Suddenly Even the Blind Can See Inflation Coming

We now move from the stage where I was, in a lonely manner, predicting for months inflation would rise near the end of summer to the stage where everyone is in on it because it has become obvious, so the rise in today’s report is suddenly no surprise. Headlines talking about the rise in inflation today, all made sure to include mention that the rise in headline inflation simply met expectations comfortably, but that is only because most economists now finally expect what nearly none were foreseeing during the summer. They adroitly saw it just before they ran into it.

At least, the ease with which everyone suddenly admits it was expected finally puts to rest any question as to whether inflation will go back to rising. It now decisively has, and one of the main things rising is one of the two factors I said would be very big—housing costs due to the lag time (where many were strangely expecting housing to come down, even though the lag makes its rise now predictable to whatever extent statistics remain honest and consistent in how they are being calculated).

Here’s the news on the matter today:

Inflation perked up in October though pretty much in line with Wall Street expectations, the Bureau of Labor Statistics reported Wednesday.

The consumer price index, which measures costs across a spectrum of goods and services, increased 0.2% for the month. That took the 12-month inflation rate to 2.6%, up 0.2 percentage point from September.

What we’re now seeing is a rise in headline inflation; whereas in the months past, I pointed out rises in the pressures on the producer side that feed into inflation and then rises in the non-headline numbers last month. Now it has fed all the way to the big title number. The number the Fed looks at (though they focus on the PCE report, not CPI) rose even more:

Excluding food and energy, the move was even more pronounced. The core CPI accelerated 0.3% for the month and was at 3.3% annually, also meeting forecasts.

That now looks like this:

So, the anticipated move IS CONFIRMED as expected.

Housing inflation builds

While I was wrong about energy (particularly oil) driving up inflation, the other major contributor I noted did turn out to lead the way quite strongly in today’s report:

Energy costs, which had been declining in recent months, were flat in October while the food index increased 0.2%. On a year-over-year basis, energy was off 4.9%.

Despite signs of inflation moderating elsewhere, shelter prices continued to be a major contributor to the CPI move. The shelter index, which carries about a one-third weighting in the broader index, climbed another 0.4% in October, double its September move and up 4.9% on an annual basis. The category was responsible for more than half the gain in the all-items CPI measure, according to the BLS.

I could never figure out why so many financial writers were saying this past summer that housing would be cutting the Fed a break. Sure, today’s news is full of stories about housing prices tumbling all over the country now; but anyone who pays attention to economic data knows that housing price changes get reported in CPI with, at least, a one-year lag. So, it should be easy to see what housing is going to do in CPI by looking at what it was doing in the real marketplace a year ago. Today’s prices shouldn’t hit CPI data until next year around this time.

(Of course, so much depends on government manipulation of data that you can never be completely sure what will come through on any report these days … as I reported on yesterday, quoting Dowd, who said government data is the most manipulated he’s ever seen.)

People are already, of course, trying to shift the blame toward Trump:

“No surprises from the CPI, so for now the Fed should be on course to cut rates again in December. Next year is a different story, though, given the uncertainty surrounding potential tariffs and other Trump administration policies,” said Ellen Zentner, chief economic strategist at Morgan Stanley Wealth Management.

No suprises here, except that NONE of you were predicting this move until less than a month ago when the month-on-month moves had become obvious, and it was likely they would start to show up in the yearly figures. And, while it is true that Trump’s huge deficit spending (given his past track record and his promised additional tax cuts plus tariffs) almost certainly portend even more inflation, please don’t take the focus off the Fed now and how it has been struggling in its battle over inflation during the first three months of this year with the current second move upward this year reasonably foreseeable but unmentioned almost everywhere. Please stop ignoring how the Fed’s rate cuts now are only going to exacerbate that. Those who focus on Trump at this juncture remove some of the deserved blame from the Fed as the inflation builds back upward.

We’re almost back to the days of “inflation is transitory” as the Fed and all the complicit financial media pretend this is not the start of worse things to come. The forces feeding it aren’t likely to back off anytime soon, and the Fed will add new forces with its rate cuts.

The latest Consumer Price Index (CPI) report out Wednesday showed that housing costs accelerated in October, posing a lingering challenge to the Federal Reserve's inflation fight….

"Falling inflation hit a snag in October, with the usual culprits — rising shelter and food costs — joined by higher used vehicles prices," Robert Frick, corporate economist with Navy Federal Credit Union, wrote in a note after the release. "Given food, transportation and shelter are the top three pain points for consumers, this report didn’t ease the burden of high prices."

Credit Where Credit is Due

And that burden is becoming quite significant, though that will eventually be anti-inflationary as burdened consumers start reeling back. So far, however, they have been covering the burden with additional debt:

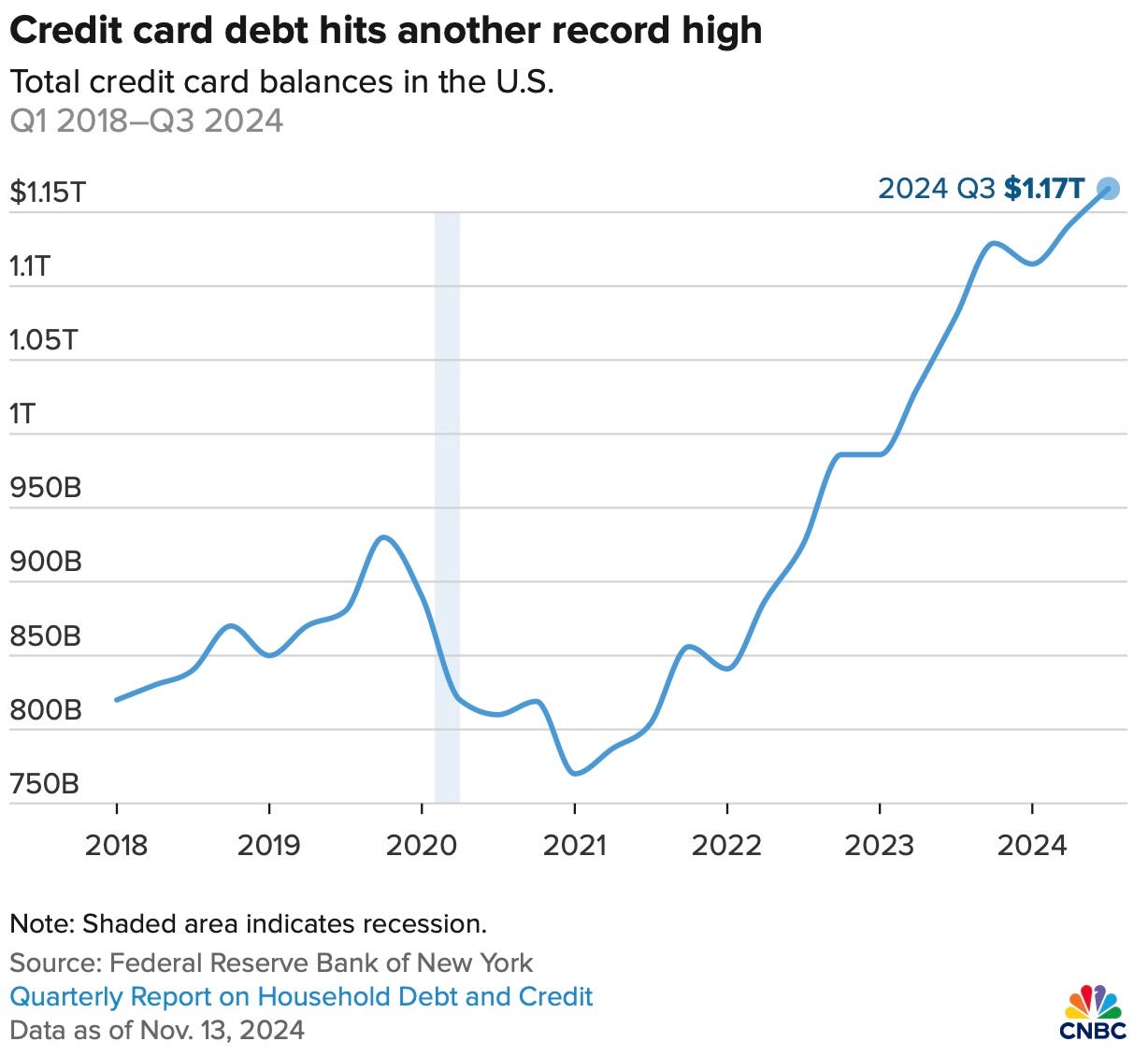

Collectively, Americans now owe a record $1.17 trillion on their credit cards, according to a new report on household debt from the Federal Reserve Bank of New York.

Credit card balances rose by $24 billion in the third quarter of 2024 and are 8.1% higher than a year ago.

While consumers are taking household debt to record highs, they are managing it better due to improved incomes, so it is not yet forcing down their purchases.

Despite that increase, credit card delinquency rates improved — with 8.8% of balances transitioning to delinquency over the last year, compared with 9.1% in the previous quarter, the New York Fed found. That change could “suggest that rising debt burdens remain manageable,” the New York Fed researchers said on a press call Wednesday.

Credit-card debt is slower now, though, than it was a year ago, indicating consumers may be finding it hard or risky to pile on more.

In the last three months, 42% of Americans said their total debt hasn’t changed, while 28% of have seen their debt rise…

Of the latter group, most said the increase was due to the ongoing difficulty of making ends meet.

Bigger voices than mine chime in

A couple of big voices in the financial world are concerned the Fed is going to lose the battle on inflation once again as it toys around with reducing interest rates. One of them is former US Treasurer Larry Summers, not my favorite economist, but I’ll quote him just because he’s a major mainstream name who sees trouble ahead when few others do. Plus he did see the last big transitory wave of inflation that wasn’t transitory coming, never buying into the Fed’s “transitory” narrative:

Larry Summers sounds the alarm bell on inflation — before Trump even takes office….

Here, again, is an effort by the article writer to start shifting the blame for the return of inflation on Donald Trump. I’m all for blaming him (or anyone) for what he (or anyone) is to blame for; but let’s keep the blame squarely on the Fed since this report’s inflation could be seen coming, while Trump’s policies remain months away.

When many were celebrating the remarkable economic recovery from the pandemic in the spring of 2021, Larry Summers warned the White House and the rest of Washington that inflation was a real danger.

That warning proved to be prescient. Price spikes engulfed the US economy, crushed consumers and forced the Federal Reserve to spike interest rates to multi-decade highs. Inflation became issue No. 1 for voters and helped send Donald Trump back to the White House.

That was a monumental and inexcusable miss on the Fed’s part back then; so, let’s not cut them slack now that we see they are about to do the same thing.

For once Liberal Larry isn’t putting his politics ahead of his predictions:

Summers, the famed economist and former Treasury secretary, cautioned Tuesday that the inflation genie may not be back in the bottle. And, most tellingly, his warning doesn’t even account for what he fears could be a very inflationary agenda from the incoming Trump administration.

“My own judgement is that the Fed and markets are still underestimating the overheating risk,” Summers said during a conversation hosted by the New York Economic Club. “I ask myself: Why is cutting rates a priority into that environment?”

The same question I’ve been asking here: If the economy is as strong as the Fed and feds claim, why did the Fed make an historically large 50-basis-point rate cut? While the Fed raised rates in big chunks like that, it rarely starts dropping them in big chunks.

The former Obama and Clinton official pointed to above-target core inflation (a metric that strips out volatile food and gas prices), a rapidly growing economy and financial markets that are “on fire.”

And why would you rush to cut rates quickly when stocks are already floating high in bubble land and the massive housing bubble is only getting started with coming down, and it needs to come down if anyone is ever going to afford a home without crippling debt.

The former Harvard president suggested the Fed could be repeating the “astonishing” and “huge error” of 2021 when, in hindsight, it was very late to respond to soaring prices by raising rates.

Uh huh. Exactly what I’ve been concerned about. We may get to do the whole inflation fight all over again by the time the Fed figures out that the present inflation is transitory like the last inflation was transitory, which is to say the present economy needs a furnace like a Sahara nomad needs a furnace. I’m pretty sure the public will be very unforgiving if it gets to go through the inflation fight and more soaring costs all over again.

“I am fearful that the Fed is going to be more like once burned, twice burned, rather than once burned, twice shy, on inflationary risks,” Summers said.

One big corporate CEO is also chiming in with warning about the return to rising inflation:

Apollo’s Kleinman Says ‘Open Your Eyes,’ Inflation Not Tamed

Scott Kleinman, co-president at Apollo Global Management Inc., has warned markets not to get too comfortable with the current trajectory of inflation and interest rates.

“Inflation is not tamed,” Kleinman said in a Bloomberg Television interview on Tuesday. “The Fed can say what it wants. You just have to open your eyes and look around.”

That seems to be a rare skill these days. What? Use your own eyes and actually think?As a financial writer, don’t just parrot what the Fed tells you. Might need a pay raise to put in all that extra work.

As with Summers (and me) Kleinman, though he sees Trump’s plan will increase inflation, does not put the blame for the present rise in inflation that he’s talking about on Trump:

Kleinman said that, aside from any potential impact from Trump’s policies, inflationary pressures are already established because of global megatrends like the build out of digital infrastructure and decarbonization. “We’re going to have to live with a higher rate environment for a lot longer,” Kleinman said.

This inflation was already baked in, and then the Fed turned up the heat to make sure to burn the baked goods.

He echoed comments made by Apollo’s Chief Executive Officer Marc Rowan, who said last month that he didn’t see a reason for the Fed to keep cutting interest rates to stimulate the economy.

Yeah, that was as smart as keeping interest rates low while stoking the economy with a rapidly rising Fed balance sheet back in the days that were as transitory as sand in the Sahara. On a long enough time scale, sure. But we would all be cooked in the desert before that transition came in.

“The more the Fed cuts, the more you’re lifting your hand off that lever to hold inflation down,” Kleinman said.

It should be a no-brainer. Rising inflation was such a no-brainer back in 2021 that no one in the mainstream financial media saw it coming because they have no brains. They occasionally asked the Fed back then whether inflation would keep rising higher, but none challenged the Fed’s boilerplate answer. (Doing that might make it harder to get called on at the next meeting.)

*********