Gold SWOT: UBS Has Raised Its Gold Price Forecast To $3,200 Over The Next Four Quarters

Strengths

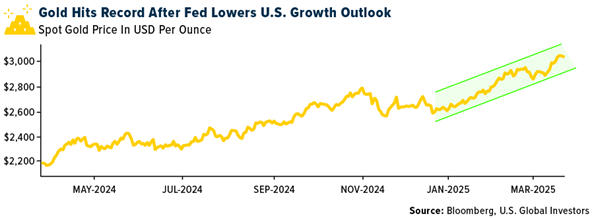

- The best-performing precious metal for the week was gold, up 0.46%. Prices rose for the third consecutive week amid continued trade war tensions and broader market uncertainty. Bullion hit a fresh high of $3,065, reinforcing its role as a safe-haven asset, with investors rallying behind its strength. Gold is now up just over 14% year-to-date, while the S&P 500 is down a little over 4%.

- Catalyst Metals, benefiting from record-high gold prices, has sold its Henty Gold Operation in Tasmania to junior miner Kaiser Reef for $30 million, split between cash and shares. Catalyst gains a 19.99% stake in Kaiser and a board seat. The acquisition underscores strength in the junior mining space, as Kaiser Reef paid a premium for Henty’s established infrastructure and high-grade resources, positioning itself for growth from the mine’s 25,000-ounce annual production and more than 10 years of mine life, according to Bloomberg.

- Bank of America, Citigroup and Macquarie Group have all reaffirmed bullish stances on gold as it hit record highs above $3,000 an ounce, Bloomberg reports. Amid rising concerns about the global economy, analysts cite persistent central bank buying and strong Chinese demand as key drivers. Since late 2022, gold has nearly doubled in price, supported by a global search for stability.

Weaknesses

- The worst-performing precious metal this week was platinum, down 3.39%. ETFs were net buyers of gold, silver and palladium, but net sellers of platinum—offloading over 11,000 ounces on March 20 alone. According to Bloomberg, this contributed to platinum's underperformance.

- Galiano Gold reported fourth-quarter earnings per share (EPS) of $0.02, missing consensus estimates of $0.04, on previously reported production of 28.5K ounces. The miss was attributed to lower-than-expected gold sales (13% below Scotia’s forecast) and elevated all-in sustaining costs (AISC) of $2,638/oz, which were 3% above expectations.

- Calibre Mining’s top shareholder has opposed Equinox Gold’s $1.8 billion takeover bid, casting doubt on the year’s largest proposed bullion deal. Van Eck’s Imaru Casanova, portfolio manager of the International Investors Gold Fund, expressed disapproval in a note, citing dilution of quality and lack of operational synergies. “We do not see any synergies between any of the companies’ operations,” she said. “Both operate in the Americas, but in vastly different locations.”

Opportunities

- According to Bank of America, Kinross, SSR Mining and New Gold show the greatest downside risk if gold prices fall by $100/oz or 10%. Conversely, KGC, B2Gold and SSRM show the most upside if gold gains $100/oz.

- UBS has raised its gold price forecast to $3,200/oz over the next four quarters, up from its long-standing estimate of $3,000. UBS analysts, including Wayne Gordon and Giovanni Staunovo, cited the increasing likelihood of a prolonged global trade conflict as a key factor for their bullish revision, underscoring gold’s role as a store of value.

- Noru Al Ali of Bloomberg points out that despite gold trading above $3,000, gold miners remain over 25% below their 2010 peak. The disconnect, driven by central bank buying and geopolitical concerns, favors the metal over miners—for now. However, if gold holds above $3,000, miners' margins may expand significantly, attracting new investor interest.

Threats

- India’s sovereign gold bond program, launched in 2015 to reduce physical gold demand, is now seen as a $13 billion naked short position for the government. With gold prices soaring, the program has become a costly liability, requiring payouts to bondholders far beyond original expectations—ultimately at taxpayer expense, Bloomberg reports.

- Silver open interest dropped by 13% in the last week of February amid renewed U.S. tariff threats and trade friction with Canada and Mexico. Meanwhile, platinum and palladium open interest have declined by 13% and 6%, respectively, year-to-date, according to Bank of America.

- After a surge in gold investment in China, the China Securities Journal cautioned investors to manage expectations and risk appropriately. “Many factors affect gold price volatility,” the Journal wrote, urging investors to allocate their gold exposure based on individual risk tolerance.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of