The Strong Case For Gold And Natural Resource Equities

Last week I attended the Denver Gold Forum along with three other U.S. Global Investors representatives, including our resident precious metals expert Ralph Aldis.

I was happy to see sentiment for gold way up compared to last year’s convention, as was turnout. I was also pleased to see Franco-Nevada, Silver Wheaton and Royal Gold in attendance, all of which I’ve written extensively about.

One of the most interesting presentations was held by Northern Star Resources—the third biggest listed gold producer in Australia, a dividend payer and a longtime holding of USGI. I’ve always appreciated Northern Star’s insistence on being a business first, a mining company second. This shareholder-friendly mantra is reflected in its stellar performance.

Compared to other companies in the NYSE ARCA Gold Miners Index (GDM), Northern Star is a sector leader in a number of factors, including five-year cash flow return on invested capital. Whereas the sector average is negative 1.6 percent over this period, Northern Star’s is a whopping 27 percent, the most of any other mining company in the GDM.

This has helped it return an amazing 800 percent over the last five years as of September 23. Compare that to the GDM, which returned negative 56 percent over the same period.

Australian gold miners as a whole trade at an impressive discount to North American producers, 5.7 times earnings versus 8.3 times earnings, according to Perth-based Doray Minerals.

Screening for high cash flow returns on invested capital, as you can see, helps give us a competitive advantage and uncovers hidden gems such as Northern Star and others.

Resource Equities Offer Attractive Diversification Benefits

A recent whitepaper published by investment strategist firm GMO makes a very convincing case for natural resource equities. I urge you to check out the entire piece when you have the time, but there are a few salient points I want to share with you here.

In the opinion of Lucas White and Jeremy Grantham, the paper’s authors, “prices of many commodities will rise in the decades to come due to growing demand and the finite supply of cheap resources,” presenting an attractive investment opportunity. Over the long-term, resource stocks have traded at a discount and outperformed their underlining metals and energy by a wide margin.

Editor's Picks:

- Making Lemonade from Lemons: The DOL Opportunity

- Market Volatility: The Perfect Answer For "It's Time Do to Something"

- How to Discover Your "Real Mission" as an Advisor

- How to Follow Your Heart AND Manage by the Numbers

- We Comes Before Me: Why Weology?

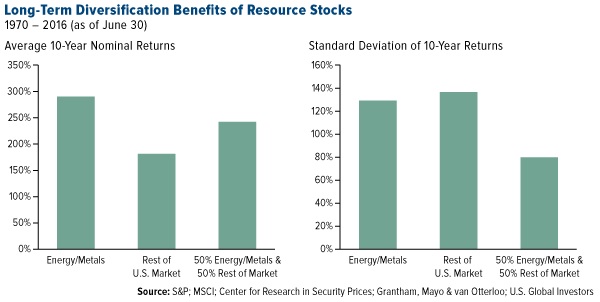

According to White and Grantham, a portfolio composed of 50 percent energy and metals, 50 percent all other equities, had a standard deviation that’s 35 percent lower than the S&P 500 Index. What’s more, the returns of such a portfolio outperformed those of the S&P 500, resulting in a risk-adjusted return that’s 50 percent higher than that of the broader market.

Resource equities have also historically shown a low to negative correlation to the broader market, which might appeal to bears. The reason? When metals and energy have risen in price, it’s been a drag on the economy. The reverse has also been true: Low prices have been a boon to the economy.

The thing is, general equities currently do not give investors enough exposure to natural resources. The weight of energy and metals in the S&P500 has been halved in the last few years as oil and other materials have declined. Considering the diversification benefits, investors should consider a greater allocation to the sector.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of