Road Sign Says: Pot Of Gold Ahead

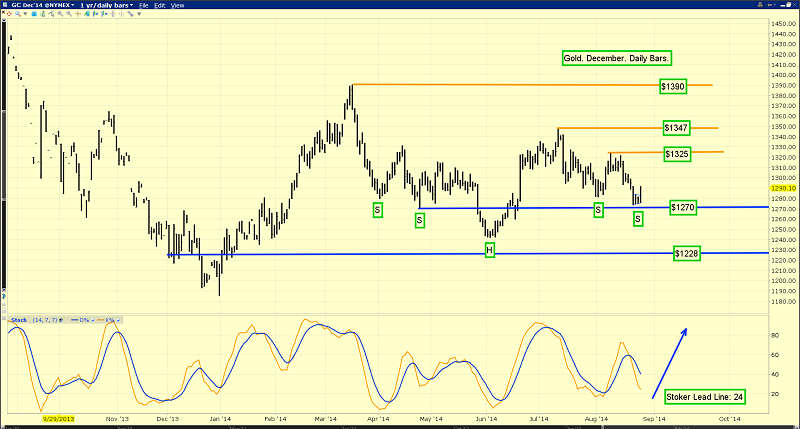

A week ago, I suggested gold would likely decline from the $1300 area to about $1275 and stop there, adding bullish symmetry to an inverse head and shoulders bottom pattern.

That’s the hourly bars chart for gold. It’s clear that gold declined to my targeted $1275 area “on cue”, and then surged higher early this morning.

The bullish symmetry price action is created on a daily chart head and shoulders pattern. This bullish chart looks like Michelangelo sculpted it, from a block of golden marble!

Note the bullish action of the price stoker (14,7,7 Stochastics series). My first target is $1325.

Given the stunning Indian and geopolitical price drivers now in play in Iraq, Syria, and the Ukraine, I think gold could charge beyond $1325, and on towards the $1347 and $1390 area highs.

Silver, which is perhaps better referred to as “gold on steroids”, looks even better. The price stoker sits at an incredibly oversold level of about 10, and is now flashing a crossover buy signal, as it bursts above a key minor trend line. My suggestion to silver enthusiasts, is to be long and strong!

The hardline Islamist group commonly referred to as ISIS has created a quasi-nation state of enormous size. It stretches across huge parts of Iraq and Syria. On the week-end, they apparently captured a Syrian airbase, and they have stated plans to capture not only Baghdad, but the entire countries of Spain and Italy. The ISIS leader, “Al-Baghdadi”, has a doctorate degree. It’s probably not a wise idea to underestimate the man’s capabilities.

While I don’t think many analysts understand the seriousness of this situation yet, Mid-East geopolitics threatens to become a much bigger gold price driver than QE ever was.

Over the past month, bank economists around the world have almost universally dropped their bearish viewpoints on gold, and adopted a generally supportive outlook.

A “$1200 floor” is a common expression used by the top economic guns now. That’s a welcome change, and the gold charts certainly support this new and “improved” analysis, of the world’s mightiest metal!

I’ve argued that the year of 2014 is a year of transition, from deflation to inflation. As a gold price driver, the economic super-crisis is on the back burner, and strong growth that produces relatively more inflation than GDP is on the front burner.

That’s the latest PMI flash report for US manufacturing growth. It’s acting like a hungry pitbull. I’m predicting that it will only take three or four more such reports, to make high quality institutional money managers start ringing their inflation alarm bells.

Rising food prices can create huge institutional liquidity flows into gold. Commerzbank agricultural market analysts are amongst the best in the business. The above is the current analysis of the wheat market.

That’s the latest COT report for wheat. The commercials (aka the “banksters”) are net long the wheat market, while the hedge funds are net short! Is wheat on the verge of soaring higher, and will that produce sizable institutional liquidity flows into gold? I think so.

In the big picture, India is the most important price driver for gold. The news coming out of the land of the “titans of ton” is now very bullish.

While about one third of the entire population of India has no electricity, that state of affairs is changing very quickly. As Indian citizens get access to the internet, they are rushing to buy gold in online accounts. Over the next couple of years, I expect this online buying will go “off the charts”.

Because a picture arguably speaks a thousand words. The road sign says “Pot Of Gold Ahead”. I think that applies to any investor who owns shares of gold mining stocks.

‘Gold likely to regain sheen in second half of 2014: Despite the possibility of deficient monsoon casting a shadow on the rural demand, riding on overall better sentiments gold is expected to recover its sheen in the second half (July-December) of the year, Somasundaram P.R, managing director (India), World Gold Council (WGC) said. “The second half will be a better one as compared with the previous year. The first half (January-June) was affected by the 80:20 rule on exports and expectations that there will be a duty cut. “People were hoping that the price will get back to the Rs.25,000 ($413) per 10 grams zone. Then there was election till the second quarter (April-June), which did have its own impact on demand. There were also a lot of operational issues for the trade,” Somasundaram told IANS in an interview.’ - The Gulf Today News, Aug 25, 2014.

If anyone deserves the “man of the year” title, it’s probably WGC director P.R. Somasundaram. I’m in complete agreement with his superb assessment of the current gold market.

Gold is set to regain its sheen, and so are the mining stocks held by the Western gold community.

That’s the GDX daily chart. GDX is in a nice uptrend channel now. In the short term, it’s consolidating in a bullish rectangle formation.

My suggestion to Western gold stock investors is to treat the gold bull era like a fine wine. Savour each moment.

Out with the old, and in with the new. The new era is not a chug-a-lug contest for “parabola demanders”. Nor is it a QE reunion party. This is a new era of consistently growing demand for gold jewellery, created from gold that is mined.

Soon this key source of demand will surpass mine and scrap supply. The man who I’ve dubbed the world gold community’s man of the year, seems to be hinting it could happen right now!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Cakes & Steaks” report. I’ll pit 3 top junior gold stocks against 3 top junior yellowcake (uranium) stocks and suggest which are poised to lead, in the gold bull era!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: