Use This Tip To Help You Avoid Taxes Like The Top One Percent

Many people might have the impression that the top 1 percent of society—those making over $521,411—deal mainly in exotic investments such as derivatives, fine art and rare French wines.

The truth is actually a lot less exciting.

It’s well documented that high-net worth individuals (HNWIs), in many respects, tend to be more practical in their spending habits than most folks. They appreciate a good deal, and they’re finely attuned to saving money where they can—one of the biggest contributors to how they got where they are.

“What are the three words that profile the affluent?” ask Thomas Stanley and Willian Danko in their bestseller The Millionaire Next Door: The Surprising Secrets of America’s Wealthy. The answer? “FRUGAL FRUGAL FRUGAL.”

This penny-pinching attitude extends to their investment decisions.

So if they’re not investing in Picassos and Renoirs, or $20,000 bottles of Romanée-Conti, what are they investing in?

Munis.

That’s the finding of Rick Fleming, the SEC’s top investor advocate, charged with analyzing how regulations might impact investors and their investments. Muni bond income, after all, is entirely exempt from federal and often state and local taxes—a feature that should appeal not just to money-saving HNWIs but to all investors.

Avoiding Income Tax with Tax-Free Municipal Bonds

At an SEC summit held August 25, Fleming revealed some statistics he finds both “interesting” and “disturbing.”

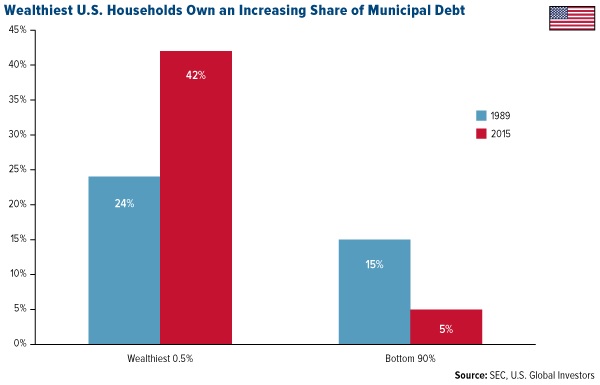

“The wealthiest one-half percent of U.S. households,” Fleming said, “now own 42 percent of all municipal bonds, as compared to ownership of 24 percent in 1989.”

Meanwhile, “The bottom 90 percent of U.S. households, as measured by net wealth, now hold less than 5 percent of muni bonds, falling from almost 15 percent in 1989.”

Let’s do the math. The muni market is currently valued at $3.71 trillion. Using Fleming’s data, that means a very small percentage of muni investors holds around $1.5 trillion—a vast sum of money for so few people. On the flip side, a great number of people—nearly all muni investors, in fact—collectively hold “only” $185 billion worth of muni debt.

This is indeed disturbing.

Muni bonds’ favorable tax exemption was created a little over 100 years ago to attract investors of all stripes, not just those at the very top of the socioeconomic ladder, to help boost infrastructure spending. Although HNWIs have historically been more drawn to munis than investors in lower tax brackets, the spread has widened alarmingly in recent years.

Fleming sees this as a problem, and you should too. I always say to follow the smart money, and in the case of municipal bonds, it’s clear the smart money has spoken.

HNWIs are unfazed by the perception that munis are “boring” or “plain vanilla.” They don’t care about that. What they do care about is a reliable, tax-free income stream, not to mention a history of stability in times of economic and political uncertainty—both of which munis can deliver.

No Loss Of Momentum

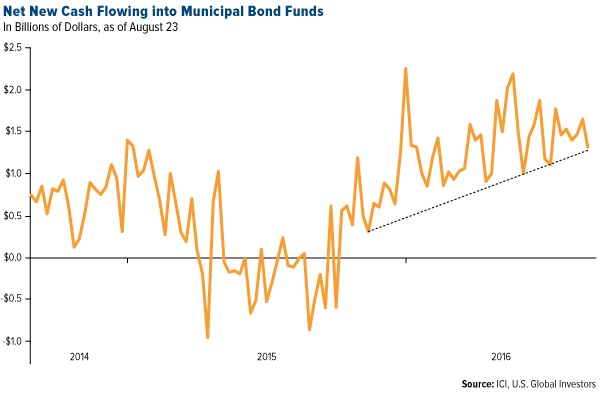

To be clear, muni investment is not in decline. Quite the contrary. There’s a clear uptrend in the amount of money that’s flowing into muni bond funds on a weekly basis, fueled by not just the appetite for tax-free income but also a need to preserve capital. For the 48th straight week as of August 31, muni bond funds, excluding ETFs, attracted net new money—a spectacular run, according to Investment Company Institute (ICI) data.

Meanwhile, capital continues to leave domestic equity funds as investors de-risk in the face of global macroeconomic uncertainty and the possibility of rising interest rates in the U.S. this year.

What I find most interesting is that, although investors are increasingly moving capital from actively-managed equity funds to ETFs, they still prefer actively-managed muni bond funds. For the 12-month period ended in July, active muni funds collected $48.7 billion. That’s eight times more than what passive funds brought in over the same period, according to a recent Bloomberg story.

In this case, I think what muni investors seek is a manager who knows how to conduct deep credit research, adjust for duration and monitor the market for risks and opportunities. That appears to be investors’ demand, whether they’re in the top 1 percent or not.

EXPLORE OPPORTUNITIES IN MUNI BOND INVESTING

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of