Gold: Thresholds & A Pullback To Buy

Some Asian money managers are raising their recommended allocation to gold from 15%-20% to 25%.

That’s good news, and for a look at some more important Asian gold-related news:

Reserve ratio cuts are a form of money printing, and money printing sets off “buy more gold” alarm bells for the citizens of China and India.

Online purchases of gold from companies like Amazon are taking off in India, and this demand could become a tidal wave in the coming years.

This is a big picture chart of US fiat versus gold.

Because gold is the world’s greatest currency, all gold bugs should consider setting a personal threshold… a minimum percentage of their net worth to hold in gold.

Nothing rises or falls in a straight line forever, and the dollar and gold are not exceptions to this rule. As gold edges closer to the key $3000 mark, a “pullback of significance” ($100-$200) becomes more and more likely.

The good news is that the pullback will give investors with meagre amounts of gold a chance to add to their holdings.

This is the daily DXY (US dollar index) chart. Both RSI and Stochastics are showing positive divergences with the price… and doing it at the key round number zone of 100.

The dollar is likely to fall significantly under 100 in the coming year, but perhaps not before one final move up occurs. Friday brings the PCE inflation report, which is Fed chief Jay’s favourite metric for measuring price action in the economy.

That PCE report could bring significant volatility to markets… and possibly mark a short-term peak for gold.

This is the US stock market “chart of concern”. The Transports continue to fail to confirm the relentless rally in the Industrials.

The Industrials show a worrying loss of relative strength with each major new high.

What is clear is that the stock market is nowhere near a buy zone of significance; RSI and Stochastics on this monthly chart should both be down to the 50 area (or lower) before the market can be said to offer value for investors.

The bull flag and inverse H&S action on this weekly close chart suggest gold could run to $2800, $3000, or even as high as $3300 before there’s a pullback of significance.

Here’s a snapshot of the key weekly chart Stochastics oscillator (14,5,5 series) for gold. It’s rare for it to hold above 90 for very long… and above 90 is where it is now.

The last major buy zone for gold was in October of 2023. That’s almost a year ago, and gold is up 40%+ against US fiat since then. Clearly, a pause or pullback of significance can be expected to occur soon.

Western debt and key buy zones are just part of the big markets picture I cover 5-6 times a week in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

For a look at silver:

The chart is incredibly bullish.

The smart money commercial traders are adding a lot of short positions while the dumb money funds pile on longs.

The good news about a pullback of significance for gold and silver is that it’s likely to be accompanied (somewhat ironically) with a “rally of significance” for key commodities like oil, wheat, and copper!

This PDBC general commodities ETF (with no K1 form required from investors) chart looks good. The price is bouncing from key support, and oil is too.

ETFs like COPX (copper stocks) and XLE (oil stocks) could fare quite well in the coming months.

What about the miners… what will they look like during a gold and silver price pullback of significance?

This is the weekly GDX chart. The current rally has stalled at $40, but a final push to $43 could occur. The key investor buy zones are $38 (gamblers), $36 (aggressive investors), and $33 (conservative investors). Ideally, a dip to $33 would be accompanied with a $100-$200 dip in the price of gold.

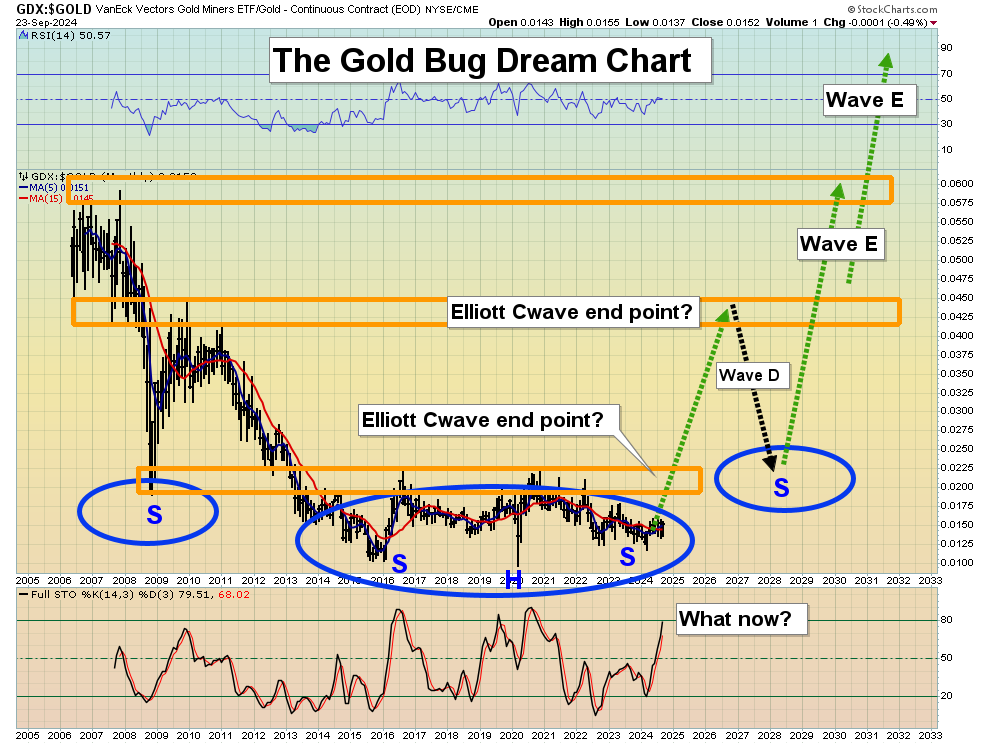

Double-click to enlarge this big picture chart of GDX versus gold. Basis Elliott Wave analysis, gold is in a “C wave”, which typically is the wave with the greatest amount of price action… action that occurs in a very short amount of time. The surge from the October 2023 lows has all the hallmarks of a C wave. It’s highly unlikely that the coming pullback marks the end of wave C, and instead… the move that follows is likely to be the most powerful gold stocks rally of the past fifteen years!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: