Why Precious Metals Remain in a Funk

The technicals for precious metals were looking positive at the end of July, but since then, the bears have driven the sector lower as the US Dollar has rebounded.

In stepping away from the short-term, we see that the secular trend has yet to change.

The S&P 500 has gained momentum after rebounding multiple times from its 40-month moving average, while Gold has again failed to break out from its bullish cup-and-handle pattern.

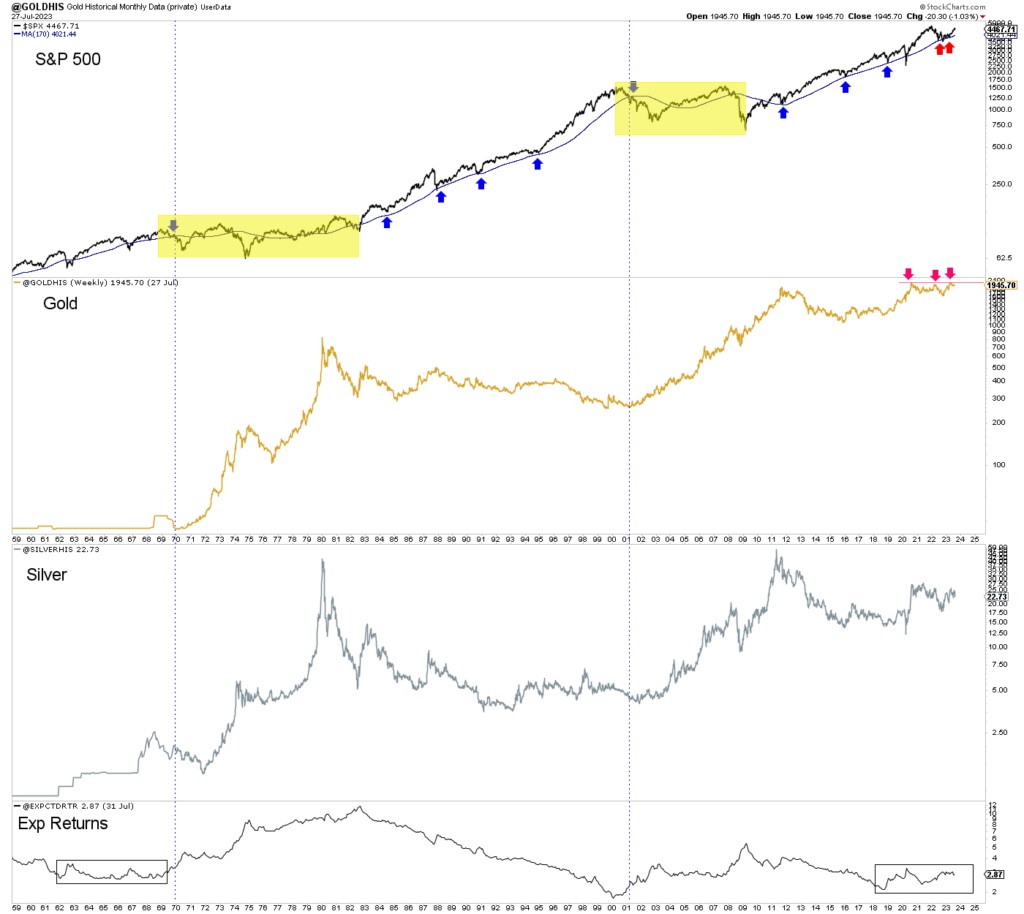

In the chart below, we plot Gold, Silver, our Expected Returns Indicator (for a 60/40 portfolio), and the S&P 500 with the weekly equivalent to its 40-month moving average. The two vertical lines mark where the S&P 500 lost its 40-month moving average.

The vast majority of the duration of two secular bulls in Gold and Silver transpired during the secular bears in the S&P 500 (in yellow).

Most recently, the S&P 500 has rallied towards its previous all-time high as the economy has avoided recession. Gold failed to break out in the spring.

Gold and silver stocks continue to struggle on the back of huge cost increases and stagnant Gold and Silver prices. In addition, over the past few months, valuations have declined.

The precious metals sector has no interest as capital is chasing the rebound in equity markets.

However, Gold remains in a bullish big-picture consolidation and is not far from resistance, even if it declines further.

Soon enough, the economy will run into headwinds as growth declines and inflation creeps higher. Then Gold will finally break resistance.

This is a time to research companies poised to benefit from the inevitable breakout in Gold.

I continue to focus on finding high-quality gold and silver juniors with 500% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

*********