Indian Gold Jewelry Sales Set to Hit a Four-Year High

Just as April showers bring May flowers, plentiful monsoon rains in India tend to drive up demand for gold jewelry among rural, income-flush farmers, who make up a third of the country’s consumption of the yellow metal.

It’s a relief to hear, then, that India just had its best monsoon season in three years, with heavy rains washing away people’s fears of yet another drought.

Add to that the fact that the yellow metal is now trading in the affordable $1,250 to $1,260 range—a sizeable discount from only a month ago—and gold jewelry sales are expected to surge as much as 60 percent over last year, according to the India Bullion and Jewellers Association.

That would take sales to a four-year high as we near Diwali—traditionally a time when gold-buying is considered auspicious—which would help support prices.

Following Diwali comes the important Indian wedding season. It’s almost impossible to exaggerate how massive this industry is, with one India-based research firm expecting it to hit 1.6 trillion rupees ($24 billion) by 2020.

I’ve shared with you before that between 35 percent and 40 percent of a typical Indian wedding’s expenses is devoted to gold jewelry. If we use the higher estimate, that means close to $10 billion could be spent on gold alone.

But for spending like this to happen, a strong monsoon is needed, which farmers in many parts of India got this year.

A Longstanding History of Driving The World Gold Market

For millennia, gold has played a key role in Indian culture, valued not only for its beauty and durability but also as financial security. That’s no less true today. A 2013 survey conducted by the Federation of Indian Chambers of Commerce & Industry (FICCI) found that more than three quarters of Indians view the precious metal as a “safe investment.”

The same FICCI study also found that gold is a regular line item in most Indian households’ budgets, comparable to what they spend every year on medical expenses and clothing.

It should come as little surprise, then, that Indian households have the largest private gold holdings in the world. Standing at an estimated 23,000 tonnes, and worth close to a whopping $1 trillion, the amount surpasses the combined official gold reserves of the United States, Germany, Italy, France, China and Russia.

Analysts: Gold Is Setting Up For A Big Comeback

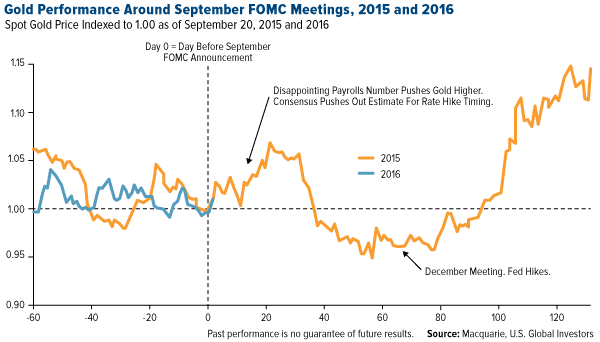

After logging its best first half of the year in 40 years, gold is now trading range-bound while we await the Federal Reserve’s decision to raise rates in December. Most, but certainly not all, of the recent economic data seems to be pointing in this direction, with initial jobless claims at a four-decade low, voluntary quits at pre-recession levels and household income finally on the rise.

The week before last was especially brutal. With markets in China, the world’s largest consumer, closed in observance of Golden Week, the short sellers had free rein, driving the price down more than 3 percent on Tuesday alone.

Despite the weakness, inflows into gold ETFs continue to pour in, as savvy investors recognize that real, or inflation-adjusted, Treasury yields are still in negative territory. I use the 2-year yield here because it’s what many currency traders look at.

But now some analysts see gold ready to turn again, perhaps prefacing a rally that could carry the metal to an all-time high.

In a note last week, UBS said that as long as the Fed doesn’t hike rates too quickly, gold should resume its upward momentum. And remember, the bull market was triggered last December after the Fed raised rates for the first time in nearly a decade.

Meanwhile, London-based investment firm Incrementum suggested last week that gold could reach a new record within the next two years, supported by higher consumer prices, low to negative government bond yields and a lack of confidence in central bank policy.

“In this uncharted territory, with big monetary experiments going on, it just makes sense” to hold bullion, Ronald Stoeferle, a managing director at Incrementum, told Bloomberg.

Peak Platinum And Palladium Demand?

Consensus suggests gold has a positive long-term outlook, but platinum and palladium might be looking at an uncertain future.

As you probably know, the platinum-group metals (PGM) are used predominantly in the fabrication of automobile catalytic converters, which are responsible for reducing emissions. Platinum is used in diesel-powered engines, palladium in gasoline-powered engines.

With vehicle sales in China rising rapidly, demand for PGMs is still strong. In fact, demand for palladium rose 3 percent this year, hitting a fresh all-time high, according to CPM Group.

But trouble could be brewing as more and more automakers deepen their shift toward battery-electric vehicles (BEVs) in an effort to comply with international environmental regulations and meet growing consumer demand. Since these vehicles don’t have an internal combustion engine, there are no emissions, meaning PGMs are not needed.

But trouble could be brewing as more and more automakers deepen their shift toward battery-electric vehicles (BEVs) in an effort to comply with international environmental regulations and meet growing consumer demand. Since these vehicles don’t have an internal combustion engine, there are no emissions, meaning PGMs are not needed.

Government policy has largely driven the emphasis on BEVs, with a few nations around the world committed to banning internal combustion engines from roads within the next 10 to 20 years.

Norway was the first, pledging to eliminate them by 2025, less than 10 years from now. The Netherlands is considering a similar ban, effective the same year. And India wants to be the first “100 percent electric vehicle nation” by 2030.

Last week, Germany—the world’s fourth-largest automobile manufacturer, home to Audi, BMW, Mercedes-Benz, Porsche and Volkswagen—voted to do away with all fossil fuel-powered vehicles within 15 years.

In its platinum and palladium outlook, Metals Focus writes that “for every additional 1 percent of global passenger car production that BEVs claim in 2020, our model suggests a loss of more than 100,000 ounces (3 tonnes) of combined PGMs offtake that year.”

All in all, not good for PGMs.

However, it is good for copper. As I’ve pointed out before, BEVs use about three times as much copper wiring as traditional combustion engines vehicles.

It’s important to recognize that disruptive technologies have always changed markets. Right now, one of them is battery-electric vehicles. Embrace them or not, the decision is yours. But as investors, we must acknowledge which way the wind is blowing, and adapt—or be left behind.

Don’t Forget To Register For MoneyShow Dallas!

Speaking of disruptive technologies, virtual reality is quickly going mainstream, with Facebook’s Oculus Rift and other VR headsets likely to become one of the next must-have consumer items.

You don’t need one of these pricey rigs to enjoy the MoneyShow Dallas virtual event, though—just an internet connection. This week I’ll be at the MoneyShow, where I’ll be presenting and learning. And if you can’t be there physically, you can always be there virtually to hear from leading economists, premier money managers and top analysts, who will share their best insights, perspectives and strategies to grow your portfolio.

I hope you’ll join me!

The French Are at It Again

One final note: Last month, I shared with you the story that European regulators were going after big American companies such as Netflix, Facebook, Amazon and more. Their envy policies demand that, if they can’t build their own companies that are just as successful, they’ll tax and regulate them into non-competitiveness.

This socialist mindset is now taking aim at internet content providers.

Last week, according to Zero Hedge, the French parliament introduced a bill that, if enacted, would levy a 2 percent tax on all ad-generated revenue on sites that distribute free content—sites such as YouTube and Dailymotion (a France-based video-sharing site).

This is just the latest example of how Europe is undermining American companies. Why hasn’t Europe created its own Netflix or Facebook? Where’s its Silicon Valley? The continent’s miles of red tape and envy policies have essentially prohibited entrepreneurism and innovation. And instead of relaxing regulations, it chooses to punish U.S. firms for their success.

********

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 6/30/2016.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of