This Past Week In Gold

COT data suggests lower metal prices overall going forward.

GLD – on buy signal.

SLV – on buy signal.

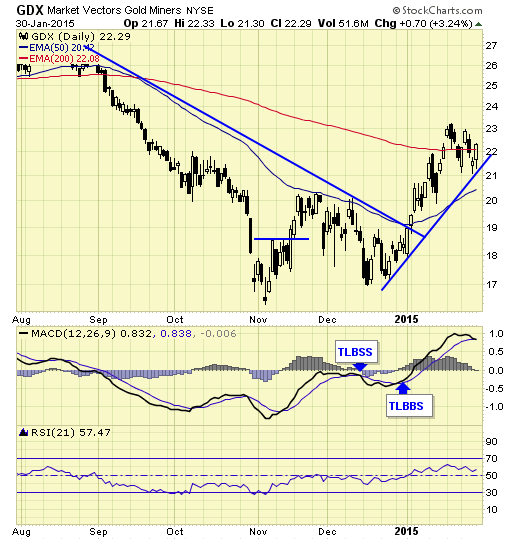

GDX – on buy signal.

XGD.TO – on buy signal.

CEF – on buy signal.

The mighty dollar had a major breakout after seven years of base building and a twenty year bear market, but many analysts continue to shun the greenback, which reminds me much of the early gold bull market in 2001 and 2002.

Summary

Long term – on major sell signal since Mar 2012 when $HUI was at 550.

Short term – on buy signals.

Gold sector cycle – up as of 11/14.

A bear market rally is in progress but upside should be limited.

COT data suggests lower metal prices overall going forward.

Disclosure

We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion.