Party On!

BIG PICTURE – Interest rates are near historic lows, credit is cheap and the prominent central banks are not planning to pursue tough monetary policies anytime soon. Consequently, the stock markets of the developed world are rallying and their property markets are recovering.

There can be no doubt that the world’s business activity is mediocre, but the financial markets are primarily driven by monetary policy. Remember, the risk free rate of return determines the value of every asset and with near zero interest rates, it is hardly surprising that prices are appreciating.

At some point in the future, the party will end but we suspect that the next bear market may only arrive after 2-3 years. If our assessment proves to be correct, the Federal Reserve will begin reducing its bond purchases next summer and if the US economy gains enough traction, QE may end by late 2015. Thereafter, the Federal Reserve will probably leave the Fed Funds Rate unchanged for several months and rate hikes may only start in 2016. Furthermore, in line with the previous cycles, the Federal Reserve may increase the Fed Funds Rate in baby steps and this should give investors sufficient time to prepare for the next major downtrend.

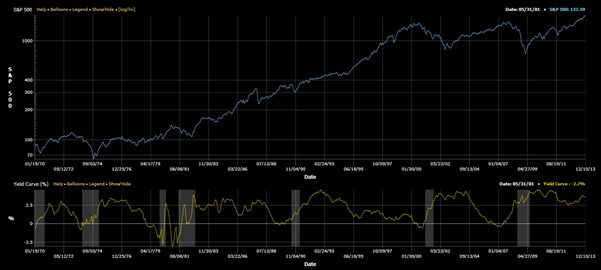

In any event, it is notable that in the past, economic recessions and bear markets have always been preceded by the inversion of the yield curve (Figure 1). Today, the yield curve is very steep and this suggests that the ongoing primary uptrend in stocks has much further to run.

Figure 1: Yield curve inversion precedes bear markets

Source: www.crystalbull.com

At this stage, nobody knows when the yield curve will invert but if we are even vaguely correct, the inversion may only occur in 3-4 years. Accordingly, apart from the usual pullbacks, the primary uptrend in stocks should remain intact for as far as the eye can see.

Even though we remain optimistic about the long-term outlook for stocks, we suspect that we will see some volatility when the Federal Reserve starts tapering its QE program. Nonetheless, we believe that any turbulence will be short-lived and as long as the Federal Reserve continues to expand its balance-sheet, the bull market will remain intact.

As you can see from Figure 2, over the past 5 years, the S&P500 has had a very tight correlation with the Federal Reserve’s balance-sheet. This relationship implies that if QE continues for another couple of years, then Wall Street should stay on its northbound journey.

Figure 2: Expansion of the Fed’s balance sheet vs. the S&P500

Source: Raymond James

From our perspective, there is no need for investors to jump the gun and as long as the monetary backdrop remains favourable, our readers should stay the course.

In terms of geographical areas, we continue to believe that Europe, Japan and the US will continue to perform well. Accordingly, we have over weighted our investment portfolios to these regions. Conversely, we are of the view that the emerging nations may not reward investors and this is why we are not exposed to these volatile markets.

Looking at various sectors, we see ongoing strength in banks, biotechnology, consumer discretionary, consumer staples, healthcare and industrials. Accordingly, our managed accounts are now concentrated in these industry groups.

You may recall that in last month’s edition of Money Matters, we opined that the biotechnology/pharmaceutical sector looked promising. As it turns out, this industry group had a stellar month and we believe that it will continue to perform well throughout the course of this bull market.

Elsewhere, it appears as though the multi-month consolidation in Japan is now complete and the stage is set for a major advance.

If you review Figure 3, you will note that after oscillating in a trading range for almost 6 months, the Tokyo Nikkei Average has just broken through overhead resistance and is currently trading around its 52-week high. Furthermore, given the fact that the November-April period is seasonally bullish for Japan’s stock market, it is probable that a powerful rally may unfold until spring.

Figure 3: Tokyo Nikkei Average – start of a new advance?

Source: www.stockcharts.com

At this point we want to make it clear that we are not fans of Japan Inc. However, with the ongoing unprecedented stimulus and the declining Yen, it will be foolish to bet against Japanese equities.

Over in Europe, it is notable that the majority of stock markets have broken out to multi-year highs and even Greece is now participating in the recovery. Interestingly, after declining by over 90% from its 2007-peak, the Athens General Share Index is now rallying and it has recently taken out its previous high. Therefore, aggressive traders can consider allocating some capital to this beaten down stock market.

At this stage, it is difficult to know why the Greek stock market is advancing but we suspect that the worst has already been discounted. If this is correct, then we may witness a big rally.

Turning to the emerging world, it is notable that the Brazilian, Chinese and Russian stock markets are struggling and this is in line with our expectation. Furthermore, the other prominent Asian and Latin American stock markets are also trading beneath their all-time highs and we suspect that this weakness will continue for several months.

If you review Figure 4, you will observe that over the past year, the MSCI Emerging Markets Index has declined in value and this is in stark contrast to the performance of the developed world. Furthermore, we suspect that when the Federal Reserve starts to reduce its bond purchases, capital will probably flee from these high-beta stock markets. Accordingly, we currently have no exposure to the developing world.

Figure 4: MSCI Emerging Markets Index

Source: MSCI

In terms of risks, we believe that the record-high margin debt on the NYSE will be problematic but this should not be an issue until borrowing costs rise. Furthermore, we are of the opinion that rising US Treasury yields should be monitored closely as a dramatic increase in interest rates may pose problems for the stock market.

Last but not least, we still recommend our readers to avoid Chinese equities. Our thorough research reveals that China’s property market is extremely overvalued and at some point, we will get the inevitable hard landing. When that happens, bad loans will rise and may create problems for the banking sector.

For sure, China’s administration has sufficient capital to bail out its prominent banks but that will occur in response to a major crisis. Therefore, until China’s real estate prices come down to more reasonable levels, investors should avoid allocating capital to the world’s second largest economy.

In summary, our strategy remains unchanged and we are still over-weighting the strong industry groups and geographical areas. Moreover, we are closely monitoring the situation and if the market condition deteriorates, our risk management system will kick into action.

Copyright © 2005-2013 Puru Saxena Limited. All rights reserved.

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.