This Past Week In Gold

GLD – on sell signal.

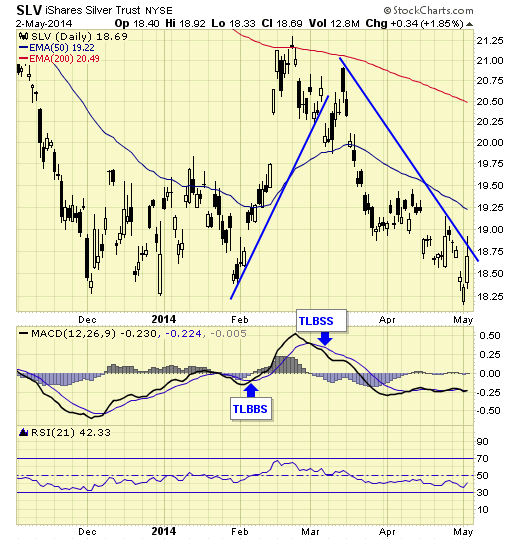

SLV – on sell signal.

GDX – on buy signal.

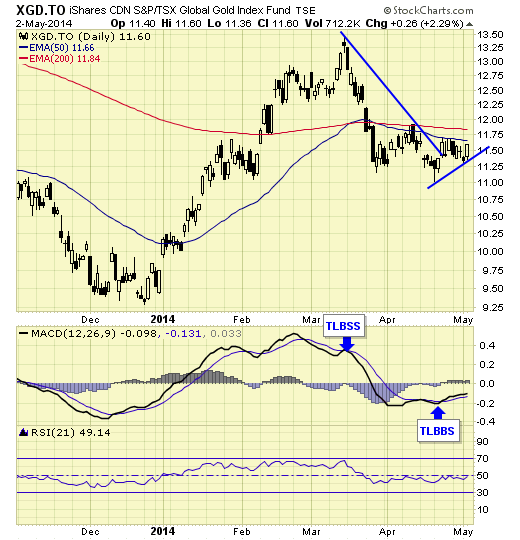

XGD.TO – on buy signal.

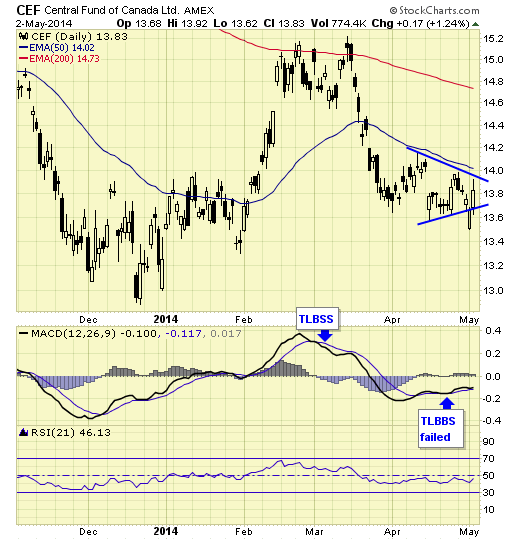

CEF – new buy signal failed, which is not unusual during a down cycle.

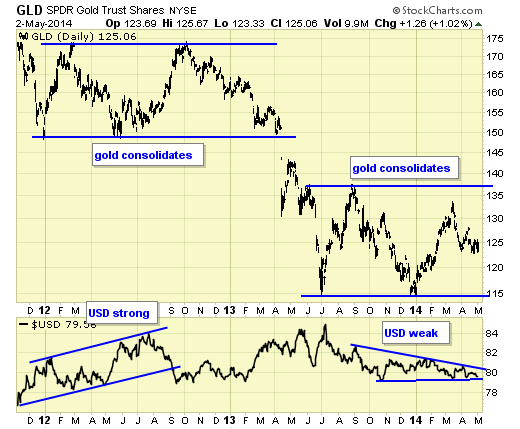

The big picture in gold has not changed as the multi month consolidation continues.

In 2012 when gold was consolidating, dollar was strong as expected.

But dollar has been weak during gold’s current consolidation, and that is a concern from the inter market relationship perspective.

Summary

Long term – on major sell signal since Mar 2012.

Short term – on mixed signals.

Gold sector cycle – down as of 3/21, ending the up cycle since 12/27.

COT data is not supportive for higher prices overall.

Disclosure

We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion.