It’s All About the Money!

“Money…..Money….

Money makes the world go around….”

- Liza Minnelli as Sally Bowles – Cabaret 1972

“Everybody needs money. That’s why they call it money.”

- Danny DeVito as Mickey Bergman – Heist 2001

“Let me issue and control a nation’s money and I care not who writes the laws.”

- Mayer Amschel Rothschild (1744-1812), founder of the House of Rothschild.

So what is money? Money they say has three purposes – a medium of exchange, a store of value and a unit of account. Money is used to purchase goods and services, to pay debts and to pay taxes. At one time all people did was barter. They even used cows or sheep. The Egyptians used grain. The trouble with those methods was they were perishable or in the case of barter, it was sometimes difficult to find common ground.

Eventually starting at least way back in 2100 BC, they began to use gold. They also used silver and bronze. Ancient Turkey used gold. The Greeks used silver and some gold. Asians used bronze. Romans started out using bronze then moved to gold and silver. Unlike some other commodities, gold, silver and bronze could be easily melted down into smaller quantities for smaller purchases and it wouldn’t lose its value.

Eventually goldsmiths also stored gold for people issuing receipts in return. They even charged a fee. Those were the first banks. The receipts were usually in bearer form so the receipts became tradable. Because the goldsmiths knew that all of the gold held would not be asked for at once they began to make loans against the gold and even charged interest. Thus fractional reserve receipt money was born. Lending also gave rise to the first “runs” because of if loans failed because of floods, droughts etc. everyone might rush to get their gold back. Since the goldsmiths couldn’t redeem all of it, the goldsmiths failed thus giving rise to the first bank failures.

Eventually there was paper money. Initially at least paper money was backed by gold and at times silver as well. There were experiments with fiat money but until recently all fiat money systems eventually failed. Fiat money is money that has been declared legal tender by government but is not backed by any physical commodity. In this respect, fiat money is whatever the government declares it to be. You can only pay taxes with money that has been approved by the government. One could conduct purchases of goods and services or pay debts with something other than government approved money as long as the two parties agree on the value of whatever is being exchanged (back to barter).

The first central bank was the Bank of England created in 1694. The bank would use debt monetization at the direction of Parliament. In 1696, the newly minted BOE “bailed out” a failing bank. Thus began a long history of the central bank intervening in the market to “bailout” failing banks at the expense of the taxpayers. The banking system today is known as fractional reserve banking whereby the banks only maintain sufficient reserves to cover a small portion of its customer deposits. The system has a central bank and the central bank has the authority to monetize debt. Government is not constrained by having to run the country only on taxes or approved real borrowings.

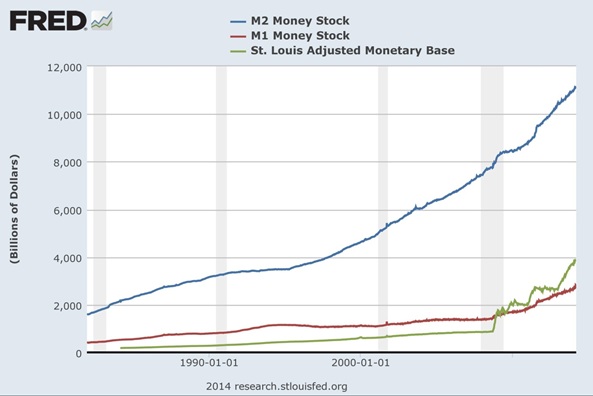

Money supply is just the amount of money that is available in the economy at any given time. There are a number of ways to define money but the standard is currency in circulation plus demand deposits. In money supply jargon, this is known as M1. M1 is not to be confused with the monetary base (MB). While the MB includes currency, it does not include demand deposits. But it does include bank reserves. Bank reserves are not available for spending in the economy. There are two types of bank reserves – required reserves and excess reserves. The monetary base may be growing rapidly but it doesn’t mean that money supply is growing rapidly. However, in the case of the Fed a rise in MB also increases the money supply as it winds up as deposits in the banking system. The question becomes how fast is the money supply growing.

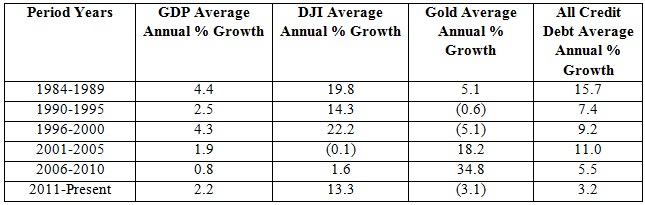

MB is impacted by the central bank’s open market operations (OMO). Quantitative easing or QE is an aggressive form of OMO. The Federal Reserve has been conducting QE since the financial crash of 2008 by buying bonds from the banking system. The result has seen an explosion in the size of MB. The money supply growth table below outlines the growth in the monetary base, M1, M2 and M3 since 1984 in tranches of 6, 6, 5, 5 and 3 years (to present). Since the 2008 financial crisis, the US MB has exploded almost 5 times. But have the other M’s grown as fast?

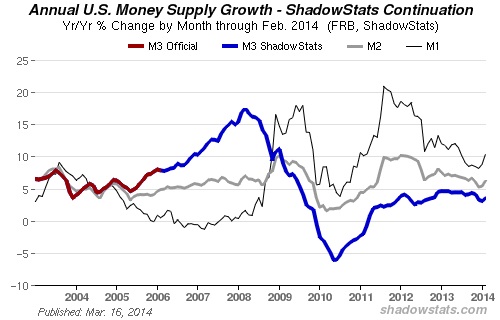

M1 has had the largest growth while M2’s growth (M2 is M1 plus savings accounts and individuals time deposits under $100 thousand) has been roughly what was seen in other periods. What is lagging is M3 growth. M3 is M2 plus large time deposits over $100 thousand, institutional money market funds, repurchase agreements and other large assets of banks and corporations. Interestingly the Fed stopped tracking M3 back in March 2006. Fortunately, there are services like Shadow Stats www.shadowstats.com that continue to calculate these numbers.

M3 growth has been the slowest in the current period since the 2001-2005 period. Low M3 growth appears to be associated with sluggish GDP growth. GDP growth was slowest in the 1990-1995 and 2001-2005 period when M3 growth was also quite slow. Oddly, during the 2006-2010 period, M3 growth was in line with other strong growth periods yet GDP growth was at its lowest. Was something else at play? It might have been. M3 monetary growth was quite strong from 2006 until 2008 as the chart of “Annual Money Supply Growth” shows but it slowed sharply from 2008 to 2010. It was during that period that the US economy’s growth was sharply negative because of the 2008 financial crash.

Money Supply Growth

Source: MGI Securities

Note: * The Fed ceased publishing M3 in March 2006. Data above is calculated from Shadow Stats www.shadowstats.com. All other money supply numbers were calculated from Federal Reserve Bank of St. Louis www.stlouisfed.org.

GDP, DJI and Gold Growth

Source: MGI Securities

Source: www.shadowstats.com

What all this seems to be telling us is that the Fed is exploding the MB but it is not necessarily translating into rapid M3 growth. The Fed is monetizing assets through its QE program. This adds to bank reserves and increases demand deposits at the banks thus the sharp jump in M1. But if the banks are not lending the funds out (as noted by the sluggish credit growth) then the turnover of money or the velocity falls and M3 growth is sluggish. That in turn results in sluggish economic growth (GDP) because not enough money is getting into the economy to have it churn higher. There is a chart of money stock growth below.

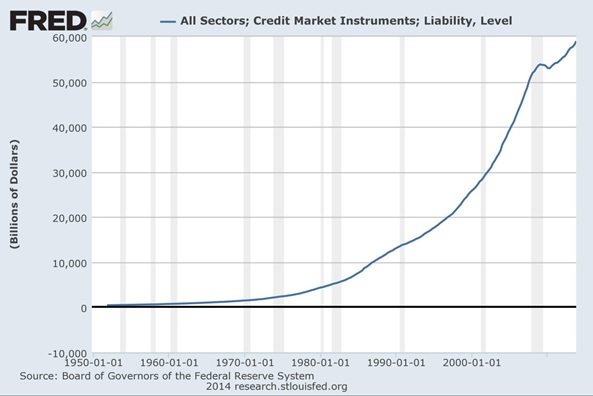

The massive growth of debt is a major drag on the economy. With upwards of $60 trillion in debt on the books of government, individuals, financial institutions and corporation (chart below) it costs at 3% $1.8 trillion annually just to service the debt. That is 10% of the US economy just for debt servicing. No wonder it takes increasing amounts of debt to purchase an additional $1 of GDP. Insufficient debt growth appears to translate into sluggish GDP growth.

And if the value of the underlying assets should fall then the spectre of debt default looms. This has a direct effect on M3 and all while one could compensate by pumping more QE into the economy it is not going to change that equation too much. The QE rather than going into the economy appears to be used instead for speculation and the stock market goes up. If the economy is threatened and they pull back from the stock market then the investors (primarily very large private investors and institutions i.e. hedge funds, private equity funds etc.) rush instead into safe havens such as bonds and gold because they are the most liquid markets available.

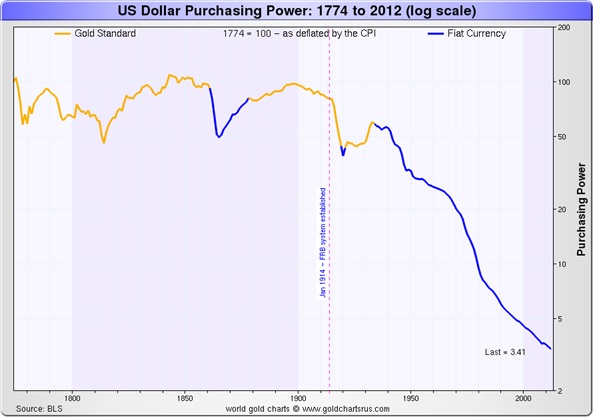

Meanwhile the purchasing power of money just keeps going down. Despite the massive growth of money since the establishment of the Federal Reserve back in 1913, the purchasing power of the US$ keeps falling. No, it is not worthless yet but the chart (below) would suggest that it could eventually go that way.

Source: www.stlouisfed.org

Source: www.stlouisfed.org

Source: www.sharelynx.com

Money does make the world go around. And yes everyone needs money. It is just that one needs more and more and more of it just to purchase the same goods and services. The central bank controls the supply of money as Mayer Rothschild intimated. Today the central bank in the US (the Fed) has been adding more and more money into the economy but it is only generating sluggish GDP growth. And if as Shadow Stats suggests, the Fed deflates GDP growth by the way inflation was calculated 20 plus years ago GDP growth would actually be negative and has been mostly since 2000.

Credit growth, particularly government credit growth, continues to rise and the spectre of debt default looms it seems everywhere. Especially vulnerable these days is country debt default ranging anywhere from Ukraine to Greece to Argentina to Venezuela and more. The central banks (and governments) have decided that they can no longer just print money and that in turn has led to the spectre of bailouts turning into bail-ins meaning the depositor pays rather than the taxpayer. And if that were to happen, money supply would most likely contract and there would be the spectre of an economic depression. No wonder that central banks (and the IMF) appear to be trying everything to hold off country defaults.

Copyright 2014 All rights reserved David Chapman

General disclosures

The information and opinions contained in this report were prepared by MGI Securities. MGI Securities is subsidiary of Industrial Alliance Insurance and Financial Services Inc. Industrial Alliance is a TSX Exchange listed company and as such, MGI Securities is an affiliate of Industrial Alliance. The opinions, estimates and projections contained in this report are those of MGI Securities as of the date of this report and are subject to change without notice. MGI Securities endeavours to ensure that the contents have been compiled or derived from sources that we believe to be reliable and contain information and opinions that are accurate and complete. However, MGI Securities makes no representations or warranty, express or implied, in respect thereof, takes no responsibility for any errors and omissions contained herein and accepts no liability whatsoever for any loss arising from any use of, or reliance on, this report or its contents. Information may be available to MGI Securities that is not reflected in this report. This report is not to be construed as an offer or solicitation to buy or sell any security. The reader should not rely solely on this report in evaluating whether or not to buy or sell securities of the subject company.

Definitions

“Technical Strategist” means any partner, director, officer, employee or agent of MGI Securities who is held out to the public as a strategist or whose responsibilities to MGI Securities include the preparation of any written technical market report for distribution to clients or prospective clients of MGI Securities which does not include a recommendation with respect to a security.

“Technical Market Report” means any written or electronic communication that MGI Securities has distributed or will distribute to its clients or the general public, which contains a strategist’s comments concerning current market technical indicators.

Conflicts of Interest

The technical strategist and or associates who prepared this report are compensated based upon (among other factors) the overall profitability of MGI Securities, which may include the profitability of investment banking and related services. In the normal course of its business, MGI Securities may provide financial advisory services for issuers. MGI Securities will include any further issuer related disclosures as needed.

Technical Strategists Certification

Each MGI Securities technical strategist whose name appears on the front page of this technical market report hereby certifies that (i) the opinions expressed in the technical market report accurately reflect the technical strategist’s personal views about the marketplace and are the subject of this report and all strategies mentioned in this report that are covered by such technical strategist and (ii) no part of the technical strategist’s compensation was, is, or will be directly or indirectly, related to the specific views expressed by such technical strategies in this report.

Technical Strategists Trading

MGI Securities permits technical strategists to own and trade in the securities and or the derivatives of the sectors discussed herein.

Dissemination of Reports

MGI Securities uses its best efforts to disseminate its technical market reports to all clients who are entitled to receive the firm’s technical market reports, contemporaneously on a timely and effective basis in electronic form, via fax or mail. Selected technical market reports may also be posted on the MGI Securities website and davidchapman.com.

For Canadian Residents: This report has been approved by MGI Securities which accepts responsibility for this report and its dissemination in Canada. Canadian clients wishing to effect transactions should do so through a qualified salesperson of MGI Securities in their particular jurisdiction where their IA is licensed.

For US Residents: This report is not intended for distribution in the United States.

Intellectual Property Notice

The materials contained herein are protected by copyright, trademark and other forms of proprietary rights and are owned or controlled by MGI Securities or the party credited as the provider of the information.

Regulatory

MGI SECURIITES is a member of the Canadian Investor Protection Fund (‘CIPF’) and the Investment Industry Regulatory Organization of Canada (‘IIROC’).

Copyright

All rights reserved. All material presented in this document may not be reproduced in whole or in part, or further published or distributed or referred to in any manner whatsoever, nor may the information, opinions or conclusions contained in it be referred to without in each case the prior express written consent of MGI Securities Inc.