in pricing, while industrial metals, energy and agricultural commodities are all moving lower for now. The group thinks gold can continue to find support from both physical demand and financial inflows, with the first U.S. rate cut likely a key catalyst.

Weaknesses

- The worst performing precious metal for the week was platinum, down 3.91%, perhaps from some platinum ETF selling reported this week. Endeavour Mining said its former CEO paid the firm $1.35 million in a settlement, months after the gold miner fired him for alleged serious misconduct, according to Bloomberg.

- The rough diamond parcels from South African operations, originally earmarked for sale in August/September as part of Tender 1 for fiscal year 2025, will now be sold under Tender 2 that is expected to close mid-October, Bloomberg reports.

- With second quarter production of 3.88 million ounces of silver equivalent pre-released (100% basis), Gatos Silver reported GAAP second quarter EPS of $0.13, lower than consensus of $0.16, due to a combination of variances in depreciation, taxes, and other expenses, CIBC reports.

Opportunities

- Gold will trade higher three months out from now as the Federal Reserve cuts interest rates, China’s economy continues to drag along, and central banks (big, medium, and small) go on stacking up bars in their vaults. According to Bloomberg, retail investors may even join in too.

- For Oceana Gold, with the Haile underground reaching 2,000 tons per day run rate reached at end of July, RBC views a significant free cash flow inflection now in sight. Coupled with higher grades from the Ledbetter Phase 2 pit and stronger output from Macraes, RBC anticipates robust free cash flow generation in the second half.

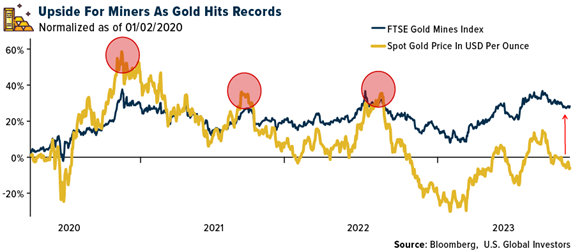

- NBF says that in the three months following the Sahm Rule being triggered, gold has, on average, risen nearly 3% while the S&P 500 has, on average, declined 8.4%. Over the last three market corrections, both gold and gold equities have outperformed the S&P 500 over the following three months from the start of a market correction. If gold is poised to move, the gold stocks may finally be back in play. For more than a year, gold stocks have failed to perform relative to the higher gold prices due to a lack of margin expansion. Over the past two quarters the number of gold miners reporting positive free cash flow and expanding margins has increased and is likely to expand further. Goldman Sachs reiterated its price target of $2,700 for gold in 2025.

Threats

- RBC feels Oceana Gold’s full-year guidance may be tough to achieve following operating challenges in the second quarter, particularly on costs with 30% AISC improvement ($600 per ounce) required in the second half to reach upper end of cost guidance.

- According to CIBC, with second quarter gold-equivalent ounces (GEOs) of 20,068 pre-released, Osisko Gold Royalties reported earnings of $0.18 per share, ahead of consensus of $0.12 per share, because of variances in G&A and finance expenses. However, investor attention will likely be focused on the reduction of annual guidance from 82k-92k GEOs to 77k-83k GEOs to account for the continued suspension of production at the Eagle mine, as well as for the recently disclosed two-month delay in Capstone’s ramp-up to 20,000 tons per day at Mantos Blancos.

- West African Resources says that a new mining code has been adopted for Burkina Faso and a new local content law has been adopted. Key changes under the new mining code include increasing the state’s free-carried equity interest in mining projects to 15% from 10%, according to Bloomberg.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of