Greece Burns And Gold Prepares To Rally

As the crisis in Greece (and now Puerto Rico) intensifies, Global markets (except gold) are tumbling. Greek banks are closed, and the situation looks grim.

Incredibly, the enormous volatility seen in US stock markets yesterday could intensify, when the US jobs report is released around 830AM on Thursday, just a few days ahead of the Greek referendum! Gold and silver have a rough general tendency to decline ahead of the jobs report, and rally following its release.

In my professional opinion, Greek citizens will probably vote “Yes” to stay in the EU, but will leave anyways in a few weeks. Their sovereign debt crisis won’t be solved by borrowing even more money. Also, once today’s payment deadline passes, it appears that the referendum becomes a vote on something the IMF by-laws prevent it from delivering!

The good news is that I expect Chinese corporations and banks to engage in serious buying of Greek assets if/when Greece leaves the EU. Greek stock markets could rally strongly, as that happens.

The Greek government is running a balanced budget now, but its overall debt is an overwhelming burden. Likewise, the US government is working towards balancing its budget, but it also has massive debts.

The poorest citizens in America are burdened with what I call “shadow taxation”; the cost of living is extremely high for most people, relative to their income. The US government and the Fed are probably mainly to blame for this situation, but greedy corporate directors are also at fault.

Rather than paying themselves fairly and paying their workers fairly, many corporate directors have issued themselves huge salaries, while underpaying workers, laying them off, and then urging the government to operate hugely inefficient social assistance programs for the impoverished workers.

US wages have stagnated for decades, while corporate profits have surged. House price inflation has been used by the government and the Fed to “create wealth”, but it’s not creating any wealth for most people. It’s destroying the ability of the country’s working class to house themselves.

In time, the US government will probably default on its debts, but it will be quite a long process, featuring an ongoing drop in the standard of living of most US residents.

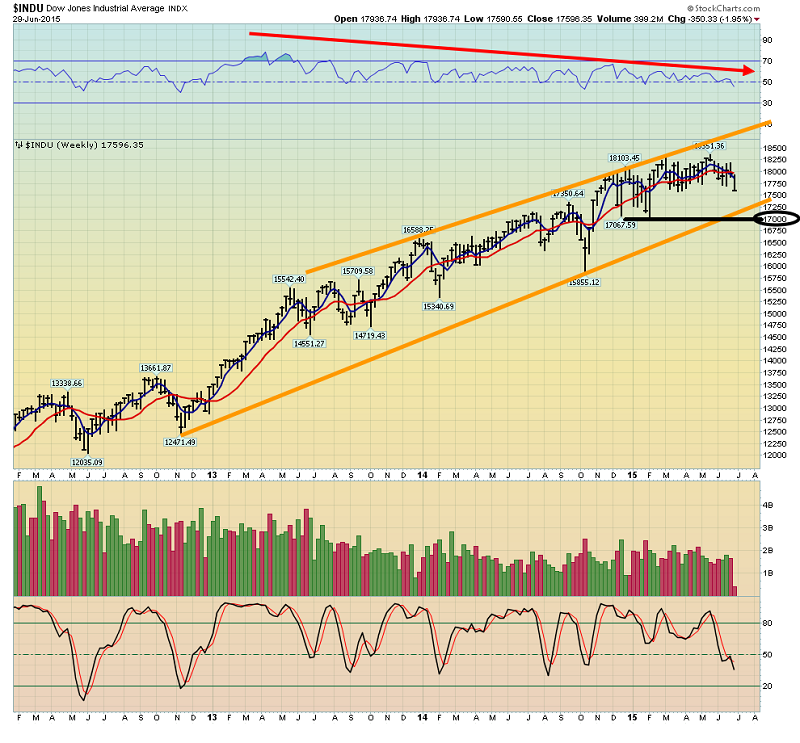

This weekly chart of the Dow looks frightening. Relative strength (RSI) has been in steady decline since 2013, while the price of US stocks has rallied. Note the bearish wedging action of the price channel I’ve highlighted on the chart.

Some analysts have suggested that the US stock market could function as a type of “safe haven”, if global bond markets collapse. I beg to differ, and yesterday’s meltdown in the Dow suggests that I’m correct to do so.

Institutional investors will move funds from bonds to stocks if interest rates rise based on surging economic growth. That’s not happening, and US corporate productivity is “dead in the water”.

The US economic upcycle is almost eight years old. Growth is not surging, and while I don’t see Greece as a domino like Lehman was, most Western countries have debt problems that could easily become similar to the problems of Greece.

America is an aging empire. The simple fact is that when they are young, empires shine brightly. When they age, they fade into obscurity.

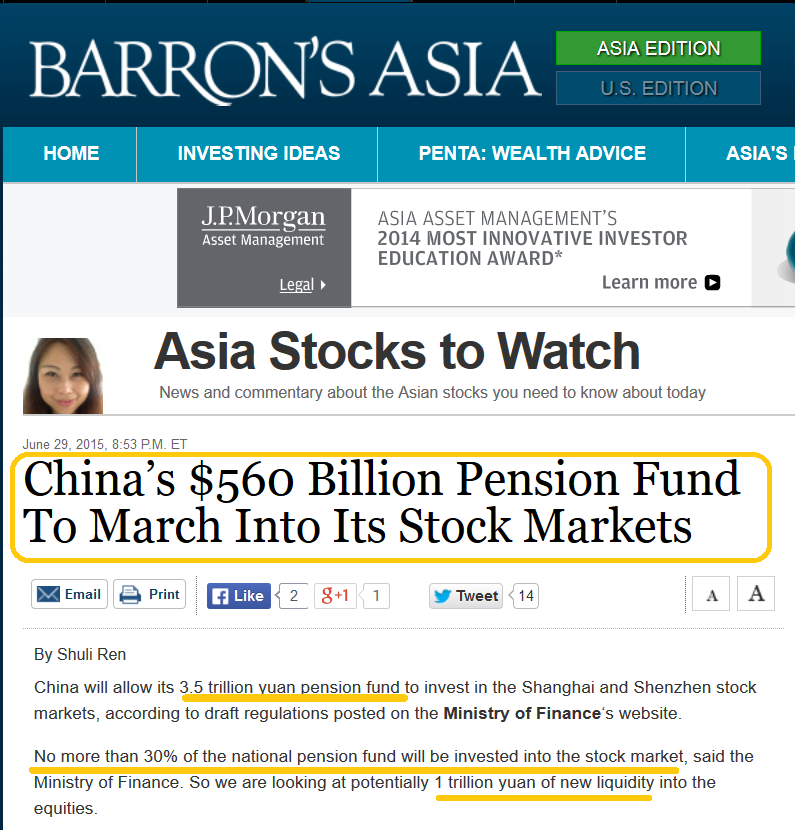

While I wouldn’t touch the stock market of the aging and debt-soaked American empire with a ten foot pole, I have no fear of buying all the price sales that occur in the Chinese stock market.

In a nutshell, the Chinese empire is young and vibrant. That’s the monthly chart for FXI-NYSE, which I refer to as the “Chinese Dow”.

A pullback to the apex of the massive symmetrical triangle pattern would be no surprise to any professional investor. With about five hundred million people poised to become part of China’s “investor class”, new pension fund rules, and the growing share of China in international stock indexes, the future is very bright for the Chinese stock market!

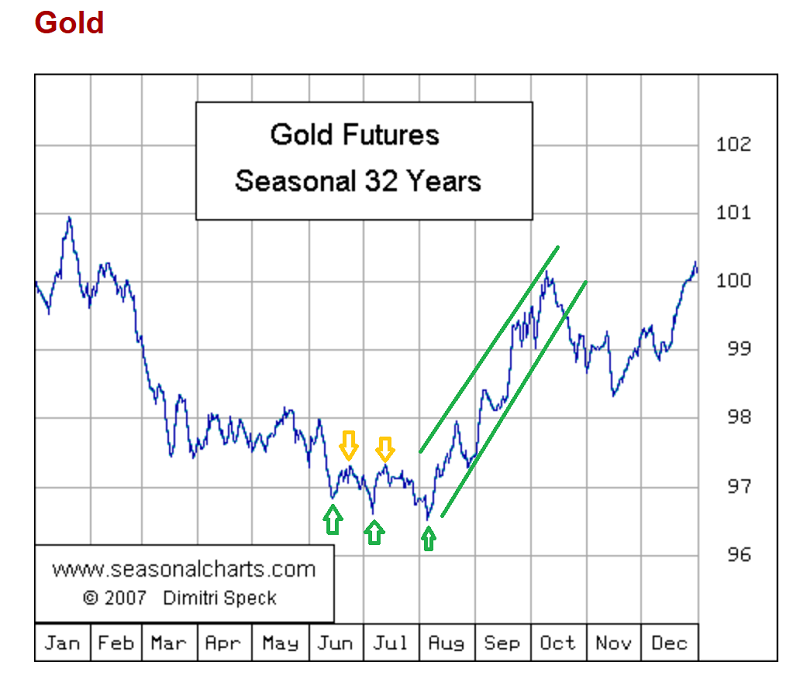

That’s the seasonal chart for the spot price of gold, courtesy of Dimitri Speck.

That’s another seasonal chart, using the price for gold futures.

Investors who put too much capital to work in a single price area, can find themselves straining to make every tiny price move important. When analysing seasonal charts, it’s important to remember that they are seasonal averages of the price action.

Generally speaking, gold tends to decline in the first half of the year, and rally in the second half. Today is last day of June, and so gold can be said, generally speaking, to be ending the weak season, and beginning its strong season.

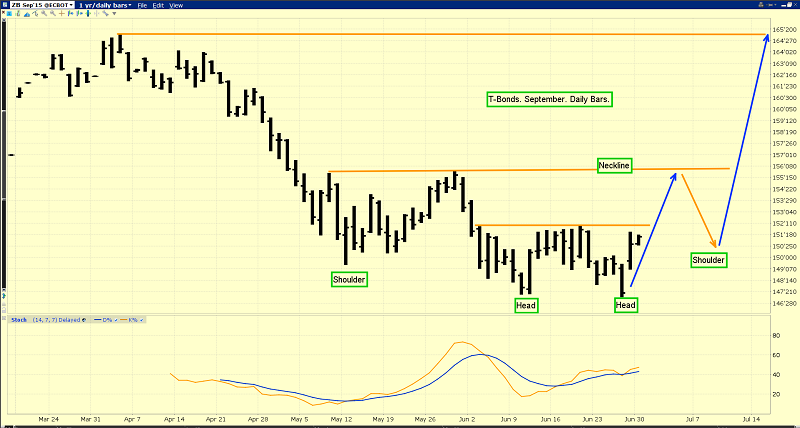

That’s the daily T-bond chart. Rallies in T-bonds are often accompanied by rallies in the price of gold. It appears that a bullish multi-headed inverse head and shoulders bottom pattern is forming on the T-bond chart, and that’s more good news for gold investors!

Nobody loves gold more than the citizens of India. The country’s mines have all been depleted, and the government has used that fact as an excuse to impose massive duties on imports. Both China and India are moving quickly to find large amounts of gold in the sea, and this should encourage the government to end the duties. Supply from conventional mines and Western investors is dwindling, so I don’t think the coming seabed discoveries will affect the gold price adversely. It’s a win-win situation for all stakeholders, in what I call… the gold bull era!

That’s the daily chart for Barrick Gold, which I use as a proxy for the next leg of the bull era. Barrick rallied from the $11 area, but the rally was halted by seasonal factors. There’s a bullish wedge pattern in play now, and there is “price symmetry” with the early November lows in the $10.77 area.

As the second half of 2015 gets underway, I expect Barrick to begin to rally towards the key supply zone in the $13 area, and burst above it in early 2016. Investors should be prepared to accumulate Barrick, or their favourite gold stocks, over the next 48 hours, into the softness that typically precedes the US jobs report. The golden good times should begin to roll, after the report is released, and keep rolling, for the rest of the year!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Gold Stock Dollar Darlings” report. I highlight key gold and silver stocks trading at under $1 that are poised to soar in the second half of 2015!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: