How to End the Fed

How can we End the Fed...

Without a government-licensed counterfeiter, would we be eating cat food?

There's an entire industry dedicated to pumping out Fear, Uncertainty, and Doubt of the post-apocalyptic dystopia that would descend upon the fair republic if we cancel the Fed's counterfeiting license.

So, what would actually happen?

Ending the Fed Isn’t Science Fiction

First thing, it's not science fiction. America didn't have a central bank for its first 140 years. We had air conditioning, telephones, and electric cars before we had a Fed.

Moreover, there are countries today that still do not have a central bank -- 7 in all, 8 if Argentina joins the party.

What Would it Take, and What Would Happen Next?

There are 2 parts to Ending the Fed:

- The legal nuts and bolts

- The economy

Legally, it's embarrassingly easy: repeal the Federal Reserve Act.

It's debatable whether that would take 50 or 60 senators -- you could make a very good case it's budget-related, in which case it's 50.

So, legally, it'd take about 10 minutes. What about the economy?

The Supposed Functions of a Central Bank

The 3 main functions of a central bank are “supervision” of the financial system — in theory, ensuring stability and ensuring it smoothly operates. And controlling monetary policy, allegedly to fight inflation and recessions.

In other words, bailing out banks, policing fraud, and manipulating interest rates to make money artificially cheap, which, of course, causes inflation and recessions.

Bank bailouts are deeply unpopular and shouldn't happen in a democracy.

Policing fraud, they singularly fail at -- Silicon Valley Bank literally had a Fed member on their board while Sam Bankman-Fried was having coffee with regulators until a magazine article exposed his fraud.

As for manipulating interest rates, artificially cheap loans swindle the middle class to pay the rich, who overwhelmingly make up borrowers — along with the Federal government.

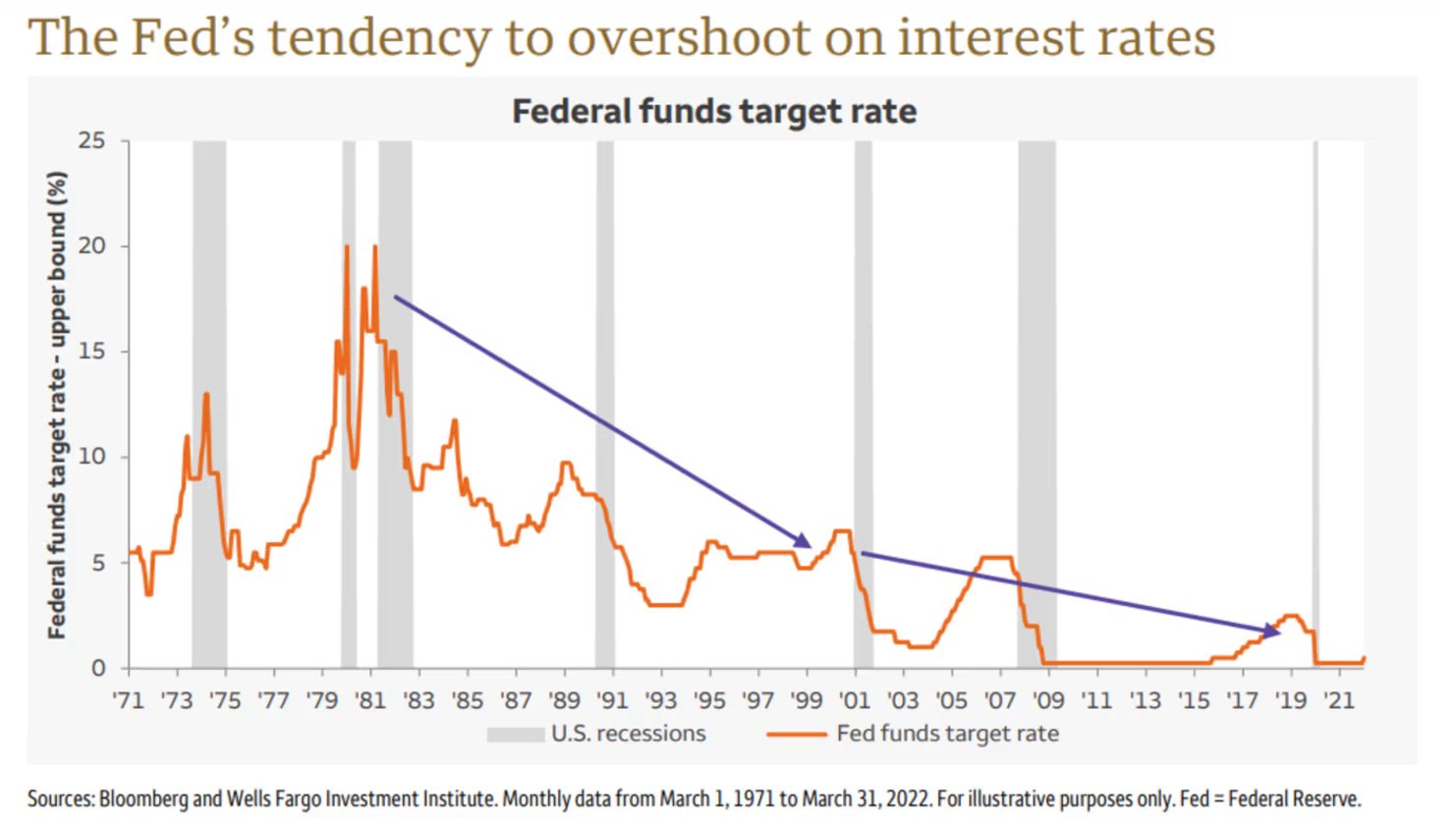

Indeed, the manipulation of rates itself causes inflation and recessions — low rates cause inflation, and high rates cause recessions.

Markets have set interest rates for thousands of years; they don't need manipulation.

So, ideally, you'd toss all 3.

The only one you'd need some lead time on is the bailouts. Because our financial system is structurally bankrupt specifically because it expects bailouts -- we saw this in 2008 when George Bush refused to bail out Lehman, sending Wall Street off the abyss.

Still, 3 years' warning that bailouts are ending should do it -- compact enough to fit in a Presidential term.

What Happens to the Dollar Without a Fed?

You can do it two ways:

- Keep paper dollars as a kind of in-game token for the American economy, either printing them at Treasury -- in which case they replace taxes.

- OR - - Not printing new ones, which leads to deflation as the economy grows but the money does not.

This helps the poor, but it also makes debts bigger.

Less disruptive is gold, which does inflate as new gold is mined, albeit slowly — about 2% per year. Meaning we’d have stable prices since the economy also grows at 2% or better, absent Fed manipulation.

One elegant way to base the dollar on gold without needing to buy up trillions of gold is to offer the 261 million ounces of gold in the Treasury to the public fixed at the current gold price -- say, 2600 dollars per ounce.

And then pass a law saying if the public is buying gold -- in other words, if there's inflation, which makes 2600 below-market -- Treasury has to buy back fresh gold on the open market before it pays bankers a dime of interest on the debt.

This effectively turns Wall Street into a human shield.

Because if the Feds spend too much, creating inflation, the bankers don't get paid.

Elegant, incentive-aligned, corruption-resistant. Shoulda' done it yesterday.

Restoring the Free Market for Money

Ending the Fed would be the greatest economic achievement in a century.

It would end inflation. It would end recessions. It would shrink the federal government and stop the systemic pillaging of the middle class and the productive economy by Wall Street.

And it's embarrassingly easy. All it takes is a willingness to stand up to the special interests — above all, Wall Street and the federal bureaucracy that lives on cheap federal borrowing.

No easy feat. But it’s not an economic challenge; it’s a political challenge.

********