The Golden Kiss

I prefer the “KIS” motto to the more common “KISS”. I define it as, “Keep It Simple”. Simply put, gold bullion is the ultimate asset, but when the price declines, Western investors often become nervous.

I prefer the “KIS” motto to the more common “KISS”. I define it as, “Keep It Simple”. Simply put, gold bullion is the ultimate asset, but when the price declines, Western investors often become nervous.

Some investors try to mitigate their worry, by reviewing factors that make gold the “queen of assets”. That helps, but I think a simple focus on gold demand versus supply is all that is required to own gold without worry.

In 2009 – 2010, the fear trade (the Western super-crisis) created massive and consistent demand for gold. Institutional investors literally flocked into gold ETFs.

That demand became so huge that it started to equal Indian and Chinese gold jewellery demand. In turn, that caused global demand to overwhelm mine and scrap supply, driving the gold price relentlessly higher until 2011.

Another part of the fear trade is geopolitics, and today’s bombing of ISIS targets in Syria is probably why gold is rallying this morning. Unfortunately for gold price enthusiasts, geopolitics has yet to create the kind of demand that the super-crisis did.

While the super-crisis has faded as a price driver, and geopolitics is not yet in play, global demand is still roughly equal to global supply now, because Chinese demand has grown and Indian demand is returning to its normal state.

‘With the festive season round the corner, analysts feel gold and jewellery sector may see higher sales. “Gold demand will get a boost as festivals such as Navratra and Diwali approach,” Bloomberg quoted Ashish Shah, Head of AC Choksi Share Brokers Equity.’ – The Financial Express News, September 23, 2014.

The bottom line is that there is nothing for investors to fear in regards to lower gold prices at this point in time, because demand and supply are well-balanced.

Still, there is a regular ebb and flow of Chindian demand. When it’s strong during a particular month, as it was in June when India officially imported over 100 tons (and probably another 20 – 30 tons in the black market), gold tends to rally $50 -$150 higher.

When demand is a bit soft, as it was in July and August, the price tends to decline, by about the same amount. Many analysts tend to get quite excited about these intermediate trend movements, but I would suggest they are movements like the tides of the oceans.

The simple fact is that the ebb and flow of Chindian jewellery demand does not suggest great bearish or bullish price action is imminent, but it does move the price modestly higher or lower on a regular basis.

Gold is probably the most stable market in the world right now, and whether the next $100 price movement is to the upside or downside is most likely going to be determined fundamentally by whether October Chindian jewellery demand has upside strength, or downside weakness. There are some hints as to what is likely coming:

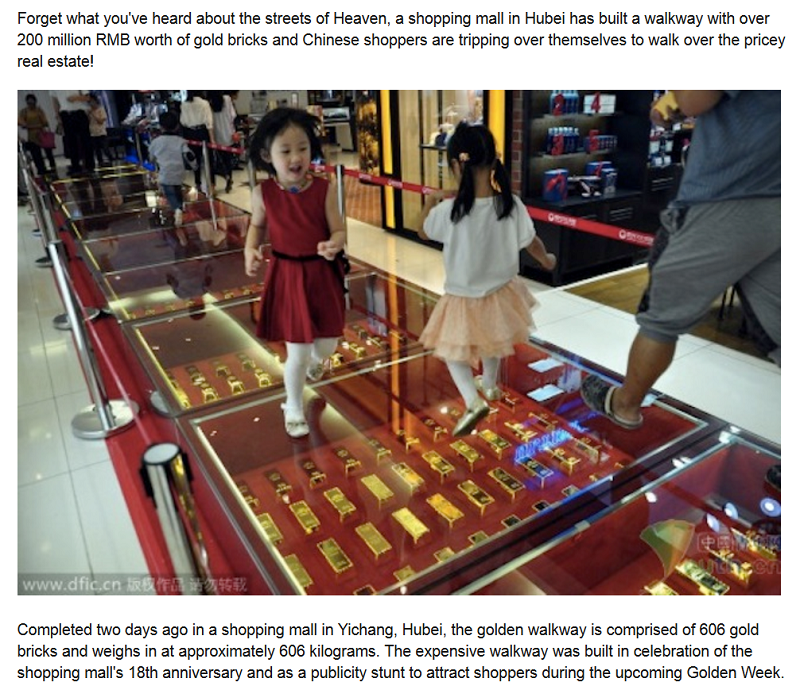

As “Golden Week” begins in China, children are celebrating by walking across a sidewalk of gold!

Indian jewellery stocks are also rallying strongly, probably in anticipation of good sales during the Diwali season.

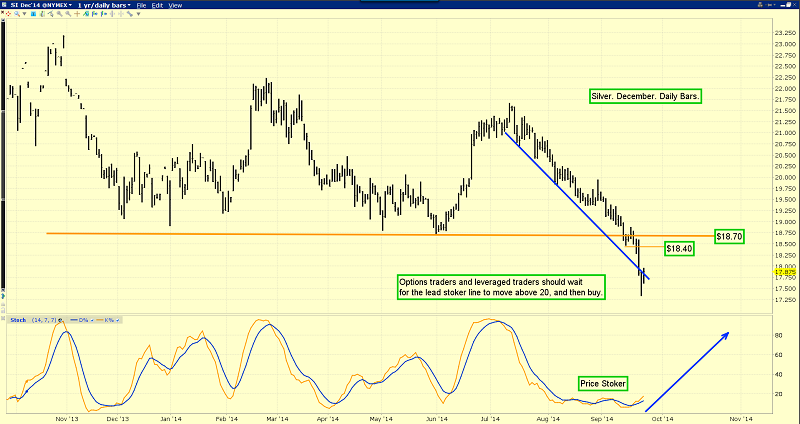

Technically, gold also looks ready to rally. I bought the recent “ebb” in Chindian demand, in modest size. Leveraged traders and options traders should wait for my price stoker oscillator to rise above the 20 line before buying, to capture a potential “momentum” style move.

I’ll be a very light seller at $1240 and $1270, and I’m hoping to see gold trade at those prices on this “stoker up cycle”. Gold has arrived at light sell-side HSR (horizontal support and resistance) near $1228 this morning, and ALGO traders are likely selling there.

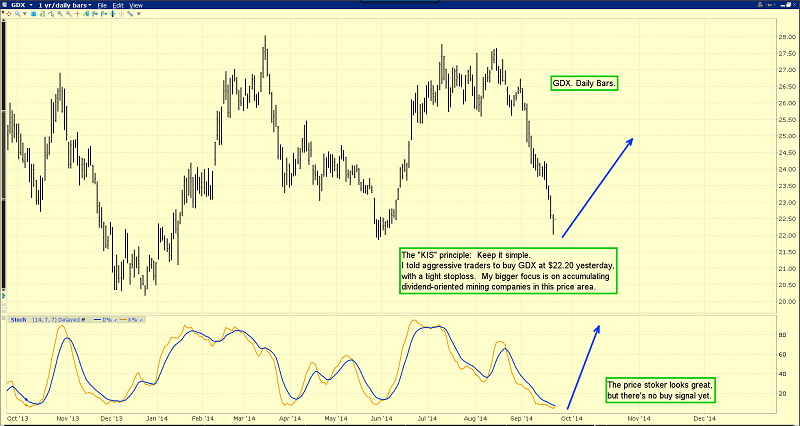

This daily GDX chart looks bullish, and I’ve been a substantially bigger buyer of gold stock than bullion, into this decline.

Clearly, patience is required. Note the position of my price stoker on that GDX chart. The last time it flashed a full crossover buy signal (where the lines are under 20 when the signal occurs) for gold stocks was in early June. That’s over three months ago!

There has been a lot of drama displayed by investors and analysts since that last buy signal, but there is nothing out of the ordinary occurring with gold stocks. Chindian demand was modestly soft for a few months, and so the price of gold stocks, which are leveraged to gold, declined more aggressively than bullion did.

I sold some gold stock for gold bullion in late June, and now I’m buying it back, without any drama. I’d like to see the entire gold community join me as I do that, albeit in a very modest way.

Some investors in the gold community have asked me if I would buy the US stock market now. I only buy significant price weakness, so the answer is no. I will be a buyer of the Dow at 14,200. That’s the thick green HSR line I’ve highlighted on this monthly candlesticks Dow chart. Aggressive investors, who feel they are missing out on the action, could buy at 16,600 or 15,600. My personal focus for my stock market monies is the stock market of India, which is vastly outperforming the US stock market, and will probably continue to do so for many decades. I view the US stock market like a rotary phone relic, and India as a “must own” Iphone!

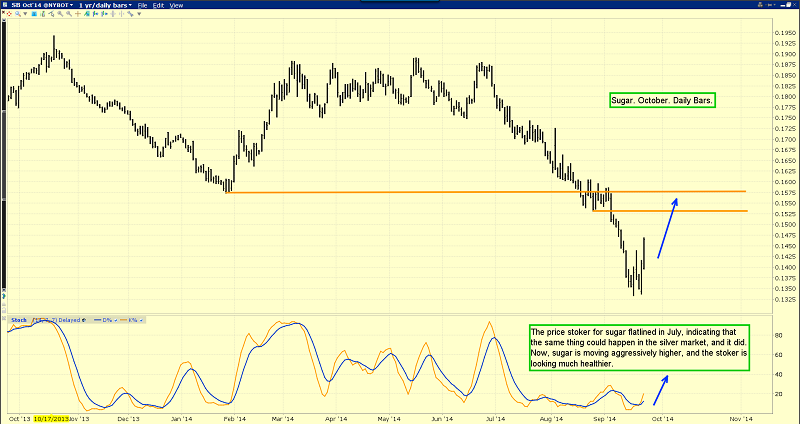

Sugar is a great asset, and it can be a key leading indicator for silver prices. This daily sugar chart looks excellent. There’s a commodity-style (short term) double bottom pattern in play, and my price stoker is pushing at the 20 line, on a crossover buy signal. This technical action suggests something similar is coming in the silver market.

That’s the daily chart for silver. Strong jewellery demand in October should produce sharply higher gold prices. If it’s strong enough, silver should be able to move well above sell-side HSR in the $18.75 area.

In closing today, I want to highlight an intriguing pattern that has developed on the COT report chart for gold. Sentimentrader charts commercial hedger activity very well. It appears that the commercial hedgers are steadily moving towards a net long position in the gold market, and there’s an inverse head and shoulders bottom pattern in play. Whether they are focused on the super-crisis, geopolitics, or gold jewellery, is unknown, but this bodes well, for all the world’s gold investors!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my “Get Richer With Juniors!” report. I’ll show you my ten rules for investing in the junior gold sector, and how to apply them to the top stocks right now!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: