Gold price dips amid strong US Dollar, rising US yields

NEW YORK (January 13) Gold price retreats during the North American session as traders seeking safety bought the Greenback as United States (US) Treasury bond yields rose to their highest level since November 2023. At the time of writing, the XAU/USD trades at $2,657 after failing to clear $2,700, down 1.20%.

A scarce economic docket on Monday keeps investors digesting the latest US Nonfarm Payrolls figures for December. Although the economy has fared better than expected, with figures rising by 256K exceeding forecasts of 160K and November's 212K, traders are eyeing the release of US inflation data.

On Wednesday, the Consumer Price Index (CPI) for December will be announced, with estimates at around 2.8% YoY, up from November 2.7%. The Core CPI, which excludes volatile items, is projected to remain unchanged at 3.3% YoY, unchanged from the latest three-months readings.

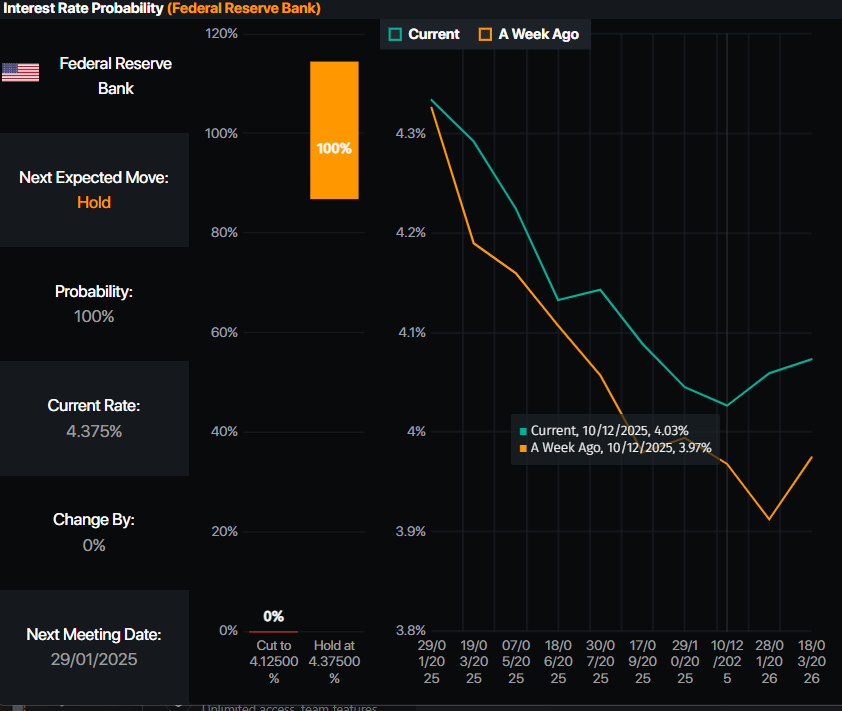

Inflation data could shifttraders expectations of Fed easing. Meanwhile, money market futures data has shown that most investors are expecting just 25 basis points of easing, leaving the fed funds interbank rate at 4.00%, down from the current 4.25% - 4.50% range.

Federal Reserve - Interest rate probability. Source: Prime-Market Terminal

Meanwhile, US Treasury bond yields cling to minimal gains, while the Greenback, after breaking the 110.00 mark, has retraced below the latter but it remains in the green.

Bullion prices are also taking a hit amid good news of a possible deal that could end Gaza's war, via Reuters, citing an official briefed on the matter.

In seven days, US President-elect Donald Trump will be sworn as the 47th President. The financial markets are awaiting its first executive orders, with some speculation growing that he would impose the first tariffs. Recently he said that he has to do something regarding trade with Mexico and Canada.

In the US, key data releases include inflation figures on the producer and consumer sides, alongside Retail Sales and jobless claims for the week ending January 11.

Daily digest market movers: Gold price falls as US Dollar advances

- Gold price faces headwinds amid high US real yields, which rise three and a half basis points by two bps to 2.30%. At the same time, the US 10-year T-note yield soared seven and a half bps to 4.767%.

- The US Dollar rose sharply to multi-month highs according to the US Dollar Index (DXY). The DXY hit 110.17 before trimming gains and is at 109.85, up 0.20%.

- The US 10-year Treasury bond yields rises two basis points, up at 4.786%.

- Easing expectations of the Federal Reserve continued to edge lower. The December Fed funds futures contract is pricing in 30 basis points of easing.

FXStreet