Say No To Debt Ceiling Drugs

Gold has rallied more than $60 per ounce in the last few weeks. In the short term a new catalyst is needed to continue the rally, but the big picture looks fabulous.

India has a population of about 1.3 billion people, with the World Gold Council (WGC) noting that about 60% of them are under the age of 25.

The WGC appears to be significantly underestimating the pace of recovery of the nation’s jewellery market. Indian demand in the first half of 2017 has already exceeded demand for the entire 2016 calendar year.

Chinese demand is solid, and Turkey is becoming a potential third force of significant love trade demand.

To be sure it could be the fear trade in the West that pushes gold over $1300. I refer to the US debt ceiling as a floor, and President Trump has wondered out loud if a government shut down is needed to stop congress from passing the buck.

Unfortunately, Trump’s Treasury Secretary is in favour of passing the buck once again, but Trump has shown himself to be willing to stand up to anyone he feels is an obstacle to his agenda.

Trump’s next statement regarding the debt floor will be a key indicator as to whether fear trade investors can help gold retake the $1335 price area that was hit on the night of Trump’s election.

That rally was violently destroyed by the Indian government’s demonetization announcement. Conspiracy buffs will note that the demonetization announcement came just as it was clear that Trump had won the election.

Perhaps it was coincidence, and perhaps not. Regardless, the good news for gold bugs is that the news about gold coming out of India is now quite positive.

With a supportive love trade from India, China, and now Turkey, any US debt floor shock could create significant fear trade buying on the COMEX. That would almost certainly push gold to $1335 or higher.

This is the daily gold chart.

Note the position of my 14,7,7 Stochastics series oscillator at the bottom of the chart. In the short term, gold is overbought.

The lead line of the oscillator is at the 90 level. Gold bugs should cheer that the oscillator has a “flat line” event, and the rally continues.

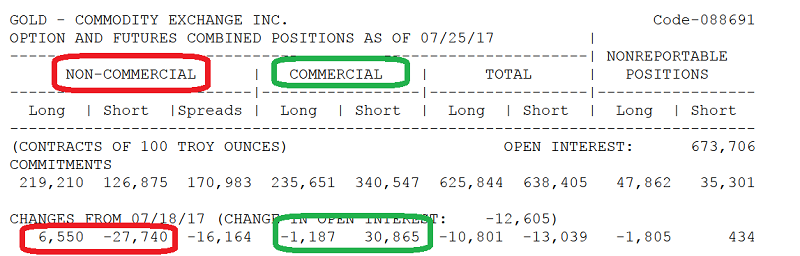

Regardless, some profit should be booked into this price strength. Investors who place heavy bets against the commercial traders generally don’t fare very well.

It’s clear that these powerful commercial traders are selling and shorting gold with some size now.

That makes sense after a $60 rally. Gold bugs should book some profit while cheering for further gains. This is a simple approach, and a winning one!

The US dollar index gets a lot of coverage from gold analysts. Bank FOREX traders tend to focus more on the dollar versus the yen, and rightly so.

This weekly chart paints a picture of a weak dollar against the yen. Further weakness appears imminent. That’s good for gold.

This is an interesting gold versus dollar index chart.

Arguably, there’s a huge double-bottom pattern in play, with a neckline at the 14.44 price zone. The target of the pattern is the resistance in the 17 area. That would correspond with a gold price of about $1400.

Many gold mining companies have significant cost cutting programs in play. Many are in advanced stages, and that means that even a modest rise in the gold price can turn these companies into highly profitable “cash flow cows”.

This is the GDX chart. It has a solid feel to it, and the current “steady as she goes” rally looks better than the previous ones. Profit needs to be booked on this price strength, but very lightly!

A major upside breakout above $26 is likely to coincide with a key breakout above 14.44 on the USDX versus gold chart. Donald “The Golden Trumpster” Trump could be the catalyst that makes the breakout happen if he soon says “no” to any more US government debt ceiling expansion drugs!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Pedal To The Golden Metal!” report. I highlight six senior gold producers that are set to make shareholders very happy, with specific buy and sell tactics for each stock.

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

https://www.gracelandupdates.com

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: