The World Is Edging Closer To A Global Financial Crisis

Since the late 1960s I have understood that the gold price is the ultimate barometer of fear in the world economy. Of course, I have not had a monopoly on this understanding and, in particular, the world’s central banks have also understood it. It is for this reason that the gold price has been “managed” so carefully by these organisations.

But the act of managing the gold price has been a two-edged sword: On the one hand, it has served to defer the day when it finally becomes transparent to ordinary people that wealth cannot possibly be created out of thin air by loose monetary policy and/or low interest rates. On the other hand, it will likely serve to magnify the emotional reaction (fear) when this understanding finally begins to dawn.

There are pragmatic people who reason that, because the day of reckoning might well be deferred for decades, there is no purpose to be served in sitting on one’s hands. One needs to be in it to win it. Therefore, we will play the game of Monopoly as best we can and, if/when the game ever ends, we will withdraw.

These are typically the people who have benefited from the asset bubbles that have been the result of monetary based stimulus to which the central banks have become addicted. These are the people who are not particularly concerned by the fact that interest rates have been kept artificially low.

If/when one has accumulated investment capital of (say) $2 million, then – even at interest rates of (say) 4% – the income thereon is sufficient to sustain a reasonable lifestyle.

But let’s look at the other end of the scale – where ageing baby boomers are trying to get by on (say) $500,000 of investment capital that it took a lifetime to accumulate. An income of (say) $20,000 a year (based on 4% return) cannot sustain any sensible lifestyle – even if one owns one’s home outright.

The way Western governments have typically responded to this has been to augment retirement income with pensions, but these pension payments have typically been funded by way of borrowings; which is one reason why sovereign debt has been growing in industrialised countries.

On top of this, a culture of socialism has evolved where even able bodied younger people have been able to jump onto the “fairness” bandwagon; and, via the medium of food stamps (to give but one example) unemployed, able bodied people have been able to augment their own incomes – enough to get by. But this type of government largesse also needs to be funded, and it has also typically been funded by borrowings.

Now, who will lend to a government that is chronically addicted to funding its deficits by way of borrowings? In particular, what is the incentive for anyone to lend to an irresponsible government that, on the one hand, chronically spends more than it has coming in by way of tax revenues and, on the other hand, only needs to pay a nominal interest rate on borrowings because interest rates are being kept artificially low by the central banks?

Answer: If the central bank has the ability to create money out of thin air, then they can “lend” to their own country’s government and this behaviour will continue until the market says “no more”.

But why should the financial markets ever say “no more”? The primary beneficiaries of this borrow and spend mentality of governments – those who are enriched as opposed to those who are just getting by – are the people who own the assets that are benefitting from the asset price bubbles.

Further, in a globalised world where all countries have become interconnected and interdependent, even the industrious countries (as opposed to the industrialised countries) understand that their future wealth is dependent on their output being sold to the deficit countries. So, until China (for example) becomes self sufficient and can survive and prosper without interacting with the outside world, it will have no incentive to rock any boats, despite the rhetoric that may be aired for public consumption.

Except that – apart from the comparably irresponsible behaviour inside China - where government organs have been involved in real estate speculation for the purpose of “driving” that economy – China is experiencing shortages of potable water, and its air has become unacceptably polluted. It has been building its economy using legacy technologies that are powered by anachronistic energy paradigms. Even China has its limits, in particular because the one-baby policy is now starting to impact on labour availability.

So where is the risk in all of this? Where is the pin that is going to burst the illusionary bubble? Just how far can the balloon be inflated before its rubber walls begin to weaken? Will China pull its horns in? Will a growing US economy be able to compensate for a slowing Chinese economy? Will the dykes in the global financial markets develop a series of cracks leading to a cascading river of bad debts?

From this analyst’s perspective, the world economy is edging ever closer to a tipping point where the central banks will not be able to continue pumping liquidity into their banking systems at peppercorn rates. The “pin” is represented by the number of people who are falling by the wayside because price inflation is growing faster than incomes are rising. In particular, when a man has nothing to lose, his behaviour becomes unpredictable. There is no downside to his participating in the growing wave of anarchy that is washing across the planet.

Below is a dictionary definition of the word “anarchy”:

1. a state of society without government or law.

2. political and social disorder due to the absence of governmental control:

* The death of the king was followed by a year of anarchy.

3. anarchism <http://dictionary.reference.com/browse/anarchism> (def 1).lack of obedience to an authority; insubordination:

* the anarchy of his rebellious teenage years.

* confusion and disorder: Intellectual and moral anarchy followed his loss of faith.

* It was impossible to find the book I was looking for in the anarchy of his bookshelves.

Here are a few examples of anarchy in the modern world that fall within the above definition:

• Extremist Islamic violence that is manifesting in several Middle Eastern countries

• The explosion of “group focussed enmity” across the face of Europe

• The flood of illegal immigrants across the US’s southern borders

• re-emergence of the KKK

• The flood of “political refugees” in general from poorer countries to richer countries.

• Russia’s aggressive behaviour towards weaker countries within its orbit

• North Korea’s rogue behaviour

• Civil disobedience leading to shootings and rioting within the US’s borders

• Spread of diseases, in particular Ebola. (political and social disorder due to the absence of

governmental control)

There are some who will argue that all the above is being caused by overpopulation of the planet.

Of course, that may be one contributory reason, but another is the fact that the reaction of central banks to weakening momentum of the global economy has been to “stimulate”; without any objective reason to believe that this stimulation is going to give rise to an increased tempo of value-add activity.

What the central banks have refused to face up to is that money supply inflation must translate to price inflation – either in the form of asset price inflation or in the form of rising costs of production that will lead to higher consumer prices.

And, the extent to which consumer prices rise relative to incomes, that is the extent to which life becomes increasingly unmanageable for ordinary people, which, in turn, stimulates further anarchy. In short, the “pool” of people who are falling by the wayside – either because they are retirees on fixed income, or because they are unemployed or have given up looking for work – has been growing.

The flip side is that the pool of middle class, self-sufficient people has been shrinking, and the element of anarchists within that pool has been rising in numbers.

That, ultimately, is the flaw in the central bankers reasoning: Their actions have been adding fuel to the flames of anarchy that have been spreading across the planet.

But the reality is that none of the anarchy has impacted on the juggernaut upward march of asset prices. The asset price bubbles keep growing. The well -heeled continue to play the game of Monopoly by the rules of that game.

Which brings us back to the gold price:

In this analysts’ view, the day will come where the gold price is no longer capable of being managed because the financial dyke will have broken. And one way to determine how close we are to that point is to monitor the prices of gold shares. Clearly, because gold mines’ profits are leverage to the gold price, if the shares break up relative to the gold price this will be a sign that “the markets” are becoming excessively twitchy and are therefore anticipating a rising gold price. Can the central banks manage the gold share prices as well as the gold price itself? Probably not.

Have a look at the weekly chart below (courtesy stockcharts.com) that shows the ratio of the $XAU to the gold price:

Chart #1 Ratio of $XAU:$GOLD

In particular, note the oval that I have drawn in that highlights the consolidation of that ratio over a period of more than a year. Technically speaking, the rounding bottom pattern (if it has been accompanied by a similar volume pattern) would evidence a market bottom.

Now have another look at the same ratio but in a 3% X 3 box reversal Point & Figure format.

Chart #2 – 3% X 3 Box Reversal of ratio of $XAU:$GOLD

Note that the ratio is approaching the downward pointing red trend line and, if the ratio breaks above the 82.29 level we might see some serious buying in the gold universe.

Taking a further step back, the 5% X 3 box reversal chart shows some significant upside potential, before the ratio can rise above its downward pointing red trend line. The ratio might rise by 50% and still be in a down trend:

Chart #3 – 5% X 3 Box Reversal of ratio of $XAU:$Gold

How far are we away from a potential panic?

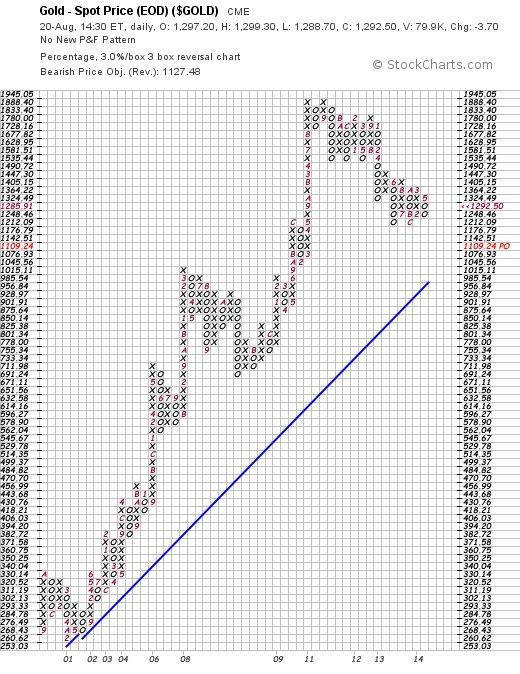

The chart below – of the gold price on its own – shows an unmet target price of $1109.24 which, even if it is reached, will still be above the rising blue trend line. It seems from this that the central banks may mount one last bear raid on the gold price, but, unless they mounted a simultaneous bear raid on the gold shares, that bear raid might well cause the ratio of the $XAU:$Gold to break up. That would be a supreme irony.

Chart #4 – 3% X 3 Box reversal P&F Chart of the Gold Price

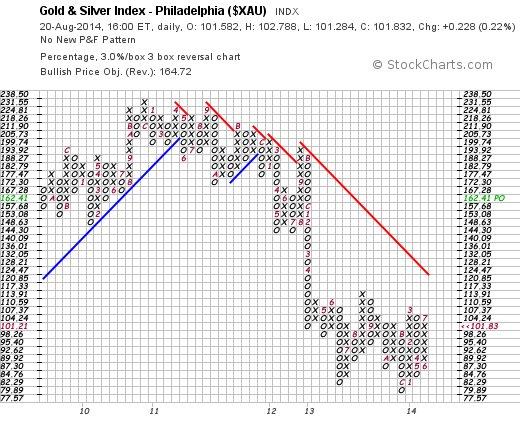

Below is the 3% X 3 box reversal P&F chart of the $XAU on its own. This chart has an unmet upside target of 162.41, which is roughly 55% above the current level, and, if met, will be well above the falling red trend line.

Chart #5 – 3% X 3 Box Reversal Chart of the $XAU Index

Overall Conclusion

The Central Banks are running out of wriggle room. If they continue stimulating, they will be adding to the growing global momentum towards anarchy. If they stop stimulating, then global economic growth may slow down as interest rates rise, and unemployment might also rise – the combination of which will give rise to a flood of bad debts. If they take a steady-as-she-goes approach then they will be forced to manage expectations in the gold universe, but the gold shares are showing signs of a waning trust in fiat currencies. Unless they manage those perceptions across both the gold markets and the gold share markets, the act of managing the gold price might actually cause a panic as gold shares refuse to confirm.

Author Comment

The rise of Islamic Extremism (by people who have nothing to lose and do not fear even death) is a litmus test of the lengths to which anarchists will go to attain their irrational and unreasonable ends. It follows that, to protect the integrity of the global economic system, Industrialised countries will have to resort to force. The risks of escalating world-wide conflict are therefore rising which, ironically, will be economically stimulative. i.e To avoid a global financial crisis, the Allied response to the pathologically driven Islamic Extremism will very likely be ramped up significantly in the months ahead. China will have to do some serious naval gazing before deciding which side to back; and Russia will be forced to stop making its own self-centred waves. Closing four McDonalds outlets, for example, is just childish petulance. Quite apart from the growing anarchy referred to above, by reference to a giant sinkhole that manifested recently at Yamal Nenetz, http://english.pravda.ru/science/earth/17-07-2014/128068-giant_sinkhole-0/ , Russia may be the location where a Clathrate Gun is fired, as the frozen tundra melts because of climate change, and the methane trapped below the previously frozen surface escapes into the atmosphere. If you want to gain a clear understanding of the risks associated with the firing of a Clathrate Gun, then read my latest novel, The Last Finesse. There really is no place for childish petulance in today’s world.

********

Brian Bloom

Tea Gardens, NSW, Australia