These Billionaire Investors Just Made Massive Bets On Gold And Airlines

I always advise investors to follow the smart money, and two people high on the list are Stanley Druckenmiller and Warren Buffett.

Second-quarter regulatory filings show that Stanley Druckenmiller, the famed hedge fund manager, just placed more than $323 million of his own money into a gold ETF, at a time when sentiment toward the yellow metal is in the basement. Meanwhile, Buffett announced this week that Berkshire Hathaway is purchasing aircraft parts supplier Precision Castparts for $32 billion.

Investors should take note!

Druckenmiller Sees Gold as a “Home Run”

Druckenmiller has commented in the past that if he sees something that really excites him, he’ll bet the ranch on it.

“The way to build long-term returns is through preservation of capital and home runs,” he said. “Grind it out until you’re up 30 to 40 percent, and then if you have the convictions, go for a 100-percent year.”

While I have always advocated for a diversified approach, this all-in approach has served him well. Between 1986 and 2010, the year he closed his fund to investors, Druckenmiller consistently delivered 30 percent on an average annual basis. Thirty percent a year! That’s a superhuman, Michael Jordan-caliber performance—or Ted Williams, if we want to stick to baseball imagery. The point is that words such as “legendary” and “titan” were invented with people like Druckenmiller in mind.

During his career, the man has made some now-mythic calls, the most storied and studied being his decision to short the British pound in 1992. This bet against the currency forced the British government to devalue the pound and withdraw it from the European Exchange Rate Mechanism (ERM), which is why many people say the trade “broke the Bank of England.” It also made Quantum, George Soros’s hedge fund, $1 billion.

And now he’s making a call on gold. The $323-million investment is currently the single largest position in Druckenmiller’s family fund. It’s twice as large, in fact, as its second-largest position, Facebook, and amounts to 20 percent of total fund holdings.

His conviction in gold can be traced to his criticism of the Federal Reserve’s policy of massive money-printing and near-zero interest rates. Such ongoing low rates push investors and central banks alike into other types of assets, including physical gold.

Concerns over government policy is why prudent investors hope for the best but prepare for the worst. I’ve always advocated a 10-percent weighting in gold: 5 percent in gold stocks, 5 percent in bullion, then rebalance every year. This is the case in good times and in bad.

Trump on Gold

Love him or hate him as a presidential candidate, Donald Trump has the same attitude toward owning gold in today’s easy-money economy. After leasing a floor of the Trump Building to Apmex, a precious metals exchange, he agreed back in 2011 to accept three 32-ounce bars of gold as the security deposit, according to TheStreet.

The U.S. dollar, Trump says, is “not being sustained by proper policy and proper thinking.” Accepting the gold “was an opportunity… to show people what’s happening with the dollar so we can do something about it.”

Trump and Druckenmiller aren’t the only ones adding to their gold positions right now. As I told Daniela Cambone on this week’s Gold Game Film, the Chinese government is now reporting its gold consumption on a monthly basis. In July it purchased 54 million ounces. This is significant in the country’s march to become a world-class currency that’s supported by the International Monetary Fund (IMF) for special drawing rights.

Both of our precious metals funds, Gold and Precious Metals Fund (USERX) and World Precious Minerals Fund (UNWPX), aim to offer protection against the sort of monetary instability Druckenmiller and Trump have warned us about.

Buffett Makes the Biggest Deal of His Career in Airlines

Many investors know that Warren Buffett has been hard on the airline industry in the past, even going so far as to say, in his 2008 letter to Berkshire Hathaway investors, that “if a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville [Wright] down.”

But since then it appears as if he’s come around—in a huge way. At more than $32 billion, his purchase of Precision Castparts is the largest-ever takeover in the aerospace sector, not to mention the largest deal Buffett’s ever been involved in.

More than that, though, the deal implies that Buffett, 85, sees great opportunity in the sector where previously he didn’t.

Indeed, the Wall Street Journal writes that the acquisition comes “as airlines’ seemingly insatiable appetite for new fuel-efficient jets in the past several years has left Airbus Group SE and Boeing Co. with combined orders on the books for over 10,000 jets.”

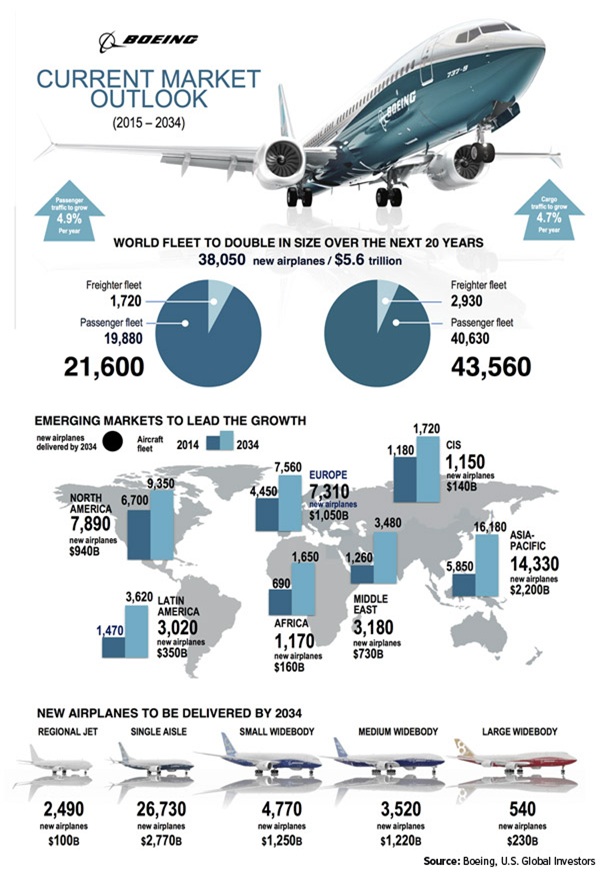

A couple of months ago, I shared with you Boeing’s estimate that $5.6 trillion in new aircraft orders will be placed over the course of the next 20 years. In the infographic below, courtesy of World Property Journal, you can see that Boeing’s world fleet is set to double in size during this period, from 21,500 units to 43,560. Click the image to make it larger.

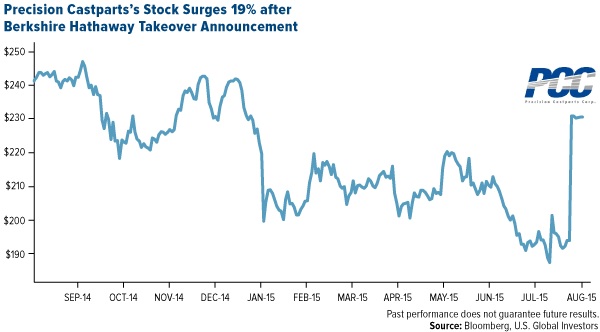

Precision Castparts, based in Portland, Oregon, manufactures parts used in gas turbines and aircraft engines. Its stock flew up 19 percent on the announcement.

“We’re going to be in this business for the next 100 years,” Buffett told CNBC’s Squawk Box.

Follow the money!

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Past performance does not guarantee future results.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the Gold and Precious Metals Fund and World Precious Minerals Fund as a percentage of net assets as of 6/30/2015: Facebook Inc. 0.00%, Apmex Inc. 0.00%, TheStreet Inc. 0.00%, Airbus Group SE 0.00%, Boeing Co. 0.00%, Precision Castparts Corp. 0.00%.

Diversification does not protect an investor from market risks and does not assure a profit.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

********

Courtesy of http://www.usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of