Gold: The Wild, Wild West

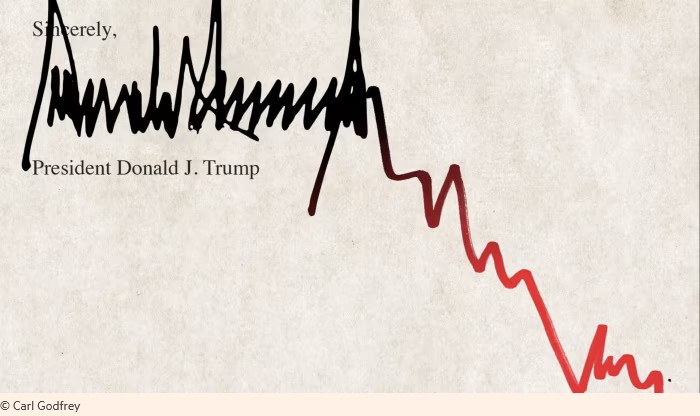

Within weeks of taking office Mr. Trump broke norm after norm, reversed 80 years of postwar American leadership in a roller-coaster ride of chaos, that toppled the long-established global rules-based order. In undermining the foundations that has preserved peace in Europe, he damaged his country’s standing in the world. The president is instinctively committed to the idea of the wild west where might is right and the biggest gun rules. And in a power grab that pushed the boundaries of his executive powers, he sowed uncertainty, deeply divided nations and raised the nation’s inflation prospects by imposing a wall of tariffs on adversaries and allies alike. He treated trade as war, and war as trade. Investors now worry that Trump’s strategic chaos is not a means to an end, but the end itself.

He is not the only one. Europe and Canada for example used the same fictional “national security” grounds to stop Chinese EVs or another countries’ steel. Beijing even responded by enacting new restrictions on critical minerals, which are necessary for a variety of sustainable products, including solar panels, batteries, magnets, wind turbines, and electric vehicles. Beijing even blacklisted American companies with big interests in China in retaliation for the barrage of tariffs.

Worrisome is that the Trump-induced on-off trade war against both allies and adversaries are at the heart of fears that an economy that was once the engine for global growth is now headed into a Thirties-type recession which morphed into the Great Depression. Today our leaders have displayed a similar impotence over the lack of economic growth, rising inflation and Mr. Trump. What’s more is that Trump’s wild, wild west game of chicken not only upends the current world order, but his contempt for “the dark state” brings major risks for markets and the economy. Simply how it plays out is yet unknown.

Everything All at Once

America has turned on its friends. Long standing alliances have been ditched and in a strange roundabout, enemies or adversaries are feted while America’s closest allies are treated as the greatest threats to US security. America has become an unreliable partner and everyone’s sovereign territory is up for grabs. Even the USMCA free trade agreement, which Mr. Trump negotiated during his first term, was his "best deal ever made." Not any more. It's the untamed west. And while he has rewarded loyalists with cabinet opportunities, even pardoning the January 6th rioters, that other arm of government, the judiciary system will adjudicate and review Mr. Trump’s efforts to push the judiciary envelope as well as his spending plans. With a hand-picked US Supreme Court, courts seem to have lost their independence and neutrality in recent years. At its essence, Trump’s blizzard of executive orders, unlawful tariffs and newly formed DOGE are about restoring presidential powers which could be vindicated by a pliant Supreme Court. The biggest test to limit his presidential powers is when Mr. Trump tries for a third term. A constitutional crisis is brewing.

Of more concern is that the president’s expansion of his presidential powers gives him direct control of entire agencies including the SEC, FDIC and CFTC and by taking back power from the bureaucrats, the president gains more direct power. All this occurred in less than 100 days, without acrimony and with the compliance of Congress and the Supreme Court. Many of the recent moves were made on ideological grounds and make no economic sense, particularly since the assault on the US economy comes at a critical economic tipping point in housing (interest rates), agriculture (tariffs), automakers (tariffs), and the Green New Deal (terminated). America is at war with itself.

In an effort to reduce regulations, the United States may also be impacted by the fact that when Clinton repealed the Glass-Steagall Act, Wall Street's derivatives of mass destruction contributed to the worldwide financial meltdown of 2008–2009, when stocks plummeted by more than 50%. And only two years ago, US financial markets were almost derailed by the Silicon Valley banking debacle when the backstop on depositors’ money was waived by the Federal Deposit Insurance Corporation (FDIC). The current global trade war, which threatens to be the largest since the 1930s, has not been priced in by the more leveraged markets. As European Commission President Ursula von der Leyen said, “it is important that we prepare for the worst.” This bubble is ready to pop.

Yet Trump is not the only president to seek more powers or retribution. Richard Nixon had an “enemies” list. LBJ was notorious for looking for disloyal members in his government. Mr. Biden turned billions of student loans into grants. Nonetheless the president’s slew of executive orders sweeps away potential guardrails in an attempt to supersede Congress and the Office of Management of Budget (OMB). The next test is the upcoming budget that will include Mr. Trump’s $4.5 trillion of tax cuts that requires trillions whilst Democrats are still licking their wounds from the last election. Amid the handwringing abroad and at home there are concerns that there is nothing on the horizon to check Mr. Trump’s zeal because the mid-terms are two years away.

DOGE Has Arrived to DODGE

Trump’s spending cuts are popular, particularly his “deep state demolition” led by the disrupter-in-chief Elon Musk’s Department of Government Efficiency (DOGE), tasked to cut a revised $1 trillion from the $7 trillion in spending. Everyone in Washington, including the defense department, is feeling the effects of Mr. Musk's DOGE attack on the federal government and its employees. DOGE’s cost cutting moves at long last brings accountability to the civil service and a much-needed brake on wasteful government spending, because red ink is splashing everywhere. The bad news is that without that spending the economy will sink faster. In taking over the federal infrastructure, already $1 billion of “savings” has attracted lawsuits. Nonetheless DOGE has proven that it has the political power to get what Mr. Musk wants. Lost in the noise is that the dismantling of the 10,000 strong USAID agency represented only $44 billion of savings or 1% of the annual $7 trillion budget. According to the Wall Street Journal, the costs and the savings claim may be exaggerated, therefore it is not yet evident that money is being saved. Moreover in shutting down USAID, America’s international reputation and “soft power” suffers helping China grow its foothold.

No doubt there are savings but importantly Mr. Musk’s DOGE and his acolytes will get direct access to data and the computer systems of the sacred cows IRS and Social Security. While Mr. Musk’s chainsaw massacre threat to “delete entire agencies”, both Trump’s cabinet and Congress is gearing up to maintain “power of the purse” and thus a fight is looming since that agency’s existence is mandated by Congress. But now the world's richest man is now in charge of the financial plumbing of the greatest nation, giving him control of the Treasury from everything to Social Security payments, tax refunds, federal grants and military salaries. Although Messieurs Trump and Musk believe that a successful DOGE will translate into lower interest rates, both are widely optimistic. For example only 77,000 of the 2 million government employees applied for bailouts. Pointedly America’s problem is not the number of bodies in government, it is that they spend so much on bodies, regulations and services that incurs deficit spending to pay. Simply the country could no longer afford to pay its bills and DOGE, we are told is the solution. Wrong.

According to this mercantile group of billionaires, Trumpism’s populist revolt to rid Washington of red tape and downsize government will allow US entrepreneurialism to make America great again. To them, the deep state was government, forgetting that they are now the government. Will DOGE collect taxes? Will DOGE manage the nation’s nuclear reactors? Will DOGE fill-in for fired air traffic controllers? Will DOGE issue money to pay America’s bills? Judges will decide. Change has arrived, whether we like it or not.

The Art of a Peace Deal

Today politics are everywhere. Under Mr. Trump everything is black or white or, either you are with him or against him. His executive branch has moved faster than Congress, the Courts and the “deep state” bureaucracy, aided in part by a distrust in everything from institutions to science and to the environment. Mr. Trump’s “might is right,” and everything else follows from then. America has become a threat, not a friend. Diplomacy is out, extortion is in. However, not black or white is his transactional power politics and the abandonment of core alliances, commitments and Ukraine (once an ally). Mr. Trump’s courtship of Russia strengthens Mr. Putin and undermines NATO, the cornerstone of the transatlantic alliance. Caught between an aggressive Russia and an indifferent America, a divided Europe harkens back to the great power competition of the late 1930s, reparations included. His America first agenda is isolationist in nature and plans to close the border to goods and people will boost inflation, not the economic growth he plans. The president claims it is all about the art of the deal, it is really about the art of deal-breaking. The resulting collapse in trust has far-reaching consequences.

While the election of Mr. Trump sent tremors around the globe, Mr. Trump is only part of the political shift in the democratic world order that saw the collapse of centralized governments and incumbents because they could not solve the problems of great concern to their constituents. True Mr. Trump’s affinity to strongman politics seems to rule, but not only in the United States. For a time, Mr. Putin and Mr. Trump were noteworthy populist autocrats, but are now joined by Mr. Modi of India, Meloni of Italy and of course Milei in Argentina. And now, deals are expected with that other autocrat, Xi Jinping of China on hopes that the US can split Russia from China. The sobering truth is that while Mr. Trump is being accused of diminishing democracy, perhaps democracy itself was diminished before. The Biden/Obama liberal eras certainly did not help. Today, Mr. Trump's job approval rating remains positive and so despite the headlines and handwringing, Mr. Trump’s burning the house down policies is winning favor with his MAGA base, but maybe not the department of USAID. This Trumpian revolution has just begun.

Trump’s Tariff Shock and Awe

Ironically, a previous Republican president, Ronald Reagan warned in 1987, “high tariffs inevitably lead to retaliation by foreign countries and the triggering of fierce trade wars.” He advised then, “the worst happen, markets shrink and collapse, businesses and industries shut down and millions of people lose their jobs.” And then he said, “the memory of all this occurring back in the 30’s made me determined when I came to Washington to spare the American people the protectionist legislation that destroys prosperity.”

Nonetheless, another Republican president, Donald Trump imposed 19th century-style tariffs on imports from its three biggest trading partners – 25 percent on Canada and Mexico (effective April 2), plus doubling tariffs on China to 20 percent to “reduce” incoming fentanyl. Tariffs are his geopolitical weapon to crush allies and enemies alike in an attempt to boost domestic jobs and industrial production. The postwar international trade system is being upended by Mr. Trump's America First, which also plans to impose "reciprocal tariffs" on trading partners, which would essentially match the levies or penalties on all US exports. Tariffs are an inflationary tax on consumers and mutually punitive. Surprisingly, his new tariffs would be dependent upon the tariffs of other countries such as VAT or GST so the taxes of one country would affect the tariffs of the US. America benefited from decades of free trade that lowered prices for electronics, toys, cars and other daily goods. Now America’s national interests are to be decided by other countries and what they decide to pay for duties. To be sure, this tariff war fallout will spark retaliation and tariffs can only increase, driving the economy into contraction, which is what happened in the Thirties when the Smoot-Hawley tariffs helped turn a recession into the Great Depression.

Under higher tariffs in Trump’s first term, China’s share of US imports fell, but China’s “plus one” strategy of continuing production abroad resulted in a huge Chinese global trade surplus while the US’s overall trade deficit widened. All this is making China appear more favourable, particularly with the US isolationist policy prompting many countries to look for ways to rebuild economic ties with China. Moreover as America ditches its soft power, China has filled the vacuum, particularly in Africa and South America. Then there is America’s embrace of Russia which is an attempt to drive a wedge between Russia and China, particularly since Europe’s efforts to sanction Russian energy resulted in the deepening of Kremlin ties with China. China and America are entering a “might is right” world where power politics and regional blocs increasingly define international relations. Both are shadow boxing and tentative phone calls are testing each other with “light blows.” Ahead lies the main match, a summit between the two superpowers.

China cannot be easily bullied and has shown they can easily retaliate both economically and geopolitically. Maybe an unpredictable Trump should do a big, beautiful deal with China. After all another Republican president, Richard Nixon, a staunch opponent visited China in 1971, to repair relations and both countries subsequently prospered. Mr. Musk could be Trump’s Kissinger. Mr. Xi would welcome a meeting of equals and China could help restore peace with Ukraine by telling its vassal to the North to settle. China with its vast markets could also help with technology, critical mineral supplies and there could be a sharing of artificial intelligence and green technology. If anything, Mr. Xi could deal with Mr. Trump since both are mercantilist from the same cloth and both do not fear Moscow. The US? China needs markets and the USA is the best. Taiwan? There is a deal here, ask Ukraine. Needed of course is for the two dominant players to sit down to come up with the big, beautiful deal. Can it happen? It did in 1971.

Oh Canada

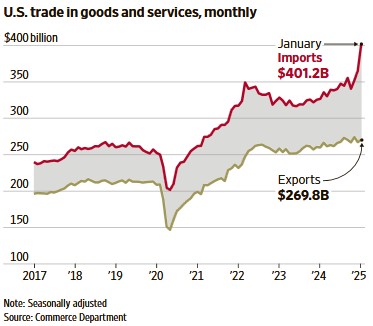

Because "we lose $200 billion a year with Canada, and I'm not going to let that happen," Mr. Trump wants to annex Canada and make us the 51st state. "Why are we spending $200 billion annually on subsidies to Canada?" he questioned. This is a fallacy. It is not a “rip off.” The United States is not losing money or providing Canada with subsidies. The imbalance is due to America buying resources such as oil that resulted in a trade gap of $72 billion in 2023. The “subsidy” is not that, it is due to the America’s needed purchases of energy, forest products or mineral resources. Simply the Americans are consuming more than they produce and importing the difference.

Canada is too close to America to see it straight. The two countries share the world’s longest undefended border and our economy is reliant on the Americans who want to annex us for our abundant resources. Some 70 percent of our exports go to the US. Maybe Canadians have to rethink the relationship and became more independent on energy and trade, making growth a priority and to reduce our dependence on America. Maybe make investment in our natural resources a national priority, to better exploit our cornucopia of natural resources. Reduce cumbersome red tape and, mine baby, mine. Maybe the supply management of dairy, cheese and yes maple syrup should be exposed to the free market. On defense, Canada has to spend more on defense rather ride on US coattails. One thing is clear, that the decades of underfunding the military to support social justice has finally come home to roost. Reversing defense cuts is a first step. All this is needed because the Bank of Canada estimates that if Trump’s tariffs last for a full year, our exports would fall by 8.5 percent and investment by 12 percent. Beyond these immediate fixes, Canada must rethink our reliance on our once great ally and take responsibility for our own defense, refocus economic growth by eliminating our “made in Canada” interprovincial trade barriers and pursue closer ties with others such as doubling the 51 odd free trade agreements with other countries, including China. Why not join BRICS?

Or even a pivot to China? After all, China is Canada's second biggest trading partner although representing only 12 percent of trade. China has cheaper EVs, artificial intelligence technology and needs our resources. Other than being next to the world’s superpower, we need investment, particularly for our envied natural resources. Geography cannot be changed, but both countries are searching for a wedge, and finding a delicate balance might be one way. Today everything Chinese is being demonized and there is a trust deficit following the Huawei debacle. Canada must join the realpolitik world. When we are looking around for export markets, China is an attractive alternative, particularly without the umbrella and goodwill of the United States. China’s economic dominance of key green technologies, critical materials, shipbuilding and EVs are trump cards in the world’s geopolitik. Canada needs China, not the other way exemplified by China slapping 100 percent tariff on canola, one of our key exports. Conversely, that might make the United States look a little more favorably towards Canada. Just saying.

You’re Fired!

Not surprisingly inflation is back. The consumer price index remains sticky at 2.8 percent as food and energy prices picked up. Egg prices jumped 15% to all-time highs because of bird flu. Producer prices spiked at their fastest pace in 2 years for the 13th straight month without a decline. Consumer prices already jumped 3% last month and all this is before Trump’s tariffs. Cocca is in short supply. Consumer spending makes up about 70 percent of America’s GDP. Online spending alone from Thanksgiving to Cyber Monday was $41 billion. Consequently the US is the largest importer of goods and services, buying some $4.1 trillion last year. The US household savings rate dropped from 5.5% to 3.8% last year as consumers spent every dollar they make.

The self-proclaimed tariff man promised lower inflation but his flip-flopping tariffs has already caused more than a “little disturbance.” Tariffs will widen the deficits with the US interest-rate bill alone exceeding what they spend on defense. Then there is higher energy and food inputs to come as tariffs take hold. Tariffs will be paid by the American consumer, a tax increase at a time when they are scrambling to pay bills. Food? Retaliation will drive up costs since it is likely that China and others would impose tariffs on American crops. Soybean producers in America are still recovering from the previous round of tariffs. Interest rates remain high and mortgage rates remain near 7 percent. At the same time government spending increased 9% while personal consumption jumped by 15%. Hot, hot, hot. And gold bars? They are also in short supply.

There are some who are disturbed by the lack of guardrails. However, we are still early in Trump’s presidency with the need to cut taxes and get spending under control, without increasing the $2 trillion annual deficit because current policies will add at least $2.8 trillion to the deficits by 2034. The point is that there are multiple guardrails. The ultimate guardrail however is inflation which helped sink President Joe Biden's attempt at a second term. If the US is ever to reduce its large deficit, it must first deal with structural issues that caused the shortfall which includes large budget deficits, low savings and overconsumption. And worse, Trump’s fiscal and monetary policies are to be paid by deficit funding, the feedstock for inflation. Mr. Trump will not have much room because the inflation numbers are posted every month. Inflation is one guardrail the Fed will be watching as the inflation numbers and rates are expected to remain high.

America’s Achilles Heel is its Debt

The real problem is not even Mr. Trump. After waging World War I and World War II, Britain was saddled with debt and not only lost its empire but sterling was replaced by the dollar as the world’s reserve currency, allowing them to print dollars at will, without even a gold backing. Ironically, today America’s balance sheet is also woefully weak with the US becoming the world’s largest debtor at $36 trillion, up from $19 trillion in 2016, with no end in sight. That soaring debt is due to America’s profligate spending and is its Achilles heel, overwhelming the capacity of their debt markets.

Tariffs would normally cause the dollar to strengthen because fewer dollars are needed to pay for imports. However as in the 30’s, tariffs could exacerbate America’s already severe fiscal problems. Noteworthy is that the dollar has weakened in a potential deflationary slump. Deficits keep on getting larger, putting more pressure on the bond market with the Congressional Budget Office forecasting a deficit of almost $2 trillion this year, sending the country’s debt to GDP over 100%, a level that spells trouble for other countries. Businesses can’t plan. The scale and scope of the fiscal deficits is already made worse by Mr. Trump’s tax cuts and his spending plans will add at least $5 trillion to the debt. Foreign aid was only 1% of the annual budget. While defense outlays have risen 8%, they are exceeded by interest payments which are expected to take a rising share of GDP up 13%. Then there are sacred cow’s entitlements that are also taking a bigger share of the budget.

America’s exceptionalism really is not exceptional. Mr. Trump promised his MAGA supporters big results to close the spending gap from raising revenues from his tariffs, to slashing spending through mass firings, to issuing $5 million EB-5 gold cards that give away rights to immigrate. He even forced the Fed to act as a backstop for cryptocurrencies which have no money use other than to trade. What happens if they don’t work? The Atlanta Federal Reserve’s GDP NOW model created in 2010, ominously projects that first quarter GDP will fall by 2.8 percent, the fastest pace since the pandemic lockdown. The model has been pretty accurate in the past. And so it begins.

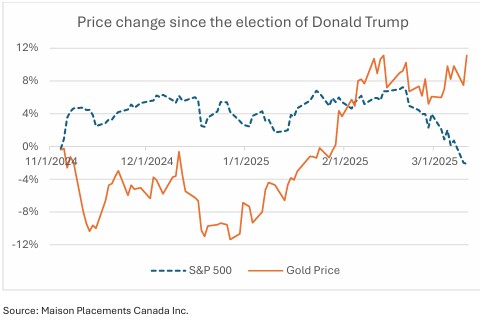

Trump Bump Turned into Trump Slump

For awhile the stock market recorded ever higher highs but the Trump bump has turned into the Trump slump as exuberance gave way to “made in America” recession fears. Even more concerning is the fact that government funding has grown more problematic since the Fed no longer purchases a significant amount of US debt due to the termination of quantitative easing. While Trump’s tariffs are getting the headlines, we believe that the dollar-based financial system is in for a revamp. As markets adjust to the new geopolitical order, the appeal for dollar assets diminishes, particularly if there are rumoured capital curbs. Today, everything has changed. America can no longer be trusted, particularly when America First isolation and retreat from a rules-based system, undermines US hegemony and the dollar’s safe haven status. After all it is the greenback that is the source of US hegemonic power allowing them to run a huge fiscal deficit. Today more and more of the $4.5 trillion hedge fund players have loaded up on treasuries to protect their portfolios from the increased volatility in markets. The US Office of Financial Research estimates that the top 10 largest hedge funds have borrowed about $1 trillion via the repo market. Because so much of America's debt is short-term, there is a risk of instability, particularly when the spending bill flirts with default.

Mr. Trump’s extreme positions cannot last. Weaponizing the US economy is a wasting asset. Price-raising tariffs will hurt corporate profits and incomes at home and abroad. Mass firings creates uncertainty. The erosion of the rule of law reduces the dollar’s popularity. The stock market has erased the gains made since last November and consumer spending, a bulwark of record US growth is down. The chickens have come to roost. And in this new world of trade wars, real wars and economic wars, investors’ and governments’ enthusiasm for the dollar is waning which is the main driver behind central banks’ stocking up on gold instead of treasuries.

China is the world’s largest creditor with $3.227 trillion foreign exchange reserves while the US is the world’s largest debtor. Recent data shows that Japan and China, the two largest holders of Treasuries have reduced their holdings, amid trade frictions making funding America’s debt more difficult to finance. The Fed remains the largest owner of US government debt despite quantitative tightening. If foreign owners of US debt keep reducing their holdings, what or who will fill the gap, particularly since the Fed too has reduced its holdings.

The US holds the world’s largest gold reserve at 8,133 tonnes valued on the Fed’s balance sheet at $42.22/oz. Given its financial woes there is talk of revaluing the reserves upward which would be worth some $800 billion instead of the $11 billion to bail-out America’s beleaguered financial system. In the first comprehensive audit of gold since 1974, Mr. Trump will go to Fort Knox with Mr. Musk to confirm the existence of 4,600 tonnes of gold purportedly kept in 15 vaults. In 1981, Ronald Reagan's Gold Commission was tasked with investigating the possibility of establishing a gold standard for the currency, backed by the gold in Fort Knox supported by Lewis Lehman and Ron Paul. Rather than using the gold standard, the commission developed a gold coin. Today there is a shortage of physical gold because the world’s major central banks, led by China have been soaking up over 20% of the world's supply over the past three years. Due to a tightening in the physical market, more than 400 tons of gold were moved from LBMA London vaults to Comex's New York vaults. As a result, New York gold is currently trading at a premium of $30/oz, which may be the result of an offside derivatives position in New York.

The world is changing, get used to it. One can detect the decline of confidence and trust in every part of the world. Meantime the US dollar has fallen to 57 percent of central bank reserves. Since the end of the Second World War, the US dollar has been the world’s reserve currency, with its “exorbitant privilege” allowing the US to finance its chronic deficits with cheap debt. When Congress passes a trillion-dollar spending bill, the Federal Reserve simply creates the dollars and credits the US Treasury. No borrowing is required.

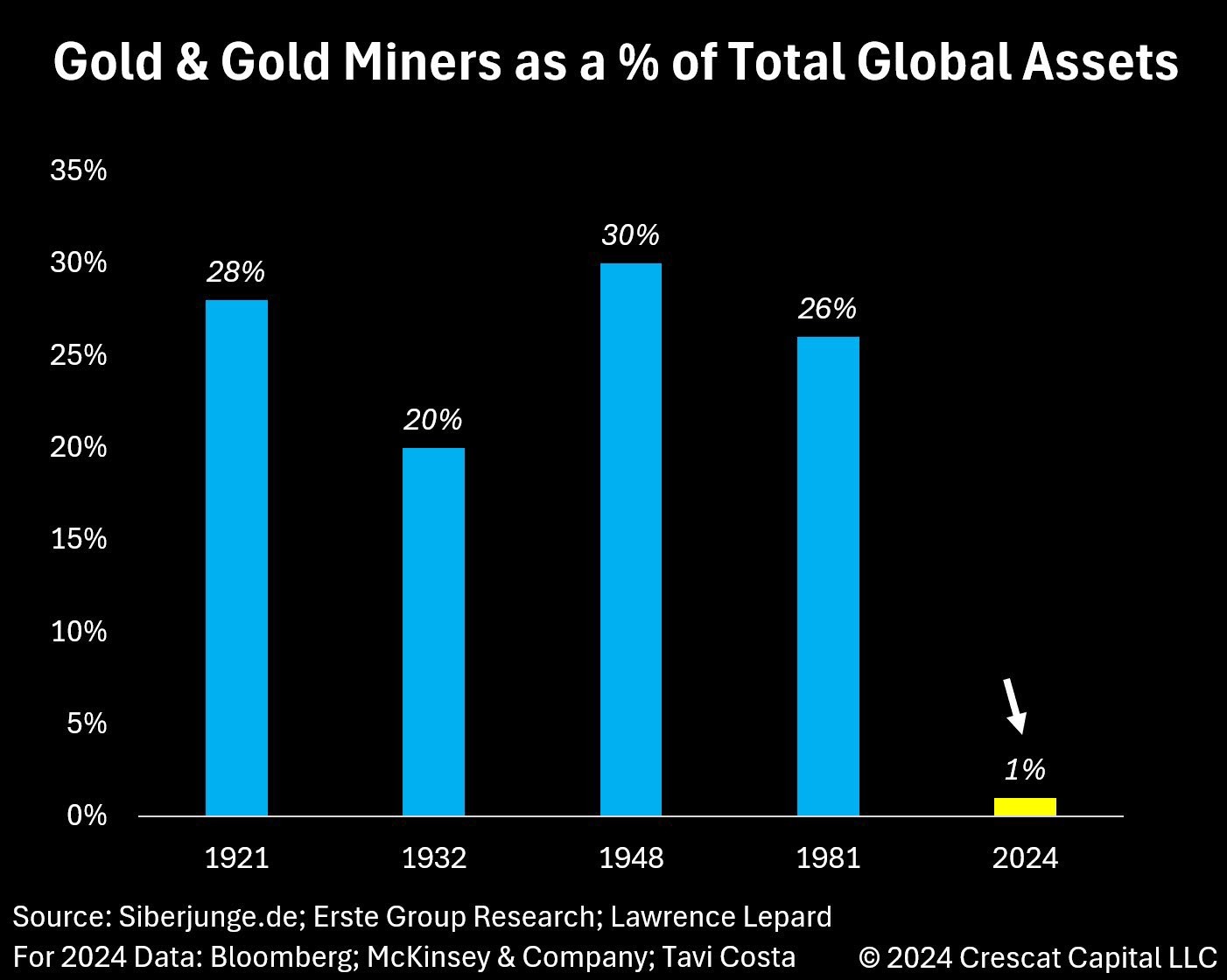

Today the tariff-weakened dollar is backed by the good faith and credit of the United States. What happens if the United States’ good faith and credit is found wanting? Today faith in its economic and financial institutions is being tested, particularly after American exceptionalism eviscerates government and the rule of law. We believe America’s growing isolation and unreliability has sapped confidence in America and eroded the dollar’s hegemony. Without confidence in the dollar, the world has no valid reserve currency. The ultimate scorekeeper then is gold. Gold is an alternative to the dollar, an asset and scarce. Mr. Trump won the election pledging a new “golden age.” He was right. Gold is up 12% this year, surging to a record $3,000/oz adding to the 27% gain of 2024. We continue to believe gold will top $3,300/oz.

The best Trump trade is gold.

Recommendations

Depleting reserves is a problem for the gold miners since most have not replaced their reserves they dig out of the ground. Consequently long-life reserves are valued highly. China is the world’s largest producer and consumer of gold but its mines have also had difficulty in replacing reserves. Many of their mines are short-life mines and thus China must import gold to satisfy demand. Mining is a long-term process and it can take up to 15 years from first discovery to first pour. Peak gold has arrived with production declines due to declining grades such that the amount of gold per ton has declined. Consequently just to standstill, miners need additional reserves or develop new mines. Mining is a capital-intensive business due to the lengthy time to bring gold into production, so capital is very important. Red tape is a problem as permitting is often lengthy and cumbersome. Capital is scarce, particularly because most investments lately have been directed towards ETFs (Exchange Traded Funds) at the expense of managed funds and exploration stocks.

As a result we believe that the developers, i.e. those mining companies that have already discovered ore bodies and are in the feasibility stage and/or about to bring their projects online are the main beneficiaries of the current rise in the price of gold. Today the mining industry is generating huge free cash flow and thus have dusted off brownfield projects, but they are few. Exploration stocks on the other hand are still suffering from lack of interest and capital as the big gold funds and ETFs primarily make investments in the large liquid seniors. Consequently, there are many exploration projects that some of the mining companies are looking at, viewing the juniors as “skunk works.” Selectivity is important here.

Jurisdiction too has become very important as many governments look to pluck the mining golden goose. Resource nationalism has spread as countries like Mali or many in central Africa have raised royalties. But they are not the only ones, in Australia some states have increased royalties to the detriment of mining projects. In Canada, the web of red tape and delays in permitting have also resulted in the shelving of projects. Also in Canada, the restrictions on foreign capital, particularly the ban on Chinese investment has resulted in some companies changing domiciles to the detriment of local jobs and projects. Mining needs long-term capital and thus artificial barriers like provincial, or even national barriers are to the detriment of the country. Barrick as an example is even considering moving its domicile because of the expectation of getting broader acceptance by the US market.

Among the seniors we like Barrick and Agnico Eagle. Developers like B2Gold, McEwen Mining and Eldorado are alternatives. We expect the M&A merry-go-round to be active and Lundin Gold and Endeavour will be participants.

Agnico Eagle Mines Ltd.

Agnico Eagle had record results producing 847,000 ounces at AISC of $1,300/oz. Production guidance however was lowered 3 percent for this year due to problems at mature Pinos Altos mine in Mexico and Malartic processing. Fourth quarter free cash flow was $570 million. Nonetheless Agnico will spend $2.1 billion this year, of which most is for sustaining capital, buyback and exploration. Last year Agnico spent a whopping $270 million on drilling alone. Agnico has an enviable pipeline with Odyssey underground, Detour, Hope Bay and Macassa. With the recent acquisition of 03 Mining at a 58 percent premium, the Marban deposit will help to keep the big Canadian Malartic mill running. Agnico reported reserves of 54.3 million ounces, which was a slight increase last year due in part to inclusion of Hope Bay’s Patch 7 results. The balance sheet has almost $1 billion in cash. We like the shares here for Agnico’s pipeline of growth based on the Malartic, Detour and Meliadine platforms.

Barrick Gold Corp.

Barrick reported a strong fourth quarter which was offset by the stalemate with the Mali government. The good news is that Barrick's patience paid off since there appears to be a resolution in the works. Loulo-Gounkoto is a major contributor to the Malian economy and putting the project on care and maintenance was a lose-lose proposition for both the company and country. Looking ahead Barrick's update at $6 billion Reko Diq in Pakistan boosted reserves and the mine has a three-decade life with first production targeted in 2028. Barrick enlisted the Saudis as a partner with the government, giving Barrick some geopolitical protection. Reserves were also boosted at the Lumwana Super Pit where the expansion (capex $2 billion) extends that mine life by 17 years. Importantly, Barrick shed more light on Fourmile in Nevada where they plan to spend $78 million on a pre-feasibility study. Fourmile has Tier 1 potential and could be included in Barrick's Nevada Gold Mines JV, the world’s largest gold complex. Barrick has the largest number of Tier 1 gold mines as well as attractive copper exposure. Management is streamlined, costs are under control and the company is one of the go-to players for institutions. We continue to like Barrick here.

B2Gold Corp.

B2Gold met guidance in the fourth quarter. However production at Fekola in Mali was down which is expected to recover this year (likely 180,000 ounces). B2Gold has finalized an agreement with the government on Fekola and Fekola regional project to consolidate the three licenses allowing the go-ahead at Fekola Regional. At Otjikoto a new discovery in the Antelope zone has depth potential. At Goose in Nunavut the heavy lifting was done with $1.54 billion spent and commercial production is expected in Q3. B2Gold has cash of $337 million and drew $400 million on their facility sufficient to complete Goose. And fund B2Gold’s next mine, Gramalote in Columbia with a feasibility study expected this year. We like the shares here for growth.

Centerra Gold Inc.

Centerra is an intermediate producer with two operating mines, Mt. Milligan copper/gold mine in BC and Öksüt gold mine in Turkey at AISC of $1,300/oz. Centerra is bringing on the Thompson Creek moly expansion (MBU) and plans to spend $400 million despite mediocre returns. Centerra took an almost $200 million writedown on the Goldfield project in Nevada which was disappointing but expected. On the other hand, Centerra has dusted off former producer Kemess on hopes to develop satellite deposits using the old Northgate facilities. Centerra is a gold miner looking for a gold mine but has a strong balance sheet. Nonetheless growth prospects are somewhat limited. We prefer B2Gold here.

Eldorado Gold Corp.

Mid-tier Eldorado produced almost 200,000 ounces from the Lamaque Complex in Quebec. The big polymetallic Skouries project (60 percent complete) in Greece will come onstream in Q1 next year. Olympias also in Greece will be expanded. At Kışladağ in Türkiye, waste shipping and infrastructure work was carried out on the leach pad and pit expansion. Eldorado has $1.1 billion of liquidity, including almost $900 million of cash. We like Eldorado, particularly because big Skouries will come on stream at the right time. Buy.

Endeavour Mining PLC

Endeavour had strong results due to Sabodala in Eastern Senegal and produced 1.1 million ounces in 2024 at AISC of $1,200/oz. Total reserves increased by 4.5 million ounces due to additions from Assafou and Ity. The company released a prefeasibility at Assafou project in Côte d’Ivoire showing annual production of 329,000 ounces at AISC of $900/oz for first 10 years with an attractive IRR 28 percent at $2,000/oz. The feasibility study is expected next year. The balance sheet is strong with $384 million cash against $700 million of debt. We like Endeavour here but believe the shares trade at a discount to its peers because of its large West Africa base in Senegal, Burkina Faso and Côte d’Ivoire. That undervaluation makes it an attractive buy.

IAMGOLD Corp.

The mid-tier miner produced 667,000 ounces last year due to contributions from the ramp up of Côté Gold and Westwood (produced 134,000 ounces). Côté is a huge low-grade project (average grade mined was 0.97 g/t) so tonnage and costs are all-important. Essakane’s costs increased over $2,100/oz due to lower grades and scheduled repairs which was disappointing. Costs remain a problem here which should come down if Côté doubles expected production. Côté is still a work-in-progress. IAMGOLD has cash of $350 million against net debt of $859 million and completed half of their prepay expensive obligation. The company has drawn $220 million, leaving $400 million available. We prefer B2Gold. Sell.

Kinross Gold Corp.

Kinross had a good quarter and shed more light on Great Bear in Northern Ontario. Paracatu in Brazil had a solid result producing more than 500,000 ounces. Manh Choh made a contribution. Free cash flow was $1.3 billion on 2 million ounces of production. Kinross has a collection of mature mines like Bald Mountain and Round Mountain, but recently some infill drilling at underground Round Mountain gave joy. At Great Bear, the PEA projected 518,000 oz/year at AISC of $800/oz which is still a long way off, particularly given the fact that the project was acquired three years ago and the heavy lifting of construction and permitting is still to come. So much money but so few ounces. Sell.

Lundin Gold Inc.

Lundin had excellent results from Fruta del Norte in Ecuador, the lowest cost mine in the industry due to its rich grade (11.3 g/t). P&P reserves were at 5.54 million ounces. Lundin produced 502,000 ounces at AISC of $875/oz, generating free cash flow of $540 million. Furthermore, Lundin paid out $300 million in dividends. The company completed 80,000 meters of drilling and plans to release a resource at nearby Bonza Sur project which has 2.6 kilometer length. The miner also doubled its dividend. We believe there is still drilling and production upside. Buy.

McEwen Mining Inc.

McEwen Mining’s Grey Fox $10 million drilling campaign had positive results with 13 drill rigs turning. The discovery of a series of deposits which can be processed at Fox will boost ounces and upside potential. The miner expanded the tailing facility. Drilling will be focused on expanding the six zones. McEwen has an extensive ground position in the Timmins-Porcupine camps. At Gold Bar in Nevada there has been improvement. McEwen plans a feasibility study to be completed mid-year next year at McEwen Copper’s Los Azules in Argentina, one of the world’s largest undeveloped copper mines with an implied value of a billion plus today exceeding the value of McEwen Mining. We expect that valuation to grow. McEwen also has a portfolio of five royalties. Buy.

New Gold Inc.

New Gold released their life of mine plan for Rainy River and New Afton. While New Gold had a strong year with free cash flow of $85 million, the bad news is that Rainy River will be processing lower grade material in first half before higher grades kick in from the underground. The company benefited from higher cash flows from New Afton after the Ontario Teacher’s buyout as well as higher copper prices. High-cost Rainy River continues to disappoint with crusher problems in the fourth quarter as it develops the underground Rainy River’s main zone. Sell, the shares are fully valued. We prefer Eldorado here.

Newmont Corp.

Newmont, the world’s largest gold miner had a strong fourth quarter but what shocked the street was that all in cost soared over $1,600 per ounce due to integration issues of the Newcrest acquisition in late 2023, as well as the high AISC costs from the leftovers from its earlier Goldcorp acquisition with Brucejack’s $1,900/oz and Red Chris’ $2,000/oz. Lihir in Papua New Guinea required costly maintenance and Cerro Negro in Argentina is problem prone. Although guidance was largely in line with expectations, Newmont's costs are much too high. Newmont’s sustaining capex budget is at $1.8 billion this year and likely next. The problem with Newmont is that management has been hit with the challenges of going for growth for growth sakes. Integration, different mining cultures, management turnover and running mines on four continents have overwhelmed the company. As well, reserves declined. Newmont is in need of a restructuring from the top down. Sell.

John R. Ing

********