Trump Is A Gold Rally Accelerant

The 2017 gold market rally continues nicely…with a current pause at light overhead resistance in the $1215 - $1220 area.

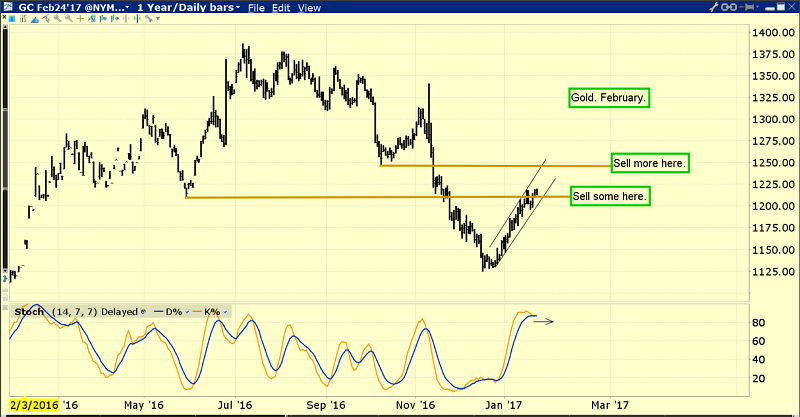

This is the daily bars gold chart.

Note the flat lining action of the 14,7,7 Stochastics oscillator at the bottom of the chart. That’s quite positive, and opens the door to a further move towards my $1245 target price area.

Donald Trump is likely to be a positive catalyst for higher gold prices, for many reasons.

On the geopolitical front, the South Sea island building by China looks like it could quickly become a major gold price driver.

Trump has also been very clear about his goal of slowing US corporate outsourcing of labour to foreign countries.

This is quite inflationary and could end up creating a bit of an earnings quagmire.

This is the daily bars US dollar versus Japanese yen chart.

It’s true that US bond market yields have risen a bit, but Trump’s dollar-negative statements are overwhelming the rise and putting downwards pressure on the dollar against both the yen and gold.

Gold has stopped rising at $1215 - $1220 at the same time as the dollar has stopped falling at 112.50 against the yen.

All Western gold community eyes should be focused on that 112.50 dollar versus yen price. If the dollar falls below that support, it should send gold through $1220, and on towards $1245.

Many gold analysts have been trying to call an end to the current rally, and have been negative since the December lows. In contrast, I would argue that the rally is poised to accelerate.

I don’t think these analysts really grasp the tremendous influence that Trump and his team can have on the value of the dollar against key currencies like the yuan and the yen.

This is the daily bars chart of the dollar versus the Swiss franc.

The dollar is beginning to look like a train wreck on this chart. It’s broken down from a head and shoulder top pattern just as Trump has been inaugurated!

When push comes to shove, the US Treasury has vastly more power than the central bank wields, and the Treasury has legal authority to devalue the dollar. The Fed has no such authority.

Janet Yellen’s recent negative statements about Trump’s stimulus policies will fall on deaf ears, and may create a backlash.

Janet would not fare very well in a confrontation with Trump. I expect future statements from her about US government policy to become quite timid as she begins to realize how determined Mr. Trump is to lower the value of the dollar.

GDX is breaking out of a small ascending triangle, and making a beeline towards my $25 target zone.

Technically, GDX looks superb now. The green downtrend line is now support, as is the horizontal resistance at $22.50!

The bottom line is that the traffic light is turning green for most gold stocks, while President Trump turns it red for the dollar.

This is the Kinross daily bars chart.

It’s blasting upwards from an inverse head and shoulders pattern at a key support zone. Investors can book some light profits near the $4.22 price zone, and use my unique pyramid generator to do so systematically.

Donald “The Golden Trumpster” Trump may or may not make debt-soaked America great (he likely won’t), but he’s almost certainly going to make gold ownership a great investment during his presidency. I will dare to suggest it’s time for the Western gold community to throw a bit of caution to the wind, and sit back and enjoy this gold price rally. This is a rally that seems poised to accelerate in quite a shocking way, as the Golden Trumpster makes one dollar-negative move after another!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Gold & Yellowcakes” report. I highlight 4 gold stocks and 4 uranium stocks that are flashing momentum buy signals right now, with key buy and sell tactics for each stock!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

https://www.gracelandupdates.com

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: