Stress Free Gold Investing

By now, almost everyone who has any interests in the financial markets are aware that gold is at levels we have not seen for twenty five years. The question I often get asked by public readers is, is it too late to buy? A follow up question would be: what should I buy?

First, is it too late to buy?

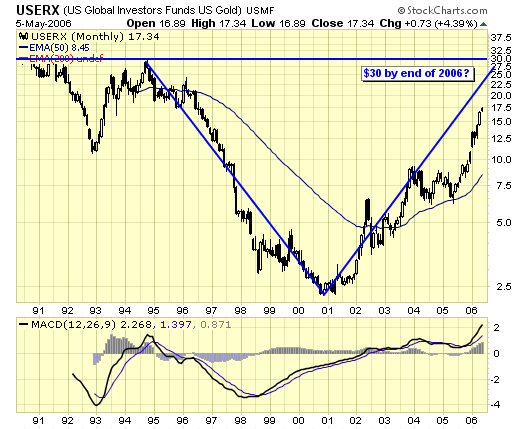

USERX - one of the best performing gold funds. As you can see, despite having gained more than 700% off the bottom, relative to the previous bull market, we've only just begun. The big move is ahead of us, not behind us.

We've had four buy signals since Oct 2005, and all four are profitable. We continue to look for set up for new money to enter the market, therefore, newcomers must wait for the next buy signal.

As to what to buy, the simplest way to invest is to pick one of the best performing gold mutual funds such as USERX. If the current trend continues, we should see $30 by the end of 2006.

RYPMX - another fund on our roster, RYPMX has now broken out of resistance and next price target is $95.

RBF468 - precious metals fund for Cdn investors, this RBC fund is quite possibly the best performing Cdn mutual fund, period. There is absolutely no overhead resistance as new money continues to buy the dips.

Summary

For most investors and traders, the funds are an excellent way to have exposure to the gold sector while keeping risk at minimum. It also offers diversification, and simple management. Despite the spectacular rise of both the metals and mining stocks in the past four years, this is just the beginning and not the end. As I have said before, I would be concerned when we have a 24 hour gold channel on TV……Get on board and stay on board!

Jack Chan at www.traderscorporation.com

9 May 2006