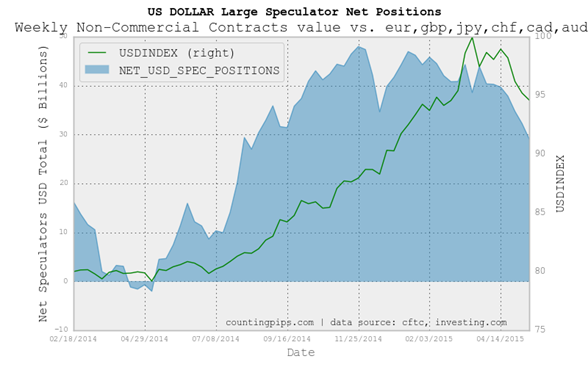

Large Currency Speculators Continued To Reduce US$ Bullish Bets For 7th Week

US Dollar net speculator positions dropped last week to +$29.11 billion

The latest data for the weekly Commitment of Traders (COT) report, released by the Commodity Futures Trading Commission (CFTC) on Friday, showed that large traders and currency speculators continued to offload their overall net bullish positions in the US dollar last week for a seventh straight week. US dollar bullish bets have now fallen to the lowest level since August 2014.

Non-commercial large futures traders, including hedge funds and large speculators, had an overall US dollar long position totaling $29.11 billion as of Tuesday May 12th, according to the latest data from the CFTC and dollar amount calculations by Reuters. This was a weekly change of -$3.14 billion from the $32.25 billion total long position that was registered on May 5th, according to the Reuters calculation that totals the US dollar contracts against the combined contracts of the euro, British pound, Japanese yen, Australian dollar, Canadian dollar and the Swiss franc.

The latest data puts the US dollar speculative level at the lowest level since August 12th when net positions equaled $27.00 billion.

Weekly Speculator Contract Changes:

Weekly changes for the major currencies showed that large speculators increased their bets in favor of the euro, Japanese yen, Swiss franc, Canadian dollar, Australian dollar and the Mexican Peso while decreasing weekly bets for the British pound sterling and the New Zealand dollar.

Notable Changes:

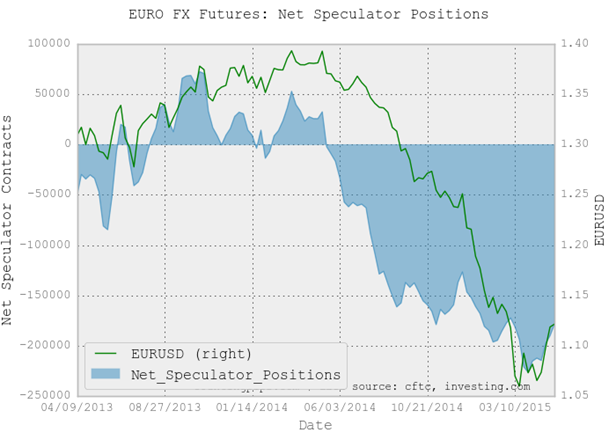

- The euro bets rose for a 2nd week by over +10,000 contracts as specs continue to pare their net bearish euro positions

- Japanese yen bets rebounded by +7,500 contracts after dropping sharply the week previous. JPY bets have gained for four out of last five weeks

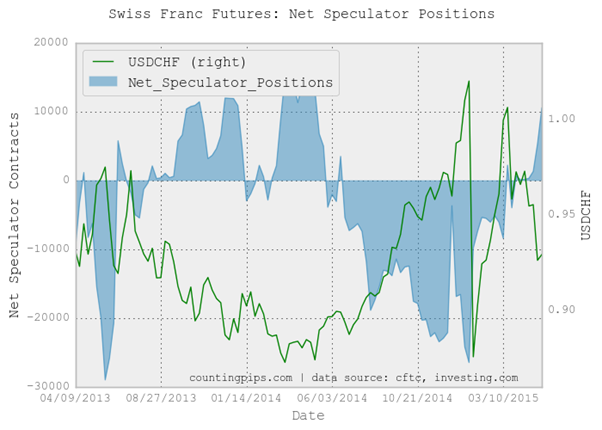

- Swiss franc bets rose for a 5th week to up its bullish position to +10,550 contracts

- Canadian dollar bets went higher for a 4th week and got closer to bullish territory as net positions stand at -3,982 contracts

- Australian dollar bets gained for a 4th week to push its bullish position higher (+4,487 contracts)

- New Zealand dollar positions dropped for a second week and NZD positions are just slightly in bullish territory at +1,770 net contracts

- Mexican Peso bets rose sharply after three weeks of declines

This latest COT data is through Tuesday May 12th and shows a quick view of how large speculators and for-profit traders (non-commercials) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Please see the individual currency charts and their respective data points below.

Weekly Charts: Large Speculators Weekly Positions vs Currency Spot Price

EuroFX:

Last Six Weeks data for EuroFX futures

|

Date |

Open Interest |

Specs Long |

Specs Short |

Com Long |

Com Short |

Net Com |

Com Chg |

Net Specs |

Specs Chg |

|

04/07/2015 |

441624 |

39444 |

254702 |

356228 |

96223 |

260005 |

-14464 |

-215258 |

11302 |

|

04/14/2015 |

453518 |

45264 |

257611 |

358360 |

101060 |

257300 |

-2705 |

-212347 |

2911 |

|

04/21/2015 |

457610 |

46821 |

261466 |

361058 |

102833 |

258225 |

925 |

-214645 |

-2298 |

|

04/28/2015 |

456919 |

50734 |

248500 |

356986 |

116294 |

240692 |

-17533 |

-197766 |

16879 |

|

05/05/2015 |

449254 |

50116 |

240243 |

343981 |

116070 |

227911 |

-12781 |

-190127 |

7639 |

|

05/12/2015 |

439122 |

43333 |

222309 |

345101 |

127933 |

217168 |

-10743 |

-178976 |

11151 |

British Pound Sterling:

Last Six Weeks data for Pound Sterling futures

|

Date |

Open Interest |

Specs Long |

Specs Short |

Com Long |

Com Short |

Net Com |

Com Chg |

Net Specs |

Specs Chg |

|

04/07/2015 |

185219 |

37641 |

71942 |

130411 |

78813 |

51598 |

-4021 |

-34301 |

2329 |

|

04/14/2015 |

189513 |

33993 |

70038 |

136944 |

79221 |

57723 |

6125 |

-36045 |

-1744 |

|

04/21/2015 |

175066 |

34830 |

64111 |

124700 |

77203 |

47497 |

-10226 |

-29281 |

6764 |

|

04/28/2015 |

171698 |

33239 |

67367 |

118250 |

73492 |

44758 |

-2739 |

-34128 |

-4847 |

|

05/05/2015 |

173468 |

34304 |

59062 |

117555 |

87212 |

30343 |

-14415 |

-24758 |

9370 |

|

05/12/2015 |

183586 |

37511 |

68280 |

124508 |

85521 |

38987 |

8644 |

-30769 |

-6011 |

Japanese Yen:

Last Six Weeks data for Yen Futures

|

Date |

Open Interest |

Specs Long |

Specs Short |

Com Long |

Com Short |

Net Com |

Com Chg |

Net Specs |

Specs Chg |

|

04/07/2015 |

189444 |

53320 |

77769 |

118118 |

54475 |

63643 |

1230 |

-24449 |

-525 |

|

04/14/2015 |

195230 |

54783 |

77853 |

121029 |

64194 |

56835 |

-6808 |

-23070 |

1379 |

|

04/21/2015 |

189332 |

51520 |

65968 |

120368 |

70330 |

50038 |

-6797 |

-14448 |

8622 |

|

04/28/2015 |

188079 |

48721 |

54214 |

118521 |

85966 |

32555 |

-17483 |

-5493 |

8955 |

|

05/05/2015 |

198886 |

41852 |

73035 |

139448 |

72449 |

66999 |

34444 |

-31183 |

-25690 |

|

05/12/2015 |

193296 |

37848 |

61441 |

137626 |

78612 |

59014 |

-7985 |

-23593 |

7590 |

Swiss Franc:

Last Six Weeks data for Franc futures

|

Date |

Open Interest |

Specs Long |

Specs Short |

Com Long |

Com Short |

Net Com |

Com Chg |

Net Specs |

Specs Chg |

|

04/07/2015 |

33245 |

12746 |

12626 |

13347 |

4548 |

8799 |

-1357 |

120 |

-586 |

|

04/14/2015 |

33935 |

12240 |

12070 |

14628 |

4733 |

9895 |

1096 |

170 |

50 |

|

04/21/2015 |

31727 |

11105 |

10770 |

13105 |

6074 |

7031 |

-2864 |

335 |

165 |

|

04/28/2015 |

31585 |

11144 |

9809 |

13114 |

7268 |

5846 |

-1185 |

1335 |

1000 |

|

05/05/2015 |

34449 |

14174 |

8843 |

12091 |

11680 |

411 |

-5435 |

5331 |

3996 |

|

05/12/2015 |

33465 |

14778 |

4228 |

8914 |

16319 |

-7405 |

-7816 |

10550 |

5219 |

Canadian Dollar:

Last Six Weeks data for Canadian dollar futures

|

Date |

Open Interest |

Specs Long |

Specs Short |

Com Long |

Com Short |

Net Com |

Com Chg |

Net Specs |

Specs Chg |

|

04/07/2015 |

114881 |

22081 |

52100 |

67159 |

23581 |

43578 |

-754 |

-30019 |

-401 |

|

04/14/2015 |

118686 |

23020 |

53598 |

66797 |

24088 |

42709 |

-869 |

-30578 |

-559 |

|

04/21/2015 |

126801 |

33343 |

60394 |

64497 |

30901 |

33596 |

-9113 |

-27051 |

3527 |

|

04/28/2015 |

128938 |

33858 |

54767 |

64232 |

39337 |

24895 |

-8701 |

-20909 |

6142 |

|

05/05/2015 |

122108 |

30028 |

40108 |

63415 |

49852 |

13563 |

-11332 |

-10080 |

10829 |

|

05/12/2015 |

123908 |

29133 |

33115 |

62731 |

62038 |

693 |

-12870 |

-3982 |

6098 |

Australian Dollar:

Last Six Weeks data for Australian dollar futures

|

Date |

Open Interest |

Specs Long |

Specs Short |

Com Long |

Com Short |

Net Com |

Com Chg |

Net Specs |

Specs Chg |

|

04/07/2015 |

159532 |

55928 |

96209 |

89081 |

21243 |

67838 |

21945 |

-40281 |

-15925 |

|

04/14/2015 |

161971 |

55077 |

97510 |

92927 |

21531 |

71396 |

3558 |

-42433 |

-2152 |

|

04/21/2015 |

153363 |

55570 |

90233 |

83040 |

23795 |

59245 |

-12151 |

-34663 |

7770 |

|

04/28/2015 |

140298 |

53753 |

81158 |

67196 |

22618 |

44578 |

-14667 |

-27405 |

7258 |

|

05/05/2015 |

137001 |

59033 |

58407 |

57213 |

44377 |

12836 |

-31742 |

626 |

28031 |

|

05/12/2015 |

136249 |

59435 |

54948 |

58529 |

48204 |

10325 |

-2511 |

4487 |

3861 |

New Zealand Dollar:

Last Six Weeks data for New Zealand dollar futures

|

Date |

Open Interest |

Specs Long |

Specs Short |

Com Long |

Com Short |

Net Com |

Com Chg |

Net Specs |

Specs Chg |

|

04/07/2015 |

24920 |

16950 |

11172 |

4489 |

8929 |

-4440 |

-3137 |

5778 |

1747 |

|

04/14/2015 |

25176 |

17081 |

11078 |

4579 |

9134 |

-4555 |

-115 |

6003 |

225 |

|

04/21/2015 |

26617 |

18473 |

9985 |

4241 |

11950 |

-7709 |

-3154 |

8488 |

2485 |

|

04/28/2015 |

28071 |

18281 |

8101 |

5134 |

15431 |

-10297 |

-2588 |

10180 |

1692 |

|

05/05/2015 |

28379 |

19585 |

10521 |

4813 |

13039 |

-8226 |

2071 |

9064 |

-1116 |

|

05/12/2015 |

25525 |

14268 |

12498 |

7678 |

8233 |

-555 |

7671 |

1770 |

-7294 |

Mexican Peso:

Last Six Weeks data for Mexican Peso futures

|

Date |

Open Interest |

Specs Long |

Specs Short |

Com Long |

Com Short |

Net Com |

Com Chg |

Net Specs |

Specs Chg |

|

04/07/2015 |

151072 |

42185 |

65110 |

101214 |

75811 |

25403 |

-8484 |

-22925 |

7364 |

|

04/14/2015 |

130501 |

63521 |

55160 |

59830 |

65310 |

-5480 |

-30883 |

8361 |

31286 |

|

04/21/2015 |

118074 |

50343 |

64018 |

60891 |

43780 |

17111 |

22591 |

-13675 |

-22036 |

|

04/28/2015 |

138497 |

38003 |

61394 |

78510 |

51737 |

26773 |

9662 |

-23391 |

-9716 |

|

05/05/2015 |

146418 |

24046 |

74162 |

102349 |

49406 |

52943 |

26170 |

-50116 |

-26725 |

|

05/12/2015 |

135526 |

34027 |

61066 |

79661 |

49638 |

30023 |

-22920 |

-27039 |

23077 |

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

The Commitment of Traders report is published every Friday by the Commodity Futures Trading Commission (CFTC) and shows futures positions data that was reported as of the previous Tuesday (3 days behind).

Each currency contract is a quote for that currency directly against the U.S. dollar, a net short amount of contracts means that more speculators are betting that currency to fall against the dollar and a net long position expect that currency to rise versus the dollar.

(The graphs overlay the forex spot closing price of each Tuesday when COT trader positions are reported for each corresponding spot currency pair.) See more information and explanation on the weekly COT report from the CFTC website.

All information contained in this article cannot be guaranteed to be accurate and is used at your own risk. All information and opinions on this website are for general informational purposes only and do not in any way constitute investment advice.

********

Courtesy of http://countingpips.com/