Rate Hikes And Gold

While all “systems are go” for the precious metals sector, or at least appear that way, things are substantially more questionable for the world’s stock, bond, and real estate markets.

While all “systems are go” for the precious metals sector, or at least appear that way, things are substantially more questionable for the world’s stock, bond, and real estate markets.

India’s top central banker, Raghuram Rajan, is highly educated, in both engineering and economics. He’s one of the smartest practical economists in the world, and the only central banker to have predicted the 2008 super-crisis.

Ominously, he’s the only central banker now, issuing dire warnings about a new super-crisis, one that could become a 1930s-style depression. My suggestion to the Western gold community is to take this man seriously. Here’s why:

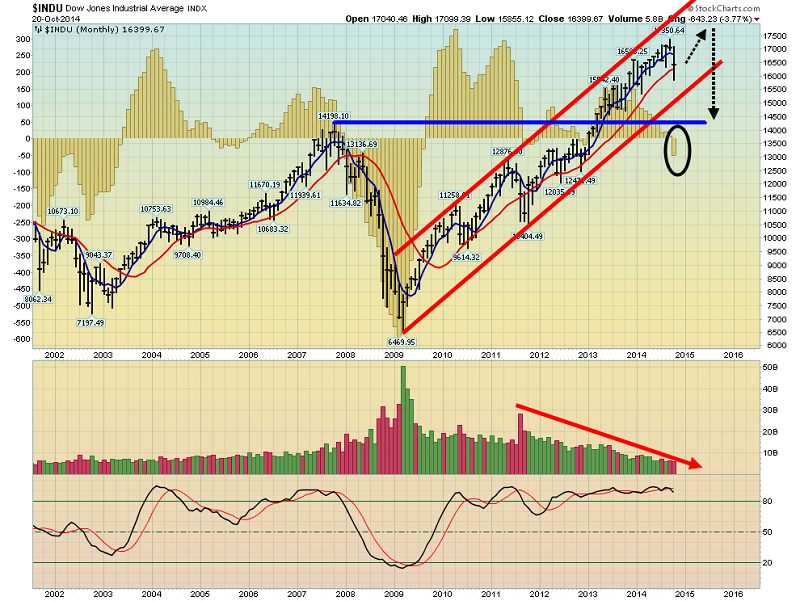

The Fed often uses a rough eight year business cycle in its calculations. The last two cycles peaked in the year 2000 and 2007. The current cycle has been anemic, and it is likely to peak in 2015, using that eight year gauge as a rule of thumb.

If Western gold community investors did not buy the US stock market into the 2002 and 2009 lows (I did), they should not be “chasing price” now, as this business cycle peaks. Bank economists keep saying this recovery cycle can continue far beyond eight years, but that’s what they said in 1999 and 2007, right before the last two crashes.

Wealth in the stock market that is “here to stay”, is generated by buying business cycle troughs, not peaks. While most bank economists and gold community analysts predicted a Fed taper would crush the price of gold, I suggested it would cause gold to rally, and turn the Dow into a wet noodle, and that’s exactly what has transpired.

Here’s what I see next: I think bank economists and gold community analysts are seriously underestimating the Fed’s concerns about inflation, and risk-on market froth. For 2015, I’m predicting substantial increases in interest rates, as the Fed works to support higher wages for low and middle income Americans.

Janet Yellen has categorically stated that she has serious concerns about the wage differential between the rich and the rest of America. Higher wages are inflationary. Higher wages are almost certainly coming in 2015, and that means the Fed must raise interest rates decisively, to halt the inflation generated by those higher wages.

While a 1929-style stock market crash may seem unlikely in 2015, trading volume has steadily shrunk in the Dow, since the 2009 lows. That’s the monthly chart for the Dow. While the market typically rallies from October to the end of the year, I think rallies now need to be sold and shorted. I can easily see the Dow at 14,200 after the first rate hike. All global stock markets would join in the “downside fun”. There are two ways to solve wage disparity. The first is by raising the wages of the poor. The second is by crushing risk-on markets, and crushing the wealth of the rich. I think the Fed will engage in both actions.

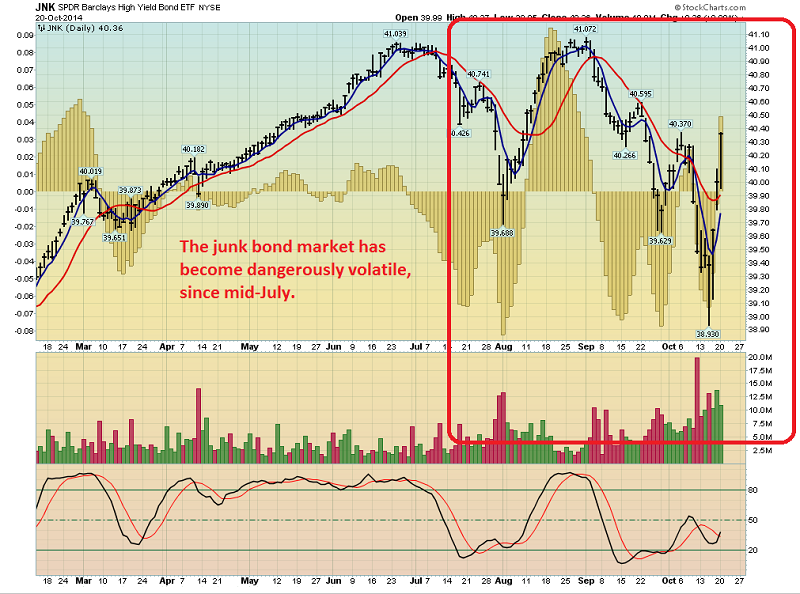

Higher rates could crush junk bonds, mortgage markets, and the Dow, while gold powers higher as inflation rises and the bond market loses its safe-haven status.

Richard Fisher is president of the Federal Reserve Bank of Dallas. He stated yesterday that QE has encouraged indiscriminate investing by investors. "We've been floating this market with the Ritalin of easy monetary policy," – Richard Fisher, CNBC News, October 20, 2014. When a Fed president compares QE and low rates to Ritalin, it’s time to seriously think about what happens to global stock markets when there is no more Ritalin. To view recent statements from Mr. Fisher, please click here now.

When Raghuram Rajan outlined the risks of the 2008 super-crisis before it happened, US government and central bank officials called him “misguided” and “lead-eyed”. Perhaps his “lead-eyed” concerns about a 1929-style crash now should not be dismissed quite so quickly, this time?

If the Fed suddenly raises rates, investors may find there are few buyers for their stock. The correction that Mr. Fisher is outlining could quickly become a much more dangerous event, depending on how global markets react to a major change in central bank interest rate policy.

That’s the daily chart of JNK-NYSE, a junk bond ETF. It’s become a “cauldron of volatility” as QE is tapered to zero. What happens to junk bonds, if the Fed actually hikes interest rates? What happens to the US real estate market, in that situation? It could get ugly. Richard Fisher is rumoured to own a lot of gold, so he’s likely fully prepared to manage this situation!

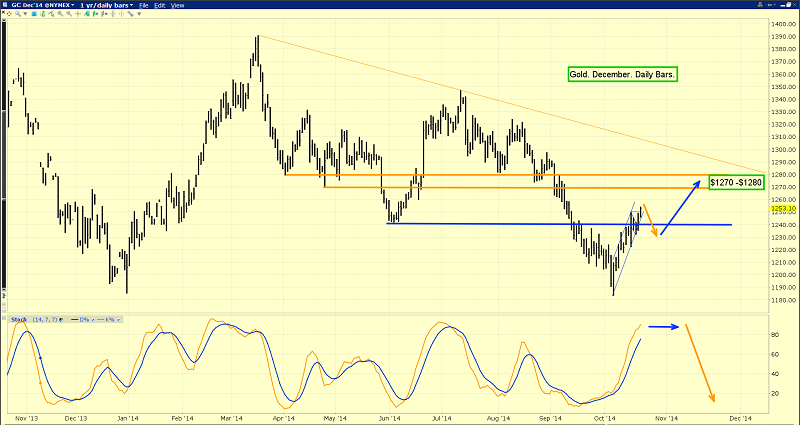

Gold itself is racing higher this morning, and the hourly bars chart is beginning to look like “bullish artwork”, painted by an old master.

From the $1183 area lows, gold has now rallied about $71, and established a nice uptrend channel. Importantly, the sell-side HSR (horizontal support and resistance) at $1240 has been penetrated this morning in a decisive manner.

That’s the daily chart for gold. Note the thick blue line I’ve drawn on this chart in the $1240 price area. The rise to the $1254 area is turning the $1240 area into buy-side HSR, which is great news for gold bulls.

The lead line of the price stoker (14,7,7 Stochastics series) at the bottom of the chart is now at about 90, which is very overbought, and so light profits can be booked on a small portion of positions, using my systematic risk capital allocator, the pyramid generator.

The weekly chart is extremely impressive.

If gold can rise above the gold coloured downtrend line on this chart, I think a further rise to about $1350 may be a realistic target. Note the position of the price stoker. It’s sitting at about 37, and is rising steadily. In the intermediate term, that supports the bullish case for gold.

Gold is generally frowned upon by governments, because it’s regarded as an “anti-debt” asset. Nobody knows this better than the citizens of India, who must import gold through a literal gauntlet of punitive rules, regulations, and kickbacks to government officials.

One Indian banker recently told me, “Government corruption has always been a part of our culture, and it always will be. Isn’t that great?” I’m not sure how great it is, but it’s clear that Indian citizens are fully prepared to do whatever it takes, to import all the gold needed for their sacred religious ceremonies, regardless of the actions of any government entity.

That gold ultimately must come from gold dug out of the ground by Western mining companies. That’s the weekly chart of GDXJ. From a technical perspective, a rare quadruple bottom pattern has materialized, with bullish implications for price of junior gold stocks.

Note the price stoker at the bottom of the chart. The lead line is at about 15, and there’s now a crossover buy signal. In the intermediate term, a rally towards the $45 area appears to be very likely!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Die Bonds Die!” report. I’m preparing to attack the global bond markets with short sales. I’ll show you how to get richer, by betting on rates hikes as gold climbs higher!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: