Gold: War and Peace

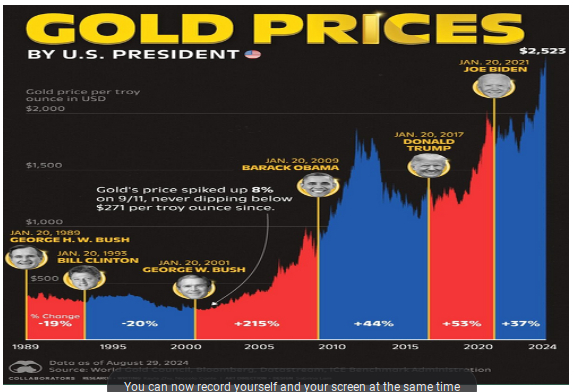

The warning signs for $10,000 gold are hiding in plain sight. Inflation is down, the job market is cooling but not imploding, helped by the jumbo rate cut and prospects of a return to easy money. While core inflation remains sticky, wage increases are double digit, reminiscent of the Seventies when inflation came roaring back. The inflation obituaries are premature. Government has boosted spending to 40% of GDP while its deficits are 8% of GDP, financed by “fiat” money, backed not by gold but by a government saying it is money. US economist and Nobel prize winner, Milton Friedman’s warning that inflation is, “always and everywhere a monetary phenomenon” rings true today.

A study of the early history of money shows that monetary policy was often conducted by the king, emperor or state. In the period of Christopher Columbus, wars were fought over and paid by gold. Then in the quest for more gold, Spaniard and the European monarchs looked to the Americas for more gold to finance their wars. Why gold? The winner would take the losers’ gold.

In this world of polarization and rising nationalism, there is a battle between globalists and nationalists. Globalization which once powered the world is in retreat as beggar-thy-neighbour nationalism reshapes the world’s economy, in an echo of the Thirties. Today, there are a scourge of wars, cold wars, proxy wars and a looming global trade war, which will keep inflation elevated. Long shadows are cast by history. The Russian-Ukraine war kicked off a period of rising energy prices and inflation. Fears that the Israeli/Gaza regional conflict could escalate into a global conflict that would severely damage the global economy have once again focused on the oil-rich Middle East. There are more lessons to be learned from history. The Great Depression of the 1930s and the boom/bust period of the 1920s both included trade disputes. Wars are expensive. Wars cause inflation. Wars were common denominators when looking at inflation because many times, wars/revolutions were deficit financed, often leading to hyperinflation and regime change.

Crossing Red Lines

Empires come and go. Great Britain lost its once great empire in the 1920s as well as pound sterling’s reserve currency status, after two wars crippled the nation’s finances, resulting in the realignment of much of Europe. It can happen again. It may be the same with the United States as it was with Great Britain. For a time, American supremacy was uncontested following the collapse of the Soviet Union. The United States was the defender of the free world, allowing Canada and others to misspend the peace dividend, eschewing the maintenance of their military capabilities. NATO was even left to whither because everyone relied on the US. Today with the world becoming more dangerous, the order that governed the global economy has been eroded, with US foreign policy facing major challenges after violations of its red lines.

America has lost its dominance in the face of numerous problems today because its red lines have been continually broken. Defeats in Vietnam, Afghanistan and Iraq after the 9/11 disaster, burst an illusory bubble, opening a Pandora’s box in one country after another. Nation building was replaced by nation destruction. George Bush’s “war on terror” dismantled ISIS that resulted in reshaping the Middle East but once again an escalating Israeli conflict prompts concern about a disruption to supplies in an area that produces a third of the world’s crude. Barrack Obama’s military adventurism had red lines in Syria, which was violated when chemical weapons were used and, when the Russians invaded Crimea, Obama did nothing. Mr. Biden’s Middle East red lines were easily crossed in Saudi Arabia, Afghanistan, and now Gaza and Lebanon are on the brink of full-blown wars. All this is inflationary.

Today the flood of red ink increases as the US will have the first ever trillion-dollar defense budget, boosting overall spending, the deficit and reflation prospects. Yet America’s red lines and military effectiveness has been found to be tentative and impotent, as external challenges against the backdrop of a great power competition dents American power. China’s red lines were crossed when then speaker Nancy Pelosi in 2022 visited Taiwan, leading Beijing to cancel talks. Talks only just resumed. The disintegration of the old-world order is visible everywhere. Despite numerous red lines crossed, American policy continues to use sanctions and threats. Like Great Britain, the dollar’s uncontested reign is being tested. And, what happens to America’s red lines if Trump wins?

Inflation is Dead, Long Live Inflation

In the French inflation of the 1790’s, the root cause was the French Revolution when an inflationary monetary policy became unmanageable. Following the French Revolution between 1789 and 1795, the government was forced to pay its bills with paper when fiat-money hyperinflation approached 50 percent. Money inflation was rampant as the paper money (assignat) was backed by land and then when they ran out of land, they issued new money, the mandat. Then there was the German inflation of 1921-1923 which led to the Weimar years, following the First World War reparations that ended with the Great Depression. The experience of Germany’s Weimar Republic in the 20s was of unchecked inflation, strikes, political upheaval and a waning democratic government and in the years following, houses and cars sold for a few dollars. The common denominator then? Fiscal and monetary profligacy.

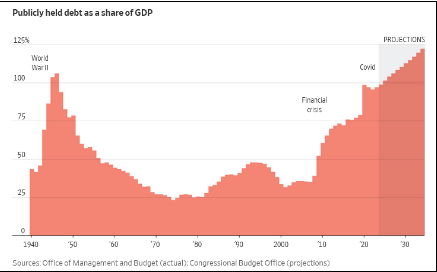

More recently there was that other Great Inflation which followed President Johnson’s “guns and butter” attempt to finance both the Vietnam war and social programs at the same time, that nearly caused hyperinflation. Fed Chair Paul Volcker was forced to raise rates to double-digit levels triggering the painful recession that led directly to the financial crises of the 1980s. In the Seventies the dollar stood for a sum of gold which was pegged at $35/oz, but US gold reserves plummeted from 15,800 tonnes to 9,800 tonnes when Europeans fearful of the devaluation of the dollar, exchanged their dollar debt for gold, which forced President Nixon to suspend the convertibility of dollars into gold in 1971. And today the major source of inflation is the government’s adoption of similar “guns and butter” policies which has led to unsustainable deficit spending as cure-alls for everything, from the Wall Street Crash to cultural wars and Covid. That consequential printing of money has left America’s finances in a mess. And today there are new inflationary influences, wars and tariffs.

Notwithstanding a slowing in inflation, we believe that the vast public debts incurred for wars, climate change, subsidies and energy will pile more liquidity onto markets, keeping the inflation fires burning “higher for longer.” US debt stands at $35.4 trillion with almost $2 trillion annual deficits as far as the eye can see. This spending in both good and bad times has quadrupled US debt as a share of GDP. The US is currently running twin deficits, trade and a budgetary deficit of 8% of GDP, keeping things hot, ensuring massive bond issuances. The Fed's balance sheet is already enormous, having grown from $1 trillion prior to the 2008 financial crisis to $9 trillion. Although the US can borrow in their currency, public debt to GDP at 130% exceeds the size of the economy, yet government keeps repeating their self-defeating economic policies, forgetting the past and looming entitlements bill.

We think a common thread is that deficit spending, whether it is for housing, defense, social programs, or wars, is what fuels inflation. In modern times, central banks issued notes to pay for their profligate governments’ spending, but when they themselves bought those notes to finance the bailouts after the 2008 crisis, they doubled down when Covid hit. They even renamed the money printing, Quantitative Easing (QE) to protect the innocent, as the Fed created trillions of paper out of the thinnest of air with freshly created money. Not surprisingly inflation hit four decades highs and now the Fed is lowering rates because of fears of slower growth. All this feeds inflation. Inflation’s paradigm is structural. Government continues to have a spending problem, not a revenue one as too much money chases too few goods. Politicians are addicted to debt. Taxes go up but spending goes up even faster. There is always a reason to spend money and borrow. The EU for example faces a rollover of €350 billion in debt, which means more money printing.

Inflation’s common denominator is always the same, profligate fiscal policies giving way to constant increases in money supply and as more debt is issued, money is debased resulting in a consequential loss of confidence. Today America isn’t fighting a recession or a banking crisis, yet the federal government is running a deficit of 8% of GDP which is 4 times past averages. Inflation is hurting America’s global competitiveness as corporate investment and jobs go to lower tax jurisdictions. Tariffs won’t fix that. Tariffs are taxes, borne by the consumer. Taxes are inflationary. History shows that inflation is dynamic and grows in stages. First there is a lag effect as the economy picks up months after an increase in money supply. The second is when prices outpace money supply. Interest rates? Interest costs are volatile and today the cost of servicing US debt is more than they spend on defense. It is the tail wagging the dog, thus with prospects of tariff wars, we can expect the return of inflation and higher rates. Inflation is dead, long live inflation.

Tariff Man

The self-styled "Tariff Man," Donald Trump, defies Republican free-market doctrine by threatening to erect a tariff wall around the US as a remedy for all of America's problems. To “make America great again,” Mr. Trump pledges tariffs on all imports, especially against China which won’t net him sufficient revenues. Last year US imports was $3.1 trillion. Slapping a 10% tariff would net only $310 billion, a fraction of his $2 trillion deficit. That cost alone does not include the retaliatory tariffs by America’s allies on American agriculture, LNG shipments or Boeings which would hurt exports and ultimately erode tax revenues. And if he slapped a 60% tariff in China’s imports that would only raise $225 billion a year. However, Mr. Trump’s extension of his 2017 tax cuts next year would add $5 trillion to the deficit, stretching America’s already strained finances. Fake news? No. Lousy arithmetic.

Ironically, Donald Trump’s main focus is the doubling down on tariffs as his main economic tool. Tariffs are an inflationary tax in disguise, paid eventually by consumers. Trump first imposed tariffs in his first term which started a trade war with China, but Biden expanded them. Of major concern is that Trump’s new tariffs on everybody, including allies, would apply to more than eight times more imports than the last time and thus would trigger a global trade war, in a return to the Dirty Thirties.

Of concern America goes to the polls within weeks and the election is still a tossup. Vice president Harris’ exceptional overnight success has her leading in the popularity polls nationwide, but the election really centers on “eight” swing states, which under the electoral rules gives them much more power than the other 42 states. Pennsylvania, Wisconsin, Michigan, Nevada, Arizona, Georgia and North Carolina collectively control 93 electoral college votes of the total 538 electoral college. Needed to win are 270 votes so the pathway to victory goes through the swing states of which the candidates are so close that it is difficult to discern the winner. Of concern is that the threat of litigation from both sides is higher and memories of January 6th continue to haunt America’s toxic politics, making the two-month gap between voting day and Congressional certification as pivotal as the election itself.

Climate Change Will Cost Money

From swine disease harming the Italian prosciutto industry to rice shortages in Japan, the effects of climate change are continuing to drive up costs and threaten food supplies. Some growing locations are no longer viable due to heatwaves, record rainfall, hurricanes, and record cold. Fish migration and even fish farms have been impacted by warmer waters. For instance, the hottest summer in Japan caused a shortage of rice, but the government there still restricts imports and production, which naturally raises prices. An estimated $200 billion in economic losses were caused by Hurricane Helene, including the flooding of mines in Spruce Pine, which produces 90% of the world's ultra-pure quartz, which is required to construct the crucibles used in the production of semiconductor chips.

China is the world’s largest car exporter, overtaking Japan and the leader in EV production. In the West, Detroit carmakers have already lost the global battle for EV supremacy losing billions making the EVs that were to be the solution to decarbonization. EV battery sales are disappointing amid obstacles such as permits, red tape and nimbyism. Ford loses $40,000 on every EV they sell. GM too has revised their plans. Meantime China’s sales of hybrids increased 70% this year. Detroit? Hybrids are still in the nascent stage. Tariffs are not a solution. In fact, tariffs on Chinese EVs will only keep prices high with the consequence of idle plants on both sides of the ocean. Today the West’s top battery maker, Northvolt has slashed jobs and fights for survival. So much taxpayer money, so few results. Decarbonization however has become second fiddle as “energy security” ironically allowed the fossil fuel contingent to pump so much more oil that the US displaced OPEC. Car companies have watered down their 2030 target to be all EV, with Volkswagen shutting down factories for the first time in its 87-year history. The risks of policy shifts and over-capacity are real. All this is just hot air.

Following suit, Canada has unnecessarily increased tensions with the second-largest economy in the world by enacting new tariffs on more Chinese goods, including a 100% tariff on electric vehicles. The Chinese responded by opening an investigation into Canada's $5 billion in canola exports, which cost Canadian farmers a staggering $2 billion in sales the previous time. The tariffs also weaken Canada’s position when USMCA talks begin in 2026. Conversely, the development of artificial intelligence and its energy-intensive data centres will lead to a scarcity of copper, which is used to conduct electricity. However, because of prohibitions on Chinese involvement in Canadian enterprises on the grounds of "national security," Canada may lose another copper mine as Solaris considers a relocation to Ecuador. Not only do Canadian mines need capital, but Canada instead is spending billions to duplicate unnecessary battery plants to compete with the Panasonics of Japan or Teslas in the US or CATL of China, regardless of cost to international competitiveness.

China Restrictions – Never the Twain Shall Meet

The geopolitical rivalry between the US and China has put globalization in retreat. The division is so wide that the critical path on climate change to reach net zero is zero. The underlying problem is that late to the game, the Biden administration’s climate agenda has made green technology the principal battleground. America’s quest for industrial independence is at great expense, including the erection of ever higher trade barriers, yet another inflation input. China too has huge domestic challenges, but its leadership position in green technology, renewables and R&D has bolstered its influence, particularly in South-East Asia. Although Mr. Biden’s $52 billion Chips and Science Act was designed to bring manufacturing back to the States, ironically those cutting-edge chips are made of silicon and sand and also sophisticated critical minerals of which the US is reliant on Chinese imports. In reaction to tariffs, China has already limited or restricted antimony, a mineral used in armor piercing ammunition, precision optics and crucial in production of batteries. That competition of course exerts upward pressure on inflation.

Ironically, China dominates the supply of rare earth elements, batteries, motors, and sensors required by the defense sector. The West still trails behind China, perhaps by 10 years, even after significant battery and tech subsidies totaling tens of billions of dollars. China had a headstart in sourcing critical minerals with deeper supply chains, investment and cost labour advantages. China controls at least 60% of rare earths, including the production of 98 percent of the world supply of gallium, according to US Geological Survey. Some 60 percent of germanium used in smartphones are also used in semiconductor applications which have military and communication implications. Significantly to catch-up to China, it might take the West over two decades and trillions of investment dollars.

US-China Financial War

Concerns about espionage and dual-use technologies under the pretence of "national security" are a major source of conflict between the two superpowers that sees spies everywhere from Chinese made cars, computer chips to even industrial port cranes. In the merging of trade and security, there seems to be no limit to this intervention on “security grounds,” particularly as the West attempts to reestablish supply chains in an attempt to de-risk the economy from China. While America relies on its military strength, providing aid and arms from Israel to Ukraine, China by contrast believes more in soft power such as the Belt and Road Initiative that helped extend Chinese influence in Africa, Latin America and its own backyard. Ironically as the European Union raises barriers to China, China instead focused on central and eastern Europe. Yet China has a single military base in contrast to America’s collaborative military agreements with almost 60 countries, hosting 900 military bases. Instead, commerce is one of China's main economic advantages. Despite the fact that Japan is America's closest ally in the Pacific, both Mr. Trump and Biden/Harris have barred Japan's largest steel manufacturer, Nippon Steel, from making a $15 billion bid for US Steel on the pretext of security. Nippon is not “a security risk” but US Steel, based in Pennsylvania, is a swing state and that the United Steel Workers Union opposes the deal. Real politiks is America’s Achille heel.

However, we believe a more realistic alternative to the realpolitiks and the scapegoating of China is to attract more, not less Chinese investment to take advantage of their technology, renewable technology and capital. Our economies are too intertwined whether we like it or not with China, the leading supplier of imported goods and the second largest holder of America’s debt. Without that, prices and inflation will continue to go up and America’s main plank of tariffs to even the playing field is as watertight as a leaking bucket. China might then find greatness thrust upon it.

Meantime the West is closing the door on access to the biggest market in the world. China has the largest number of internet users reaching 1.1 billion and a penetration rate of 78% as of June 2024. Recently its strong finances enabled China to roll out a bazooka of policy support to boost its economy and achieve its enviable 5 percent growth target. As a result, China has a solid base underpinning rare metal prices which have surged there because there are few alternatives. What drives China are its exports to the world with annual surpluses of almost $900 billion which has offset the three-year property slump. Industrial output has grown 4.5% over last year. Chinese exports rose almost 9% in August.

The United States on the other hand has become debtor to the world with large twin deficits and little savings. While household consumption is 70% of GDP in the US and a central part of its growth, Chinese household spending by comparison is only 37% of GDP, including three “Golden Week,” national holidays designed to encourage consumers to spend on holidays, visit relatives and gift giving. No matter who wins the election, US policy is unlikely to be less hawkish and the standoff will only get riskier. Unwittingly America’s debtor position gives China huge leverage. We thus believe, needed is engagement as a practical necessity, or risk falling into Harvard’s Graham Allison’s Thucydides Trap which observed that in 12 of past 16 episodes, when an established hegemon (America) and a rising power (China) clashed, the end result was bloodshed.

Dollar is not Forever

Wars, wars, and more wars. There are cold wars, the war on terror and now exploding pagers and the bombing of Lebanon threatens an escalation, enveloping much of the Middle East. Amid these wars, the US dollar is particularly vulnerable. More spending, more wars, more tariffs, more taxes, more government and more inflation. But that does not tell the whole story.

Fresh cracks are appearing as the great power competition clogs the global financial plumbing, fueling dedollarization to reduce dependance on the US and the dollar. The Opium Wars of 19th century marked the rise of Western influence as the British invaded China. And today, blame for America’s fentanyl drug problem is being directed at China. Déjà vu? The US may view its actions against China as purely defensive, but unsurprisingly China and others view them differently.

China and other Asian nations have reestablished their connections in response to the fractured West, which has accelerated the geopolitical alignment of capital flows. The western centered world order long dominated by the US has fragmented into a multi-polarity one. Trading bloc BRICS (Brazil, Russia, India, China and South Africa), is in competition with the G7 and represents almost 45% of the world’s population in contrast to less than 15% for the G7. The group is expanding to 11 members including Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and UAE. As a result India and China are buying Russian oil in their currencies. The Saudis are exchanging oil for petroyuan, or renminbi. Russia is even slated to host the BRICS summit, and the bloc is rapidly gaining importance by creating alternate financial ecosystems. The trading powers are even using gold as a medium of exchange. The battlegrounds today are currencies, green technologies, critical minerals and supply chains. Then there are Türkiye, Mexico and Vietnam which have become intermediaries, creating alternative supply chains as part of “friendshoring”. And as the world discovers alternatives to America, gold is a good thing to hedge.

In the last decade, China has developed systems integrating its financial system with key markets such as Russia, India and Asian trading partners. To avoid potential sanctions, China has expanded a SWIFT financial messaging alternative as well as purchases of gold in the past two years. China is also banker to the developing world, and flush with external surpluses has refashioned capital markets. According to China’s State Administration of Foreign Exchange (SAFE), 53% of inbound and outbound transactions used the renminbi, up from 40% in 2021. However, from a global perspective the renminbi is used less than 5% due in part because China is a state-backed industrial society, and foreign investors have given the cold shoulder to Chinese investments, notwithstanding that China’s huge reserves gives it major leverage.

Because the US consumes much more than it produces and owes much more abroad, the end of globalization has doomed the greenback. As competing trading blocs use their respective currencies, they further weaken the dollar’s hegemony, raising fears of an old-fashioned currency war. As inflation picked up and its trade balance sagged, America’s protectionist stance and use of sanctions in one third of the world has eroded faith in the dollar as a store of value. In the last 23 years, dollar usage has declined from 72% to 58%, coinciding with its reduced share of world output.

Ominously as one of America’s largest foreign creditors, China has liquidated its hoard of US treasuries by 24% over the past two years. Crucially the sustainability of America’s outsized international funding requirements depends upon America’s ability to maintain its privileged position in the global financial ecosystem. To date America’s excessive consumption has been financed by foreign capital. But with the dedollarization moves and weaponization of the dollar testing the rule-based system, a trade war lessens the appeal for dollars. Thus we believe the experience of the 1930s is an apt guide as the debasement of the dollar through oversupply again points to the familiar protectionist and economic nationalism of the past. Trump may be successful in his goal of a declining dollar to counteract his high tariffs, but devaluation would merely deter foreign investment and cut off one of the most important sources of funding for US deficits.

The Fiat Currency System is Broken

What would happen if the world decoupled from the US? Some believe America can no longer be relied upon because of its deeply polarized politics. Then there are the changing red lines, sanctions, tariffs and, Mr. Trump. Others are concerned about America’s stretched fiscal situation, and the underlying worry that as the US weaponizes its hegemony, the large deficits will become exorbitantly more expensive, and unsustainable. Some even worry about American democracy. Nonetheless amid the growing economic, political and geopolitical uncertainties, the dollar is not forever.

Our institutions are squeezed by this great power rivalry. American deficits need to be financed since spending as if there is no tomorrow is unsustainable. So are borrowings. By 2028, interest expense alone will represent more than 60 percent of the federal deficit. At some point, the volume of debt like an avalanche will exceed lenders’ willingness to finance. The national debt is at $35 trillion which is 50 percent higher than it was before Covid. And at the end of the year, the debt ceiling limit shenanigans will return from a hiatus. Politicians do not seem to care. They should heed their own noted economist, Milton Friedman who said, “inflation is made in Washington because only Washington can create money. What produces it is too much government spending and too much government creation of money and nothing else.” The US dollar is vulnerable, particularly if Mr. Trump is reelected, and he carries out his threat to both weaponize the dollar and create an alternative cryptocurrency.

Gold is a finite commodity and has proven a better store of value over thousands of years than any fiat currency backed by politicians’ promises. We believe that gold is at $2,600/oz because the dollar is no longer good as gold. Not surprisingly then, gold is back in demand posting ever higher highs. In August, the world’s largest gold Exchange Traded Funds (ETFs) had a $300 million of new money, more than the entire 2023 inflow. Over the past three years central banks have been buying gold, accumulating almost one third of the world’s production over concerns of the dollar. China has a long tradition of hoarding gold and has been a steady buyer for the past 2 years, and a five-month hiatus has been replaced by Saudi buying. Retail buying (Costco is selling gold bars) has surged as the world loses confidence in the dollar, pushing gold prices higher.

In our view gold’s surge to reach record highs was sparked in part by the central bank purchases following the Ukraine invasion as countries sought alternatives when sanctions were applied to Russia. This year gold is up almost 27% as both investors and central banks sought hedges due to the geopolitical and economic uncertainties. Gold is a barometer of investor anxiety and, with premature inflation obituaries, the prospect of global shocks from the crossing of red lines, rising trade tensions and another Cold War, gold will be a good thing to have. While the prospect of interest rate cuts has weakened the greenback, our view is that the key driving force is America’s fiscal instability, reinforcing gold’s role as a universal store of value.

In November the American people will elect another inflationary president. That will be good for gold and bad for the dollar. This bull market is only just beginning. Near term we continue to expect to top $3,000/oz with $10,000/oz gold is in sight.

Gold mining is risky. There are operational risks, financial risks and/or expropriation risks. Despite operating since 2010, First Quantum’s $10 billion Cobre Panama Mine was shutdown by Panama’s Supreme Court. Then there is the operational risk when Ascot Resources’ Premier Gold in BC was forced to close after running out of ore, only months after commissioning its mine. Or, there is financial risk such as IAMGOLD’s Côté Lake which may never payback the billions spent to build the mine. Simply all gold companies are not created equal. Selectivity is all important.

Recommendations

Gold is precious, particularly in the ground. A modern-day gold rush is underway because reserves are valued too cheaply, causing a global rush to buy each other. South Africa’s Gold Fields is buying Osisko’s Windfall at a 70% premium for $2.16 billion or under $300/oz for reserves in the ground. AngloGold Ashanti is purchasing Centamin’s Egyptian Sukari mine for $2.5 billion. The problem today is that in this game of M&A musical chairs, there are too few empty chairs. Producers today are throwing off huge cash flow as margins expand allowing them to dust off some projects with a focus on “organic” growth. Others are buying back shares (Newmont) and some like Lundin Gold have raised their dividends. The senior producers will report “skookum” free cash flow in the third quarter allowing for dividend increases and buybacks. Consequently, we continue to favour seniors such as Barrick Gold, Agnico Eagle and mid-tier Lundin Gold whose second half production will be better than the first. We also expect a rotation to the developers who will bring on production within the next couple years and thus will benefit from the current bull market cycle. We like B2Gold, McEwen Mining, Endeavour and Eldorado among the developers.

Agnico Eagle Mines Ltd.

The largest miner in Canada, Agnico will have a strong quarter. Agnico is concentrating on organic growth as it brings the Malartic underground expansion and Detour Lake expansion into production. Hope Bay in Canada’s north is somewhat off in the future and more of a development project. Agnico will generate record free cash flow allowing them to bring down debt, further boost its dividend and bump up their exploration budget. Agnico has a great pipeline including Odyssey where ramp development is progressing and destined to become one of Canada’s largest underground mines. The Detour expansion, Macassa and Amaruq are part an enviable pipeline of projects. We continue to recommend the shares here.

Barrick Gold Corp.

Barrick, the world’s second largest gold producer has the largest array of Tier 1 mines but share performance has been lagging. Barrick is expected to have a better second half due to contributions from the Pueblo Viejo (JV) plant expansion in the Dominican Republic and the Nevada joint venture. To date, Barrick has avoided the M&A merry go-around concentrating on growth of its deep pipeline. The creation of the Nevada joint venture (with Newmont) has seen steady improvements with Goldrush ramping up. News from Fourmill is expected. Down the road, Barrick is expanding the Lumwana Super pit in Zambia which will boost Barrick copper exposure. In Pakistan, Reko Diq’s geopolitical risk was lowered by bringing in the governments of Pakistan and Saudi Arabia as partners. In the interim, organic growth from Kibali, Loulo and Gounkoto will fill the gap. Unfortunately, despite a new mining code, the Malian government is trying to extract $500 million in additional taxes applicable to Loulo-Gounkoto, so the games began. Nonetheless we continue to recommend Barrick for its array of Tier 1 mines, disciplined management and undervaluation.

B2Gold Corp.

B2Gold shares should improve in the second half in anticipation of the commissioning of the Back River project in Nunavut next year. Back River has cost more than expected and is taking longer due in part to its isolated location in the Arctic. Nonetheless Back River will be a major contributor. In the near-term, B2Gold has a framework agreement with the Mali government under the 2023 Mining Code, allowing the expansion of Fekola Regional and Underground. B2Gold is also working on the feasibility study of Gramalote which will be completed next year that could add 240,000 ounces a year. Otjikoto and Masbate are expected to perform well. We maintain our buy recommendation.

Centerra Gold Inc.

Centerra plans to bring its molybdenum assets into production with the Thompson Creek feasibility study to be completed this year. Although the expected return is modest, the life of mine plan calls for an additional 12 million pounds of molybdenum being produced. At this time there is little value being given to the moly assets, although Centerra sold 2.7 million pounds in the second quarter. Centerra has a strong balance sheet with no debt and gold/copper from Mount Milligan mine and gold from Öksüt in Türkiye, Centerra is in need of a flagship asset. Cash is not king in a gold bull market.

Eldorado Gold Corp.

Mid-tier Eldorado expects to have a better second half to meet guidance of 550,000 ounces this year with improved production from Kisladaq in Türkiye and Lamaque in Québec. Work at the Skouries gold/copper project in Greece is continuing as planned and slated to be in production in the third quarter next year. Eldorado has almost $600 million of cash and $200 million of available credit, sufficient to build out Skouries whose capital cost has increased. Nonetheless Skouries will be a company builder and will benefit from the higher gold prices. We like Eldorado for Skouries and the prospect that Eldorado will be a player in the M&A merry-go-around. Buy.

IAMGOLD Corp.

IAMGOLD shares performed well. IAMGOLD has brought Côté Lake near Sudbury, Ontario into production. The miner will repurchase the 10% stake sold to partner Sumitomo for $370 million or so. Côté will make a contribution but 20 percent of Côté Lake production is hedged and so it will not benefit from the higher gold price. We continue to believe that given the cost overruns and inevitable teething problem, particularly processing, that IAMGOLD will have difficulty making money. Côté is in the “show me” category. Meantime Essakane and Westwood are performing well but costs remain a problem. Sell in this strength.

Kinross Gold Corp.

Kinross is a Canadian based miner with mines in the US, Brazil and West Africa. Seventy percent owned Manh Choh project came on stream in the quarter and will be a contributor. Kinross released the long-awaited PEA on Great Bear in Northern Ontario which shows higher production in the first early years with a 12-year mine life. The PEA contemplates production from both the open pit and underground but with a whopping price tag of $1.4 billion and sustaining capital of $1 billion. Surprisingly, the update resource was disappointing as M&A resource declined to 2.7 million ounces despite extensive drilling by the company. Nonetheless the first eight years of production will average about 500,000 ounces annually. We believe Great Bear’s completion is too far off into the future to affect the shares near-term and thus Kinross with five other mature mines, Kinross is a source of capital. Sell.

Newmont Corp.

Newmont announced the sale of Australian Telfer and Havieron to Greatland Gold for about $475 million, part cash and Greatland shares. On the other hand, China’s Zijin will buy Akyem in Ghana.

for a billion dollars as part of Newmont non-core sales to net $2 billion. Despite higher gold prices, remaining sales might be disappointing, particularly with the four Canadian assets because mines like Porcupine possess huge reclamation liabilities. The world’s largest miner’s performance has been laggard because of the need to restructures its portfolio after two major acquisitions (Goldcorp and Newcrest) as “two and two did not necessarily add up to four,” since the sale of “non-core” assets and the combination of operating new mines consumed management time. Writedowns are next notwithstanding the higher gold price. We prefer Barrick here.

John R. Ing

Please refer to the Legal Section of our website (maisonplacements.com) for our Research Disclosures for an explanation of our rating structure at https://maisonplacements.com/research-reports/

*******