Holidays Come Early For Investors As Consumer Spending Surges From Previous Year

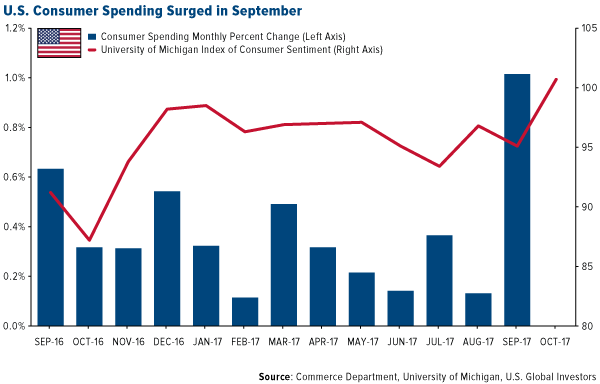

American consumers were more willing to open their wallets in September, an encouraging sign of what Santa might bring for investors this year. According to the latest Bureau of Economic Analysis (BEA) data, consumer spending in the U.S. rose a robust 1 percent between August and September, the largest month-to-month gain since 2009.

For investors, I think this news bodes well for the consumer discretionary sector as we head toward the busy holiday shopping season, already expected to be strong compared to last year’s.

In its report, the BEA notes that consumption was driven primarily by new automobile sales and household utilities. Americans drove an impressive 18.5 million autos and light trucks off car lots in September, up 4.7 percent from a year earlier. Contributing to this, it must be pointed out, was the loss of an estimated 1 million vehicles as a result of Hurricanes Harvey and Irma.

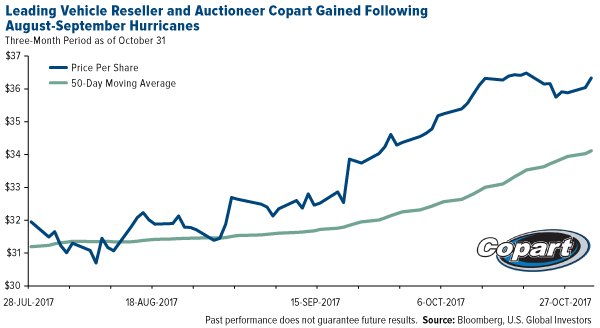

Among the companies whose stock appreciated following the two devastating storms was Copart, a preowned vehicle auctioneer. The company has yet to report sales figures for the third quarter—which includes the period when Harvey and Irma struck the U.S.—but its July quarter saw attractive top and bottom growth year-over-year, with sales up 14 percent.

Copart, which just celebrated its 35th anniversary, is one of the top holdings in our Holmes Macro Trends Fund (MEGAX).

Although the unusually high consumption rate partially reflected Americans’ need to replace vehicles and other durables in the wake of Harvey and Irma, total U.S. spending in September was also supported by rising household incomes and strengthening confidence in the U.S. economy.

According to the University of Michigan’s survey of U.S. households, consumer sentiment surged to 100.7 in October, up from 95.1 in September. This is the highest monthly level since 2004 and, amazingly, represents only the second time the survey has crossed above 100 since the end of the 1990s.

“Personal finances were judged near all-time record favorable levels due to gains in household incomes as well as decade highs in home and stock values,” the University of Michigan writes.

Americans Splurged On Home Improvement And DIY

Of particular note is the increase in spending at building, hardware and garden stores. The most recent Visa Retail Spending Monitor finds that consumption on home improvement and do-it-yourself (DIY) goods and services rose 12.8 percent in August compared to the same month in 2016.

Many Americans, according to Visa chief economist Wayne Best, “are opting to remodel rather than wait for the elusive housing market to pick up, a boon for building, hardware and garden sales.”

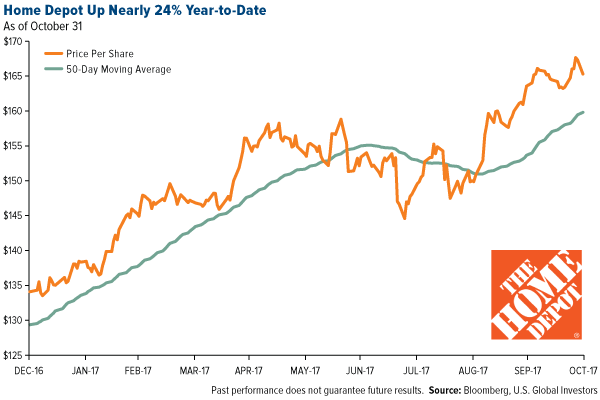

I believe this could also be a boon for our Holmes Macro Trends Fund (MEGAX). Not only is consumer discretionary the fund’s largest sector weighting at 27.55 percent, as of September 30, but it also invests heavily in names associated with building and home improvement. Among the companies we own in MEGAX are Home Depot, the fund’s number one holding; Trex, a decking and railing company; Toro, which manufacturers turf maintenance equipment; and the WD-40 Company.

As with Copart, we’re eagerly awaiting Home Depot’s third-quarter earnings report, but its financials for the July quarter were especially solid. Basic earnings per share stood at $2.26, up more than 14 percent from the same three-month period in 2016, on sales of $28.1 billion.

Will Santa Deliver Record Holiday Sales?

As I said earlier, expectations for the upcoming holiday shopping season are high. The National Retail Federation (NRF) estimates sales in November and December to grow between 3.6 and 4 percent year-over-year, which would equate to between $678.8 billion and $682 billion, an all-time high.

“The combination of job creation, improved wages, tame inflation and an increase in net worth all provide the capacity and the confidence to spend,” says NRF chief economist Jack Kleinhenz.

Consulting firm Bain & Company has a slightly less optimistic estimate, forecasting sales to grow between 3.5 and 3.9 percent.

Both firms note, though, that consumption could get an extra boost this year on account of there being 32 days between Thanksgiving and Christmas, as opposed to 31 last year, giving shoppers one additional day to browse in stores and online.

********

To learn more on consumer discretionaries with high growth potential, visit the fund page for our Holmes Macro Trends Fund (MEGAX).

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Stock markets can be volatile and share prices can fluctuate in response to sector-related and other risks as described in the fund prospectus.

The University of Michigan Consumer Sentiment Index uses telephone surveys to gather information on consumer expectations regarding the overall economy. The preliminary report, which includes about 60% of total survey results, is released around the 10th of each month. A final report for the prior month is released on the first of the month.

Visa’s Retail Spending Monitor provides a real-time window into how and where Americans are spending their money and its broader impact on the economy. With billions of transactions flowing through its payment network each day, Visa sees roughly 25 cents of every retail dollar spent in the United States. Using these actual transactions as a starting point, Visa has created a sophisticated, robust model that allows it to gauge overall spending activity across all forms of payment and across major spending categories, including retail, travel and entertainment.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the Holmes Macro Trends Fund as a percentage of net assets as of 9/30/2017: The Home Depot Inc. 5.87%, Copart Inc. 4.05%, Trex Co. Inc. 3.69%, The Toro Co. 3.21%, WD-40 Co. 2.38%.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of