The Resource Cycles

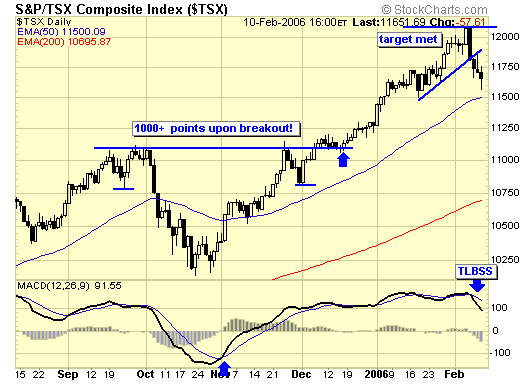

I've shown the TSX in early Dec, suggesting a breakout of the "cup with handle" pattern portends a rally into the 12000 area. That target was met early last week and price was firmly rejected, causing a plunge of 500 points. Since the Toronto index is heavily weighted with the resource sectors such as oil, gas, and metals, there is no surprise that we also had confirmed sell signals in both our energy and gold sector.

Now that the price target has been met, where do we go from here? First downside target is the 50ema, a TLBBS at the 50ema will give us an IP1, a very bullish signal. If support fails, we could correct all the way to the 200ema where a TLBBS will give us a BSBS. To get a glimpse of the future, lets look at the commodities….

Copper - had a great run, we were able to identify the "running correction" and scalped a few points off FCX, but the blow off top has rolled over and we are now on a sell signal.

Gold is also on a sell signal, 50ema has been providing support, lets see if it will again.

Crude oil - prices tested the high at $70 and failed, and as prices often do, when they are rejected by resistance, they will test support, currently at $60.

Natural gas - has absolutely collapsed after hitting $15 in Dec, when analysts were calling for $25. Where are they now?

What is truly amazing, is the fact that commercials have been neutral, and large specs have been net short while small specs are net long. This is a battle between the big boys (funds) and the little guys, and despite natgas prices dropping 50% from the top, small traders are fearless, hanging on to their losing positions in hope of a turn around soon. In the futures market, David very seldom beats Goliath.

And then there's mad money…

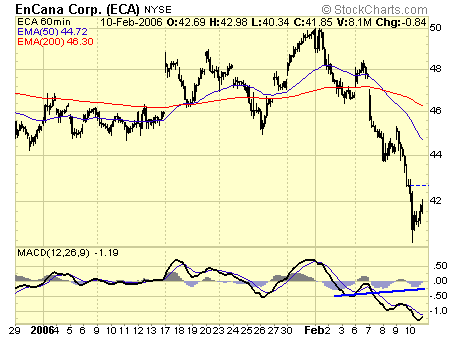

ECA - a few members asked me about ECA a few weeks ago after Cramer pounded on the table because ECA was a screaming buy….it is now down 30% from the top, and a full correction on the weekly chart could take us down to $30 where the 200ema is. I'm not saying it will but that is the next level of support…

short term tho, we have some multiple bullish divergences and that should produce a strong bounce in the next few days.

GG - another Cramer's "must own" stock a few days ago on TV, and that scares me….

short term wise, GG also has a bullish divergence and that portends a bounce to the $26 area.

Summary

The resource sectors have been hot, hot, hot, and there is no doubt that they are in a full fledge bull market. However, corrections within a bull market is sharp and brutal, and very few late comers could stomach the sell offs. These market chasers are inexperienced investors who often end up buying at the tops and selling out at the bottoms of a bull market. Trading is a zero sum game, therefore, we need these folks if we want to make a few bucks. Long term investors need not to be concerned with short term volatility, but those who are late to the party should always place a hard stop at breakeven for protection. Of course, seasoned traders could try to trade this oversold bounce but most are better off to be patient and hit the markets hard at the next cycle bottom on a buy signal.

Jack Chan at www.traderscorporation.com

13 February 2006