Will Gold Bullion Be Positive In 2017?

Strengths

- The best performing precious metal for the week was palladium with a gain of 3.32 percent. HSBC noted they expect the rise of palladium prices to continue into 2017 with limited supply growth and steady auto demand.

- According to a Bloomberg survey late this week, gold traders and analysts are bullish on gold for the first time in three weeks. The change in sentiment was reflected in holdings in gold-backed ETFs, which rose 0.5 metric tons to 1,778.3 as of Thursday. This rise broke the 33-day drop in gold assets held in ETFs, which was the longest-running drop since 2004.

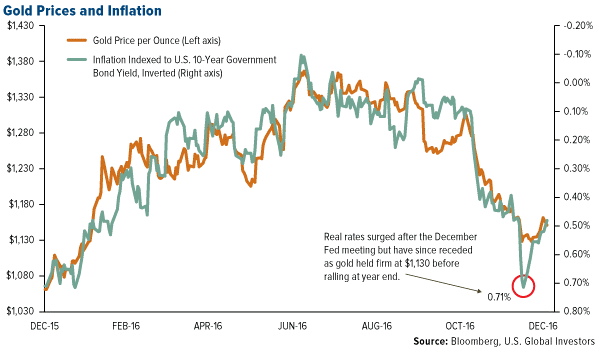

- Precious metals are enjoying a year-end rally, with gold rising above $1,150 per ounce earlier in week and finishing above that level by Friday, snapping a three year losing streak with an 8.56 percent gain. As shown in the chart above, gold prices track very closely with real interest rates. What turned out to be a test of wills a couple days after the Fed interest rate hike in December, real rates jumped to 71 basis points, yet gold held on at $1,130 support, and real rates finally backed off below 50 basis points by year end. At the start of the year, 71 basis points of positive yield had gold pinned down almost $90 lower.

Weaknesses

- The worst performing precious metal for the week was platinum, with a gain of only 1.15 percent as it rallied along with the precious metal group going into yearend, possibly on short covering.

- China’s gold imports in November were the lowest all year. Net purchases were about 40.6 metric tons, down from 60.4 tons in October and 66.8 tons in November of last year. Depreciation of the renminbi currency has made imports more expensive.

- The impact of demonetization in India is still being felt in gold demand. Gold imports in India for 2016 were much lower than the annual average of 1,000 metric tons, with just over 600 tons this year. Analysts anticipate that demand will be similarly low in 2017. In Dubai, the gold market has noted a marked absence of Indian buyers since the demonetization. Typically, the Dubai Gold Souq market would process about 15 percent of sales with Indian rupee transactions.

Opportunities

- Political surprises and uncertainty with Donald Trump’s election are reviving gold’s “safe haven” attraction for investors. Mark O’Byrne, a director at broker GoldCore Ltd. commented, “140 characters of unfiltered Trump is likely to create tensions with America’s largest trading partners. Markets that are already shaken by the fallout from Brexit, the coming elections in Europe and indeed the increasing specter of cyber warfare could again see a safe-haven bid.” Indeed, Trump’s choice for the Office of Budget and Management, Mick Mulvaney, owns significant amounts of precious metals and gold mining stocks, according to financial disclosures. Mulvaney has been known to be critical of the Federal Reserve.

- Barry Rehfelt noted in an article published by TheStreet that the stock market rally could provide an incentive for investors to look to gold. Although there have been recent gains in the stock market, there is a threat of a trade war with China, which would impact the stock market. Rehfelt reminds readers that gold does well in uncertain times. In addition, UBS anticipates gold will average $1,350 per ounce in 2017, noting that the current weaker environment could be a good buying opportunity.

- Commerzbank has expressed belief that gold bullion will be positive in 2017, also related to the upcoming Trump presidency and the U.K.’s talks to leave the European Union. Gold has had its longest run of gains this week, since early November just before the election. Ironically, most of the media is citing the surprise Trump win as the reason gold fell but the U.S. election results came out as India’s Prime Minister Modi announced his surprise crackdown on tax evasion with demonetization of the Indian economy. The unpredictability of President Elect Trump may turn out to be just what investors thought: good for gold.

Threats

- The Shanghai Gold Exchange, the world’s biggest physical gold exchange, is imposing limits on the size of transactions that can be made, starting on January 1. The maximum transaction will be 500 kg, half of the current limit of 1,000 kg. Analysts say the move is targeted at institutional investors. However, critics note that the size of transactions won’t limit the amount of gold traded, as larger amounts can be broken up into multiple trades. It is doubtful the smaller transaction size limit will lower the volatility of the Shanghai gold market.

- Consumer inflation expectations have fallen to a 143 month low, according to the Gavekal Capital Blog. Investors may be expecting higher inflation next year, but consumers expect inflation to have a more nascent effect in 2017. Expectations have round tripped back to pre-2000 levels.

- Australian miner Kingsgate has been ordered by Thailand’s government to shut down operation of its Chatree mine. Thailand’s prime minister has warned the mining company that it would be a “waste of time and have no benefit” to sue the government. This is likely yet another instance of government seizure of a natural resource for its own benefit similar to Venezuela’s attempt to expropriate several of its gold deposits from the nondomestic companies that made the original discovery.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of