Indian Gold Demand Shifts To Overdrive

Goldman Sachs is making more rational statements about gold stocks. ‘The investment bank says 24 of the 27 gold operations under its coverage posted recoveries in line with its expectations – “which suggests to us that the vast majority of gold assets are now producing at steady state, and/or at least have their mills preforming [sic] consistently.”’ –Business Spectator News, Australia, November 11, 2014.

Goldman Sachs is making more rational statements about gold stocks. ‘The investment bank says 24 of the 27 gold operations under its coverage posted recoveries in line with its expectations – “which suggests to us that the vast majority of gold assets are now producing at steady state, and/or at least have their mills preforming [sic] consistently.”’ –Business Spectator News, Australia, November 11, 2014.

The bank recently issued a buy recommendation for Barrick stock, and while the price has slipped a bit since then, today’s update is good news for gold stock investors.

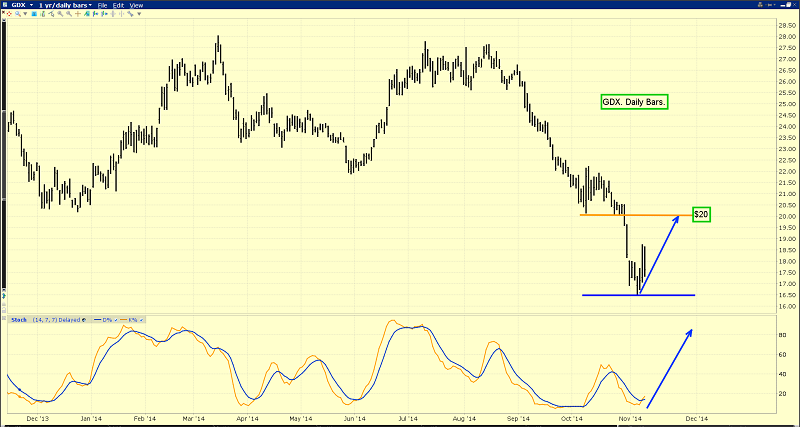

That’s the GDX daily chart. There’s a buy signal flashing now on the key 14,7,7 series Stochastics oscillator.

That’s another look at the GDX daily chart, with volume highlighted.

Friday’s trading volume exceeded the 100 million share level, and was the largest in the history of GDX!

Over the past week, volume has been consistently gargantuan. Is Goldman on the buy-side now?

Their positive statements and recommendations for gold stocks, suggests to me that their huge client base is warming up to this key asset class right now.

That’s the hourly bars chart for GDX. Note the bullish inverse head and shoulders bottom pattern in play.

Price patterns that appear on hourly bar charts tend to be unreliable, and a similar pattern on gold has failed.

Regardless, GDX is close to long term HSR (horizontal support and resistance) defined by the 2008 lows.

That gives this bottom formation a decent chance of helping send GDX higher, towards the $20 short term target zone.

That’s a look at the HUI/gold ratio chart in the year 2000 – 2001 period.

While gold went nowhere, gold stocks surged from late November in the year 2000, until the spring of 2001.

I think a similar situation is on the horizon now. Is the Western gold community prepared to profit, if it happens? I hope so!

When Indian gold imports were imposed in 2013, the current account deficit was about 5% of GDP. Gold has been used as the scapegoat for causing that deficit. Government corruption and oil imports are much bigger factors, but they are ignored by most fiat-focused analysts.

Interestingly, Merrill Lynch economists are quoted by the Economic Times this morning, discussing the Indian current account deficit. “Given gold import curbs, the bank forecasts the current account deficit at a manageable 1.5% of GDP for the current fiscal at its house $100/bbl Brent forecast.” -The Economic Times, November 11, 2014.

Incredibly, while praising the import curbs on gold, Merrill is using $100 Brent oil for their Indian current account forecast, when the actual price is under $85!

I think that India may soon have a current account surplus, and pressure to ease Indian gold market restrictions will grow substantially, as the current account deficit shrinks.

The good news is that some action is already being taken.

The bottom line is that the Indian bullion bank cartel has always charged small jewellers large premiums for gold, and the Indian government finally seems willing to take action against the cartel.

That’s good news for the small jewellers, and good news for Western mining companies, because the lower premiums mean the smaller jewellers can buy more gold.

I’ve argued that India’s real current GDP growth is about 8%, and headed to 11% by 2017. If that’s the case, why isn’t the Indian stock market surging higher? That’s the daily chart of a key Indian stock market ETF. It looks shaky now, but it’s rallied about fifty percent higher this year, and is vastly overdue for a serious correction.

That’s the daily gold chart. Note the beautiful and bullish posture of the 14,7,7 Stochastics oscillator, at the bottom of the chart. Gold looks ready to make a successful charge at supply-side HSR, in the $1180 price area.

Importantly, Indians tend to buy more gold, as rising GDP enriches them. The stock market is not part of the Hindu religion, whereas gold plays a major role in it. Gold, not stock market casino chips, will be where India puts their growing riches, and rightly so! With Indian gold demand potentially moving into “overdrive” mode, most gold stocks appear ready to have a great year in 2015!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free ”Silver Versus Gold” report. I like silver better than gold right now, and I’ll show you why I do! I’ll include coverage of my 3 favourite silver stocks, to play the coming rally.

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: