You’re Probably Underinvested In Gold

In a September report, the World Gold Council (WGC) pointed out that some investors are underexposed to gold. The gist of the study is that investors may assume they have adequate exposure to gold because they’re invested in a fund that tracks a broad-based commodity index. The problem with this assumption is that most major commodity indices have a relatively small weighting in gold, and so their gold exposure is much smaller than they realized.

Take a look at the tables above. The S&P GSCI, which tracks 24 commodities, has only a 3.37 percent weighting in gold. The Bloomberg Commodity Index is slightly better, with a weighting of 12 percent. These percentages shrink even more when you consider that commodities in general represent a small portion of most investors’ portfolios.

“If you are buy-and-hold investor, if you are trying to create long-term strategies, the evidence overwhelmingly shows that gold is a more effective strategic asset than commodities alone,” explains the WGC’s director of investment research, Juan Carlos Artigas, who I had the opportunity to chat with recently.

To illustrate Juan Carlos’ point, look at the following chart. In the 20-year, 10-year and five-year periods through June 2019, gold outperformed all other commodities, including energy, industrial metals and precious metals. Despite this, gold may still be under-represented in some investors’ portfolios.

“The optimal weight for gold, or the amount of gold that can help investors get better risk-adjusted returns, is between 2 percent and 10 percent,” Juan Carlos says.

This is mostly in line with my own recommendation of a 10 percent weighting in gold, with 5 percent in bullion, the other 5 percent in high-quality gold mining stocks.

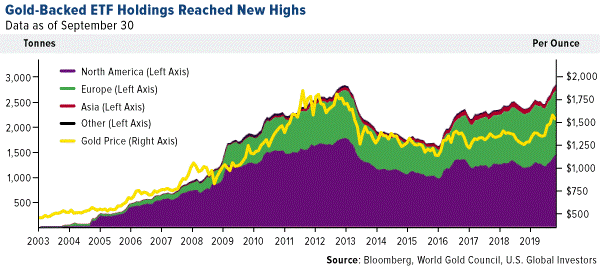

Gold-Backed ETFs at All-Time Highs

At the same time that gold is largely under-represented in many investors’ portfolios, those “in the know” have been buying at a healthy clip. In fact, since the start of the most recent gold price rally, holdings in gold-backed ETFs have climbed to an all-time high. Holdings as of September stood at more than 2,855 tonnes, surpassing the previous high of 2,839 tonnes in November 2012.

With bond yields at historic lows at the moment, “gold may become an attractive and more effective diversifier than bonds, justifying a higher portfolio allocation than historical performance suggests,” the WGC writes in its latest report, “It may be time to replace bonds with gold.”

--

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The S&P GSCI Total Return Index in USD is widely recognized as the leading measure of general commodity price movements and inflation in the world economy. Index is calculated primarily on a world production weighted basis, comprised of the principal physical commodities futures contracts. The Bloomberg Commodity Index is made up of 22 exchange-traded futures on physical commodities. The index represents 20 commodities, which are weighted to account for economic significance and market liquidity.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC. This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of