Gold News: Price Rises but Faces Pressure from Strong Dollar and Treasury Yields

LONDON (December 26) Gold prices are recovering from the sharp December 18 drop, but upside momentum faces challenges as traders digest the Federal Reserve’s hawkish tone and anticipate policy shifts from the Trump administration.

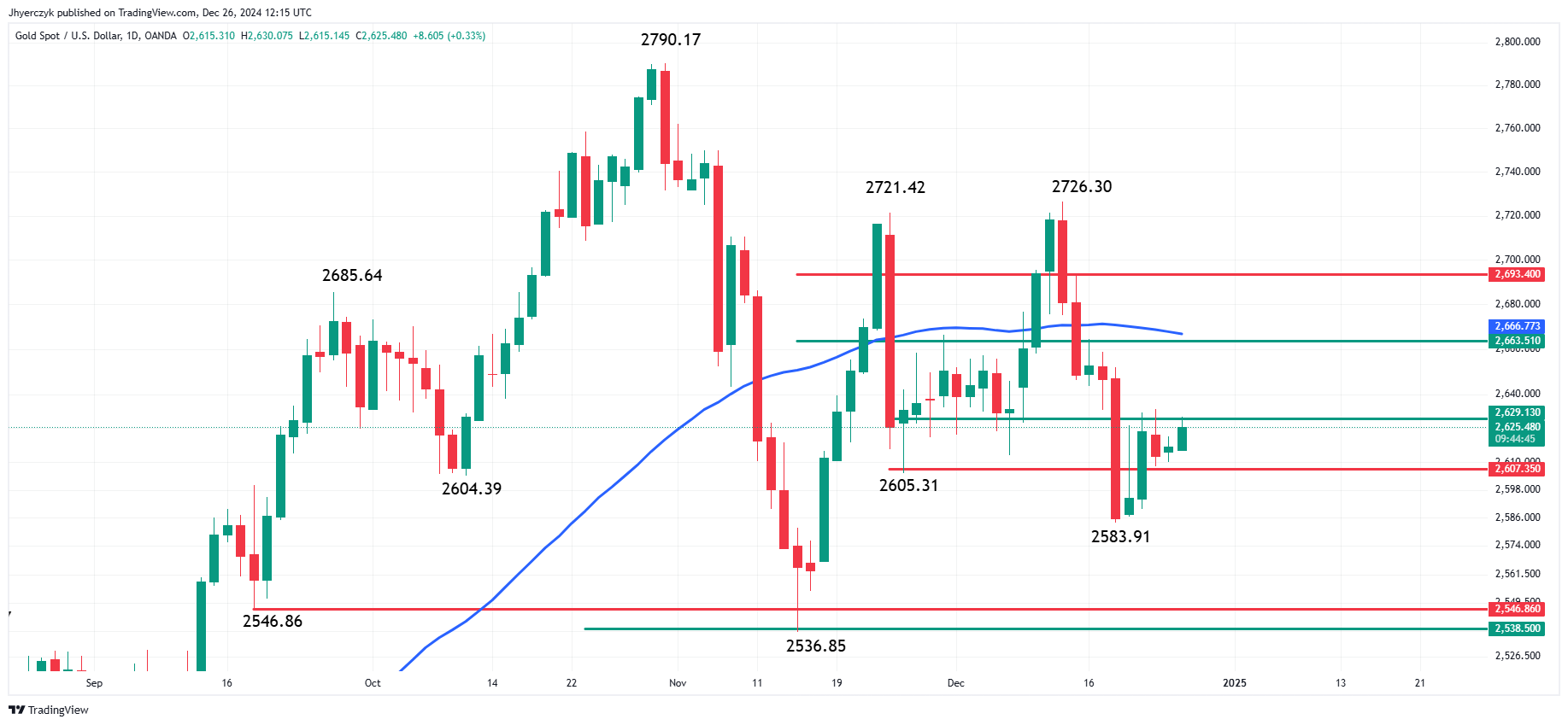

Daily Gold (XAU/USD)

Gold is currently testing the retracement zone of $2607.35 to $2629.13. A break above this level could signal strength, though significant resistance lies ahead at $2663.51 to $2693.40, coinciding with the 50-day moving average at $2666.83. A move below $2607.35 would signal weakness, potentially targeting the $2583.91 low.

Holiday Trading Keeps Focus on Fed Policy and U.S. Economic Data

In holiday-thinned trading, gold edged higher on Thursday as markets awaited further signals on the Fed’s 2025 rate plans and economic policies from Donald Trump’s incoming administration. With eurozone markets closed for the Boxing Day holiday, trading volumes remained light.

The first half of 2025 may provide support for gold due to geopolitical risks, but the second half could see profit-taking as economic conditions evolve. Gold has gained 27% this year, underscoring its safe-haven appeal during uncertain periods.

Fed’s Hawkish Stance Limits Gold’s Upside

The Federal Reserve’s rate cuts in 2023, including those in September, November, and December, fueled gold’s rally. However, the Fed’s guidance for fewer rate cuts in 2025 introduces headwinds for the metal. A more restrictive monetary policy typically supports the dollar and Treasury yields, reducing gold’s appeal.

Traders are closely monitoring U.S. jobless claims data, with forecasts predicting 224,000 claims for the week ending December 21, slightly above the prior week’s 220,000. A higher-than-expected figure could weaken the dollar, potentially boosting gold.

Dollar and Treasury Yields Present Key Resistance

Daily US Dollar Index (DXY)

The U.S. dollar continues to strengthen against major currencies, driven by the Fed’s hawkish outlook. Meanwhile, U.S. 10-year Treasury yields are rising but remain within Tuesday’s range. A breakout above 4.638% could accelerate downward pressure on gold prices.

Daily US Government Bonds 10-Year Yield

Market Forecast: Cautiously Bearish in the Near Term

Gold’s short-term outlook is tilted bearish due to the Fed’s restrictive stance and the potential for higher yields. While geopolitical uncertainties may provide intermittent support, traders should expect resistance around $2663.51 to $2693.40. A sustained break below $2607.35 could trigger further downside pressure into early 2025.

FXEmpire