A Massive Windfall For China’s Fast-Growing Tech Giants

Stop buying Iranian oil or face the music.

That’s the message the U.S. government shared with the world last week, giving importers until November 4 to cut their consumption of Iran’s crude to zero—or expect sanctions. The threat comes a month after President Donald Trump withdrew the U.S. from the Obama-era nuclear deal.

West Texas Intermediate (WTI) responded by adding more than $6 to the price of a barrel last week alone, to end above $74.

Other drivers included supply disruptions in Canada and Libya, as well as a sharp, more-than-expected decline in U.S. crude inventories. Nearly 10 million barrels were drawn in the week ended June 27, the most since September 2016. Crude is now up an eye-popping 70 percent from the same time last year, contributing to the inflationary pressure that’s pushed consumer price growth to a six-year high.

And there could be more upside, should supply crunches continue along with Trump’s ongoing geopolitical efforts to isolate Tehran. Ready to see $90-a-barrel oil? That’s the forecast from Bank of America Merrill Lynch analyst Hootan Yazhari.

“We are in a very attractive oil price environment,” Yazhari told CNBC this week, “and our house view is that oil will hit $90 by the end of the second quarter of next year,” or 12 months from now.

Even if this prediction ends up overshooting the mark, I believe there could still be money to be made in the energy space on tightening supply and strong global demand. For more, I urge you to watch this brief video outlining the six factors that matter when picking energy stocks.

Bull Market May Have Just Hit a Trade War Wall

The U.S. market is mere days from hitting a milestone that some investors might not have anticipated in the business-friendly era of Trump. Both the S&P 500 Index and Dow Jones Industrial Average have been stuck in correction mode since early February of this year, when inflation fears and concerns of a global trade war triggered a monster selloff.

Today marks the 100th day both indices have been in correction, and according to MarketWatch, if they stay sideways another nine trading days, it will become the longest such stretch since 1984.

Stocks managed to recover then, but as I see it, unless Trump softens his stance on trade, they will have a difficult time doing the same today. Stiff retaliatory barriers are scheduled to be raised by China, Canada and other key markets, and Canadian consumers have already started boycotting American-made goods. U.S. exports of steel, soybeans and other products are down from a year ago because of friction over the tariffs, which are essentially regulations that could jeopardize the positive work Trump has done in cutting red tape in other areas.

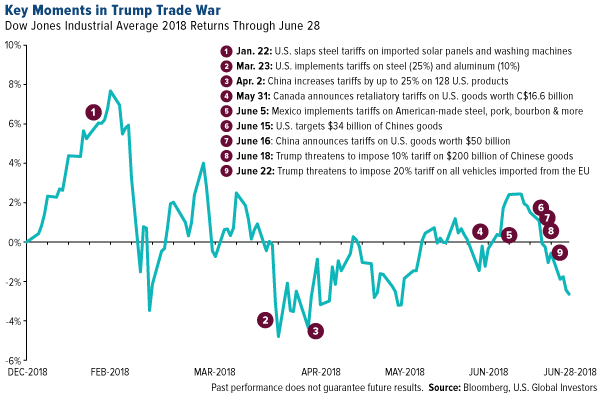

Below is the Dow’s performance so far this year, not including today, annotated with some key moments in the Trump trade war. I chose the Dow specifically because it includes the very largest U.S. exporters, some of which do tens of billions of dollars in sales in China alone. As the biggest U.S. exporter, Boeing delivered more than 200 aircraft to the Asian country last year, accounting for a quarter of the plane maker’s global sales. Apple generated around 20 percent of its revenue in China, or the equivalent of $44.7 billion.

The question now is whether we’re headed for a recession, and how investors can prepare—though I believe the market is oversold, as I explain in the most recent edition of Frank Talk Live. The last nine years have been extraordinarily profitable, but every bull market must come to an end—not from age, remember, but from changes in monetary or fiscal policy.

Last week I offered one of my favorite strategies to face the next bear market with confidence. Discover what it is by clicking here.

Trade war friction has strained international relations in other ways than just trade, of course. Among those is foreign direct investment (FDI), essential for global economic growth.

Chinese FDI in the U.S. Just Fell 92 Percent

China’s tech industry is exploding. Last year, gross output value of Chinese tech firms hit 20 trillion yuan, or about $3 trillion, for the first time ever. Nine of the world’s 20 biggest tech firms now call China home, beginning with Alibaba, valued at half a trillion dollars. And for the past several years, China has filed far more patent applications than the U.S. on an annual basis. (I should point out, though, that the U.S. still has more patents overall, having just issued patent number 10 million.)

The Asian country, in fact, has more unicorns—or startups worth $1 billion or more—than any other nation on earth. Chinese unicorns account for more than half of the global total, and 66 percent in terms of valuation, according to the World Economic Forum (WEF).

Just look at the top 10 Chinese unicorns. Ant Financial, formerly known as Alipay, ranks first with a valuation of $145 billion. That’s about twice the value of the number one U.S. unicorn, Uber.

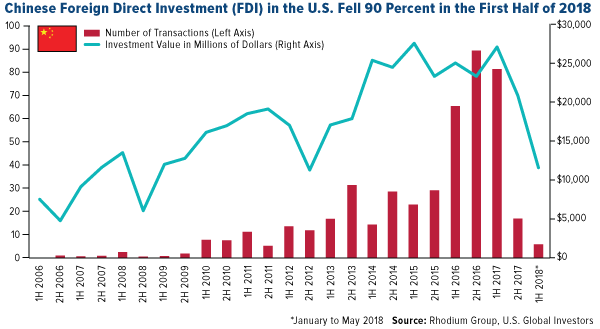

It’s very likely even more capital will flow into these firms this year and next. That’s because Chinese FDI in the U.S. fell an incredible 92 percent in the first half of 2018, as the government cracks down on capital flight. The decline is also likely in response to the U.S. government’s increased scrutiny of Chinese acquisitions.

According to economic research firm Rhodium, Chinese investors have sold $9.6 billion worth of U.S. assets, including office buildings in New York, San Francisco, Chicago and Los Angeles. That’s after making only $1.8 billion in investments. What this means is that the country’s net U.S. FDI is negative $7.8 billion so far this year.

And regarding a possible rebound in Chinese investment activity, “looming U.S. policies present substantial headwinds,” writes Rhodium’s director of research, Thilo Hanemann.

So where will all this capital go?

I don’t think anyone can say for sure, but my guess is that this will be a huge windfall for the already fast expanding Chinese tech industry.

Only Half of China Is Online

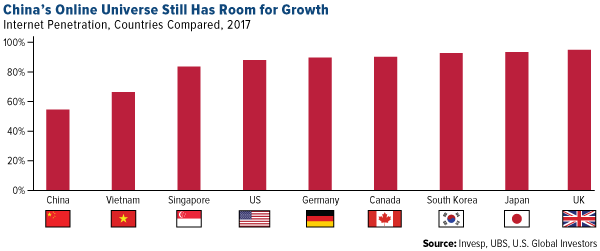

There are even more reasons to be optimistic about the Chinese tech industry, including the fact that only a little over half of the country’s population is online. At 772 million people, the user base is massive—more than twice the size of the entire U.S. population—but penetration is only 54.6 percent, according to UBS. That’s well behind the U.K. (94.8 percent), Japan (93.3 percent) and the U.S. (87.9 percent).

This means, of course, that the country’s tech and internet industries still have much room to grow.

China is already number one in mobile payments, having surged to a whopping $9 trillion in 2016, compared to only $112 billion for the U.S. The Asian giant is rapidly becoming cashless—so much so that a friend of mine recently had a hard time using paper money to make a purchase in a Chinese convenience store. In fact, a number of unmanned, fully-automated stores—most notably BingoBox and Alibaba’s Tao Cafe—have sprung up all over the country. Transactions are made simply by scanning your smartphone on a designated counter or plate before leaving the store.

Learn more about one of the world’s fastest-growing regions by clicking here!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 3/31/2018: The Boeing Co.

********

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of