Many Gold Traders Bullish After Federal Reserve Raised Rates

Strengths

·The best performing precious metal for the week was palladium, up 1.71 percent. Automobile replacement was up due to water damaged cars post hurricane season. Catalytic converters containing palladium will enter the recycling phase. A Bloomberg survey of gold traders shows most are bullish on the yellow metal after the Federal Reserve raised rates earlier in the week. This is in part due to gold advancing for the first time in four weeks as the Fed stuck to its projection of three hikes in 2018, writes Ranjeetha Pakiam of Bloomberg.

·The European Central Bank left its policy rate unchanged, leading Bloomberg Intelligence analyst Mike McGlone to suggest that relative value and mean reversion might lead to gold outperforming bitcoin and the U.S. dollar. Gold counter-intuitively rallied the last five times the Fed raised interest rates, leading some to believe gold has no reason not to rally again.

·Pure Gold Mining Inc. announced the addition of mineral resources to two of its mines in Ontario. The estimate includes an additional 96,000 ounces of indicated resources and 118,000 ounces of inferred resources. CEO and President of the company, Darin Labrenz, said the addition has “strong potential to positively impact project economics."

Weaknesses

·The worst performing precious metal for the week was platinum, up just 0.57 percent post the rate hike but not out of favor completely as Sibanye Gold made an all-share takeout offer for Lonmin which has been on the ropes for several years now. The Democratic Republic of Congo changed its mining code again with details still emerging. The last time the nation changed its code it resulted in increased royalties, tax rates, minimum unpaid share of new mining projects and now, for large projects, 10 percent of a mine’s shares must be owned by a Congolese investor.

·Bloomberg reports that economists are telling investors to prepare for the largest tightening of monetary policy in more than 10 years as forecasts predict average interest rates to rise at least 1 percent next year, the biggest increase since 2006.

·Two of Gold Fields Ghana mines will now use contractors for operations. A contractor will take over the Tarkwa operations early next year after terminating 1,500 staff while the Damang mine has been run by contractors since 2016. Perhaps Gold Fields is winding down its focus on operating these two mines to instead have increased future focus on the Namdini project in Ghana owned by Cardinal Resources of which Gold Fields has an interest in.

Opportunities

·Over the past thirty years gold and silver metal equities have demonstrated seasonal trading patterns, which means now is the time to buy the precious metals when they are at a bargain. The seasonal rally has occurred from December to February four of the past five years, reports CIBC World Markets Corp. The history of rate hikes also favors gold faring better than expected while in the aftermath of previous rate hikes bitcoin declined 20 percent dipping below its 60-day mean.

·John Reade, chief market strategist of the World Gold Council, believes gold will continue its upward trajectory in 2018. Reade said, “Investor attention may have been focused on U.S. equity markets, technology stocks and cryptocurrencies this year, but gold still had a decent 2017, delivering double-digit growth in the first eleven months alone.”

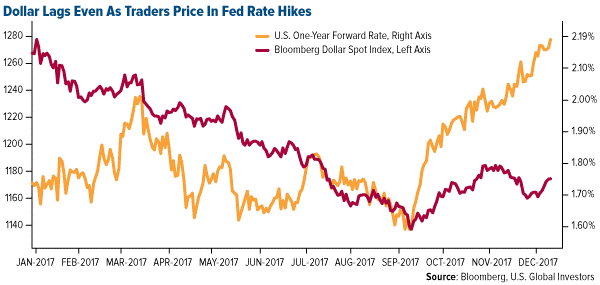

·UBS Global Macro Strategy analyzed the repatriation component of the upcoming tax bill and found that it may not ignite capital inflows back to the U.S. They report that nearly three quarters of foreign retained earnings are already in U.S. dollars and that a large share of non-U.S. dollar cash held abroad is hedged or used for offshore operations. During the last tax holiday of 2005-2006 to bring dollars back to the U.S., the dollar ended flat. Lananh Nguyen of Bloomberg writes that the U.S. dollar will continue to worsen into 2018 as the greenback is currently down more than 7 percent versus the world’s major currencies this year, and he expects the euro and other emerging markets to do well in 2018.

Threats

·Libor, the interest rate basis for trillions of dollars in loans, is surging after the Federal Reserve’s latest interest-rate increase, reports Bloomberg. Three-month dollar Libor hit 1.6 percent after the rate increase, the highest level since December 2008 during the global financial crisis.

·For cross-currency basis swap, the interest rate differential between the dollar and euro is making dollar-funding much more expensive with Libor surging. Macro Strategy Partnership suggests that the extra cost to borrow U.S. dollars in Europe is equivalent to a 150 basis point rate hike for the offshore U.S. dollar economy and suggests investors should avoid commodities and miners.

·Dominic Schnider, head of commodities at UBS Wealth Management said in a Bloomberg TV interview that gold is likely to trade around $1,200 in early 2018 due to slower physical demand but expects that demand to rebuild closer to the end of 2018.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of