Gold: There Is NO Santa Clause

Capital markets are supposed to be free of manipulation yet there is little wonder that investors question the integrity of the global banking sector when its participants were so openly greedy, protecting their own interests instead of their clients.’

Yes, Virginia there is no Santa Clause. In a now familiar pattern, some of the biggest Wall Street banks like HSBC, JP Morgan and Citigroup once penalized for their roles in the subprime mortgage disaster were fined billions for rigging the trillion dollar foreign exchange market only two years after they were caught rigging the important Libor interest rate. Then there was the London gold fix scandal where five banks manipulated the benchmark which led to the abolishment of the century old fixing of the gold price, to be replaced by one of the major derivative players (sort of like having the fox protect the hen house). US authorities also targeted offshore banks, fining the big French bank BNP Paribas a record $8.9 billion for breaking US sanctions. Commerzbank is facing a billion dollar fine for breaking sanctions against Iran and Sudan. Investors don’t like it when everything from interest rates to foreign exchange markets were found to be rigged and so blatantly illegal and risky. The problem today is that governments still condone this activity by guaranteeing the banks’ obligations, shifting risk or “bail-ins” to the banks’ shareholders or depositors.

Wall Street has Lost the Public’s Trust

Noteworthy is amid the multibillion dollar penalties, questions for the regulators, lawmakers and their supervisory role were not asked. Instead, this misconduct only disclosed the need for scapegoats. The problems still exist. Cronyism and government supported monopolies plus the dilution of moral hazard is alive and well. No one has gone to jail. Greed and short term thinking has undermined our financial system. Needed are politically challenging structural reforms favouring the investor. Yet reforms are much harder to make when the banks are so powerful. The much feared Volcker Rule has been diluted and the remnants make “Volcker light” easy to evade. And today, to pass the $1.1 trillion spending bill in the United States, the lawmakers conveniently rolled back part of the Dodd-Frank financial reform law making it easier for banks to “push out” some of their riskier derivative activities into affiliates, putting taxpayers again on the hook for losses in yet another Wall Street bailout. What chance has the investor?

Global capital flows have surged from repeated quantitative easing programs (aka money printing), forcing down rates to record levels causing cash to chase fast vanishing yields. Global stock markets and real estate were the main beneficiaries of this largesse. Cashed-up corporations spent more on buybacks and dividends rather than traditional capital investment. And six years after the fall of Lehman Brothers, while taxpayers continue to prop up Wall Street, Main Street has seen its gains disappear. The richest one percent holds one third of total wealth in the US economy, while the middle class was hollowed out. The per capital median wealth of the US middle class is at its lowest since 1969 at $63,800. In 2013 dollars, the middle class median fell 44 percent from 2007 according to Saez and Zucman of NBER.

At Christmas time there is daily madness with incentives to rack up more debt to buy more cars or houses at zero interest rates. Debt is today’s prescription to prosperity. Savers have been penalized. Companies that built up cash are objects of derision and those seeking lower tax jurisdictions (all legal) are branded tax dodgers. Cash is no longer king, because of the lack of incentives to save with zero interest rates. But do central banks tell us that? Do they tell us savings are needed to invest or as a buffer for that rainy day or for retirement? Instead, the Federal Reserve has created an illusion of a solvent economy with the housing market, car sales, asset prices built on debt which is highly dependent upon the willingness of the capital markets.

A Winter of Discontent

The diagnostic problem is that policymakers continue to take the easy option of running massive budgets and current account deficits, racking up record large amounts of debt hidden beneath the market’s buoyancy. This is wrong. The disconnect between the record stock prices and the economic realities on the other hand cannot last. It is not so different this time.

For example, currency mercantilism is a central plank of central banks today. The president of the European Central Bank (ECB), Mario Draghi, recent jawboning kicked the can down the road again but the euro collapsed. Prime Minister Abe of Japan, unleashed quantitative easing to infinity to get the yen down. South Korea’s won also suffered. China too reduced interest rates prompting a reversal of the renminbi after eight years of increases. We believe that the currency devaluations are a blatant attempt to boost exports in the hope that current account surpluses will help their economies. The risk is that this stealth currency war spreads repeating the Brazil, Russia, India and China (BRIC) debacle in the late nineties. So far the dollar has been supported by quantitative easing but the Republicans’ ambition to force Obama to abandon his free spending ways is likely to cause a lower dollar and higher inflation.

Since Bretton Woods, global currencies have floated against the dollar. The world is awash with some $70 trillion fueled by the Federal Reserve’s balance sheet which has exploded to a record $5 trillion, a liability of the state. Despite the rhetoric of austerity, America will spend $1.1 trillion with another budget deficit. As a result, America’s creditors are looking for alternatives to the outdated US hegemony regime. China has curtailed their dollar purchases in a diversification move.

How Fortunes Change

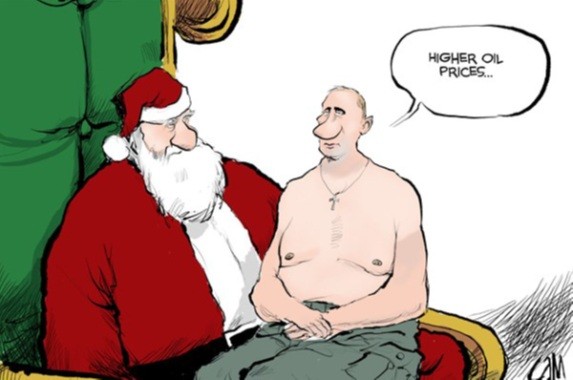

Saudi Arabia and OPEC are gambling that lower prices will inflict more pain on US shale players than themselves. The global oil collapse has threatened their regional foes increasing geo-political risk, but not just in the usual trouble spots, shifting economic power away from oil exporters. Cheap fuel will help the consuming states. However unintended consequences have opened on two fronts at once. One front sees the larger players like Russia and the big Latin American players in big trouble because their operating budgets are heavily dependent on higher oil revenues. Currencies of the big oil exporters from Mexico to Canada to Venezuela hit multi year lows against the dollar. The Russian ruble fell 50 percent to the lowest level ever despite attempts to prop up the beleaguered currency. Near term, Russia is the biggest loser as are its creditors, the big European banks. Dominoes anyone? The financialization of oil also engulfed other players which could backfire on those sovereign players including the Middle East players themselves. Algeria, Iraq, Libya and Nigeria are fighting out-of-control sectarian wars and are heavily dependent on higher oil prices. OPEC is taking a big gamble by opening the barn door.

The drop in oil opened a third front, reversing a trend that saw the oil producers provide liquidity to a highly leveraged financial system from hotels to equities and of course US Treasuries. An unintended consequence is Wall Street who financed the oil explosion taking advantage of free money. Combined with lower energy prices, the overleveraged American oil producers, backed by the big private players and Wall Street, are to be the next major casualties. In the seventies, low oil prices almost tipped the world into hyperinflation. We believe the financialisation of oil exposes the global banks’ leveraged position, which will unnerve financial markets. Ironically while the big international banks were too busy colluding and fixing other markets, their inattention has done more harm than good.

The World’s Second Largest Economy

The rise of China and America’s road to decline surfaced at the APEC summit in Beijing. China’s economy will soon overtake America, becoming the world’s largest economy. This should be a wake-up call and many are wondering if the two can exist in the same bathtub. Of course both can share the bathtub and in fact China’s growth and capital will be the major driver to the world’s economy as China grows its middle class. Savings and investment currently make up close to 50 percent of GDP. We believe China’s abundant capital, state capitalism and economic clout will be centered on the greater use and internationalisation of the renminbi. A tempo of reform, financial deregulation and “going out” strategy are part of Mr. Xi’s structural reform plans. However, as China expands its sphere of influence, it wants a larger role in international institutions, using its rising economic strength to secure its financial ambitions. To date, they have set up three development banks such as the Asian Infrastructure Investment Bank. China’s ambition to become a major player in the world’s trading and financial systems will require infrastructure networks or alliances with neighbouring countries. To be sure, China’s largest trading partners are now its neighbours where the Chinese renminbi is watched more closely than the American dollar.

China gobbled up the world’s coal, oil and now gold fueling its booming economy. China is the largest producer of gold in the world as well as the largest consumer of gold. Already stuffed with paper obligations like US Treasuries and asset backed securities, China has expressed concern over what underpins and protects their $4 trillion hoard. Thus when China buys gold it protects them from a volatile dollar. To be sure, the Republicans too are distrustful of big government and the role of the printing press in cheapening its currency. The recent swing in the midterm elections strengthened the Republican Party, who clearly favour the greater use of gold. Rand Paul’s father has been a proponent of not only boosting gold reserves but also auditing Fort Knox, whose last audit was when President Eisenhower was in power.

Gold Rush

After the Swiss rejection, gold collapsed in a free fall to $1,142 an ounce as Hong Kong and “Johnny come lately” hedgers dumped gold retesting the old lows but in less than 24 hours recaptured its losses in a stunning $70 an ounce turnaround in a classic physical short squeeze. There was also an option expiry which coincided with one of the largest backwardations in history. Investors, it seems were willing to pay more for gold today than tomorrow. But when they came in Monday morning, there was a scramble for physical gold in part due to the Chinese soaking up physical supplies. In one week alone, about 55 tonnes was taken up on the Shanghai Gold Futures Exchange (SGE).

Lately gold has been relegated to the doghouse in part because of its so-called failure to lift following Middle East tensions and recently the Swiss rejection. More relevant however is that neither factor was behind gold’s performance. We believe the fundamentals have long pointed to higher gold prices. Gold is a barometer of investor anxiety influenced by a multitude of factors. In the seventies it was inflation. Gold’s current bull run of twelve years was due to global monetary easing prompting strong physical buying by central banks and investor demand despite the absence of inflation. Critics also don’t like gold because they can’t value gold. Gold’s valuation is subjective. Its value is the sum of investor demand. It is an alternative store of value to currencies. Since the 2008 financial crisis, gold is up some 62 percent while the so-called record breaking equity market is only up 27 percent. The long term narrative, however remains the same. The unprecedented monetization of America’s record debt cannot be done painlessly and without consequences.

As such, we believe more and more central banks are repatriating their gold in an old fashioned “run on the bank”. Belgium is the latest bank to request the return of its gold in the belief that ownership is nine-tenth of the law. There are too many fiat-based currencies sloshing around and gold’s role in central banks’ reserves has become more and more important. Venezuela got their gold back to shore up its weakened treasury. The Dutch serendipitously repatriated 123 tonnes of gold from America. The Germans also wanted to repatriate their gold, but were told that it will take seven years. Even the French are musing about a recall of their gold in an old fashion gold rush.

Central banks are buying gold and in some cases recalling their reserves because of their distrust and worry that the dollar’s role as a reserve currency protects America and not them. In the third quarter, central banks bought almost 100 tonnes and will likely have purchased some 500 tonnes this year. The US dollar is a faith-based fiat currency and the dollar’s “exorbitant privilege” is being questioned by its creditors. Last year, some nineteen central banks bought gold. Indeed, Russia has expanded its gold holdings for the seventh straight month, adding 18.9 tonnes for a total 1,169 tonnes, making them the fifth largest holder in the world. With only 10 percent of GDP in debt, Russia is building up reserves as a hedge against of the dollar and the possibility that new financial sanctions might freeze their dollar holdings.

History shows gold is an anchor at a time of currency wars and protection against defaults. Defaults? In July, Argentina defaulted for the second time in thirteen years. Russia’s ruble is lower than when they last defaulted in 1999. And four years later after two separate rescues, Greece still needs EU support. Plus ca change… Gold is the antidote in an overvalued world kept afloat by too much debt. It is easily exchangeable into other currencies, a store of value and a hedge against central banks propensity to print money to finance profligate governments.

Neither a lender….

“Neither a lender nor a borrower be”, said Polonius in Act I, Scene 3 of William Shakespeare's Hamlet. Notwithstanding that derivatives almost crashed the system in 2008, along with a too-easy monetary policy and underlying mortgage crisis, derivatives are bigger today. Gold remains a central activity for central banks for both collateral and reserve purposes. Also quantitative easing has soaked up quality treasuries or mortgage bonds as collateral and over time there developed a shortage of collateral. As such, central bankers consider gold a viable collateral replacement. The big banks became the handmaidens of the central banks dating back when hedging was in full swing. Central banks loaned gold to the bullion banks to lend to the gold producers. The bankers used that gold on loan for better uses, as collateral for their paper obligations. The business soon imploded when the producers flattened their toxic hedges. Comex was the central character then and today the markets have caught up to the fact that there are too many paper obligations against not enough physical collateral. There is no Santa Clause.

Sounds familiar? This is the genesis for the trillions of derivatives circulating today. And now, the establishment of a rival market in Asia, the Shanghai Gold Exchange adds another factor in the physical market as gold moves from the West to the East. We believe that the reversal of the hedges, China’s insatiable appetite for physical and central banks repatriation has caused a shortage of physical gold. That is a better narrative.

Recommendations

One the reasons for the poor results, was that the gold miners made expensive acquisitions. Hubris was all too common. The industry is littered with Tsasiast-type acquisitions which turned out to be a company destroyer. Miners bid up asset prices with the expectation of higher and higher gold prices and institutions, pushing for growth and diversification financed the industry. Feasibility studies were sold as simple and prefeasibility (PEA) morphed from scoping studies, but they were anything but. Now that balance sheets are stretched and execution has become all important, the topdown models, black boxes and assumptions were shown to be just as flawed as was the drilling and spacing. The industry soon replaced the CEOs, with backgrounds in accounting, law and investment banking who made too many decisions on theoretical returns. Institutions too bought into this, financing the grandiose studies and rather than study the underlying deposits, depended more on flawed computer models. So much moeny has been lost by so few.

prices. The industry had its mea culpa moment and the new crop of CEOs have sworn that it will be different this time. A two tier or dumbbell type market has developed with lower cost, growth oriented companies like Barrick, Eldorado, or Agnico on one side and on the other, higher costs, weaker balance sheets or mature assets miners like Kinross, IAMGold and Yamana. However, the junior miners have been decimated no matter how promising their projects or how they’re valued. St. Andrews, McEwen Mining, B2Gold and Richmont fall into that category. As such, there’s no question that M&A activity will continue into the new year, particularly since producer and non-producers are so undervalued with reserves in the ground so attractive making it cheaper to buy than to build.

Allied Nevada Gold

Allied’s open pit Hycroft mine continues to perform well. The heap leach operation in Nevada however is running out of oxide and the Feasibility Study to mine the sulphides will cost $768 million, down from $935 million. Allied plans to produce 340,000 ounces of gold and 15 million ounces of silver are enviable but the plans are ambitious for the company. A detailed capital cost is being worked on with the first phase at 60,000 tpd. To replenish its reserves, Allied had to raise $22 million but the key remains financing the Hycroft expansion. We believe a joint venture with a third party would make much more sense.

Barrick Gold

Barrick, the world’s largest gold producer, maintained its guidance for the year and surprised the Street with a strong performance. Barrick will produce a hefty 6.1 million ounces at a sub $1,000 all-in cost. Nevada-based Goldstrike Mines and Cortez continue to do well. African Barrick was turned around. The strength of Barrick’s key mine assets is the majority of its production comes from five core producers, Cortez, Goldstrike, PV, Lagunas and Veladero. Barrick’s high debt load is manageable particularly since it has the largest reserves in the ground in the world. We believe Chairman John Thornton has reset the narrative. John has flattened the organization, cut costs, struck a deal with the Saudis and successfully changed the focus. The new strategy will unfold in the months ahead which will result in higher stock prices. Barrick has also added six new Board members, and technically strong management tasked with optimising Barrick’s quality assets. The stock is a buy here.

B2Gold Corp

B2Gold operates three mines (two in Nicaragua and one in the Philippines). B2 Gold has a development pipeline in Namibia, Mali, Burkina Faso and Columbia. The company will produce 390,000 ounces this year. B2Gold shares were hard hit due in part to a miss in the third quarter. However, Otjikito in Namibia was commissioned and will produce 150,000 ounces next year at a $500 an ounce cash cost. B2Gold’s cost structure is favourable. B2 is an emerging mid-tier producer with an operating team known for execution. The shares are cheap down here.

Detour Gold Corporation

Detour is soon to become Canada’s largest gold producer. Located in north-eastern Ontario, Detour lowered its guidance, but cash costs remain stubbornly high due to the current mine plan. Detour has more than 16 million ounces in the ground with only 20 percent of its land position explored. There is a lot of blue sky here. The processing plant has stabilized and mining and milling should be much improved next year. Detour produced 115,000 ounces in the third quarter. Detour Gold’s operation has turned around but will likely take six months getting mining rates back up to capacity. We like the shares here.

Eldorado Gold

Eldorado is a low cost producer with mines in Europe, China and South America. Cash at September stood at $562 million with $375 million of undrawn credit facilities. The company delivered another strong quarter. Eldorado has seven operating mines producing almost 800,000 ounces this year at $850 all-in cost. Eldorado continues to wait for permitting on Eastern Dragon in China which is currently on “care and maintenance”. Kisladag in Turkey will increase mill capacity and produced 222,000 ounces so far. In Greece, the mill foundation was laid at Skouries. Gold production at Efemkucuru in Turkey was higher at 78,000 ounces due to improved mill throughput and better grades. We like Eldorado shares here.

Newmont Mining Corp.

Newmont is one of the world’s largest producers, headquartered in Denver, whose all-in cost is about $1,050 an ounce. Newmont has mines in North, South America and Asia but output has been flat. In fact, Newmont has excess cash flow and a strong balance sheet with $5 billion in liquidity, but its array of mines are stuck in a harvesting mode. Newmont has a strong base in Nevada and Australia. Merian in Suriname will cost $1 billion but is a non-starter under the current price deck. We continue to believe a merger between heavyweight Barrick and Newmont would make sense. There are synergies in Nevada and a spinoff of the noncore assets makes sense. Near term, we prefer Barrick.

Yamana Gold Inc.

Yamana has production and development assets in Argentina, Brazil, Chile, Mexico and Canada. El Penon in Chile is its flagship asset and the company continues to find parallel veins near infrastructure. Yamana is spinning off its Latin American assets into a new company called Brio Gold. Many of these assets were on the auction block but there were no takers. Yamana’s balance sheet is too heavy having acquired 50 percent of Canadian Malartic with debt. Yamana is now in a “show me” position. Brio Gold will include non-core Fazenda, Brasileiro, Pilar, C1 Santa Luz and Aqua-Rica assets. Yamana will extend a $10 million bridge loan and appoint new management who have been tasked with the job of what to do with Brio. However we think that Brio is just a relabeling exercise, and since the assets did not find a buyer before, they are unlikely to find a buyer today. Sell.

John R. Ing

416-947-6040