Gold (XAU) Price: Resistance at $2726.30 Holds Key to Upside Breakout

LONDON (January 17) Gold prices edged lower on Friday but remained on track for a third consecutive weekly gain. Traders are balancing Federal Reserve signals and weaker-than-expected economic data while monitoring critical technical levels for direction. The market remains supported by expectations of a dovish Fed stance as inflation shows signs of easing.

Fed’s Dovish Signals Strengthen Gold’s Outlook

This week, gold gained momentum after inflation data came in softer than forecast. The Consumer Price Index (CPI) grew 0.2% monthly and slowed to 3.2% on an annual basis, while core inflation data also missed expectations. Producer Price Index (PPI) figures reinforced the trend, raising hopes that the Federal Reserve might ease policy sooner than anticipated.

Federal Reserve Governor Christopher Waller fueled these expectations by suggesting the possibility of multiple rate cuts if inflation continues to cool. Futures markets now indicate nearly even odds of two cuts before the end of the year. Rate cuts typically benefit gold by reducing the opportunity cost of holding the non-yielding asset and weakening the U.S. dollar, enhancing its appeal to global investors.

Treasury Yields Fall, Supporting Gold Prices

Daily US Government Bonds 10-Year Yield

The decline in U.S. Treasury yields has further strengthened gold’s appeal. The 10-year yield fell by 13 basis points this week, while the 2-year yield dropped 10 basis points, signaling increased investor expectations for less restrictive monetary policy. Lower yields reduce the attractiveness of bonds compared to gold, providing additional support for the metal.

Traders are also awaiting the release of housing starts and building permits data, which could provide further insights into economic conditions. A weak housing market report may reinforce expectations for Federal Reserve easing, potentially boosting gold’s appeal further.

Key Levels for Gold Traders to Watch

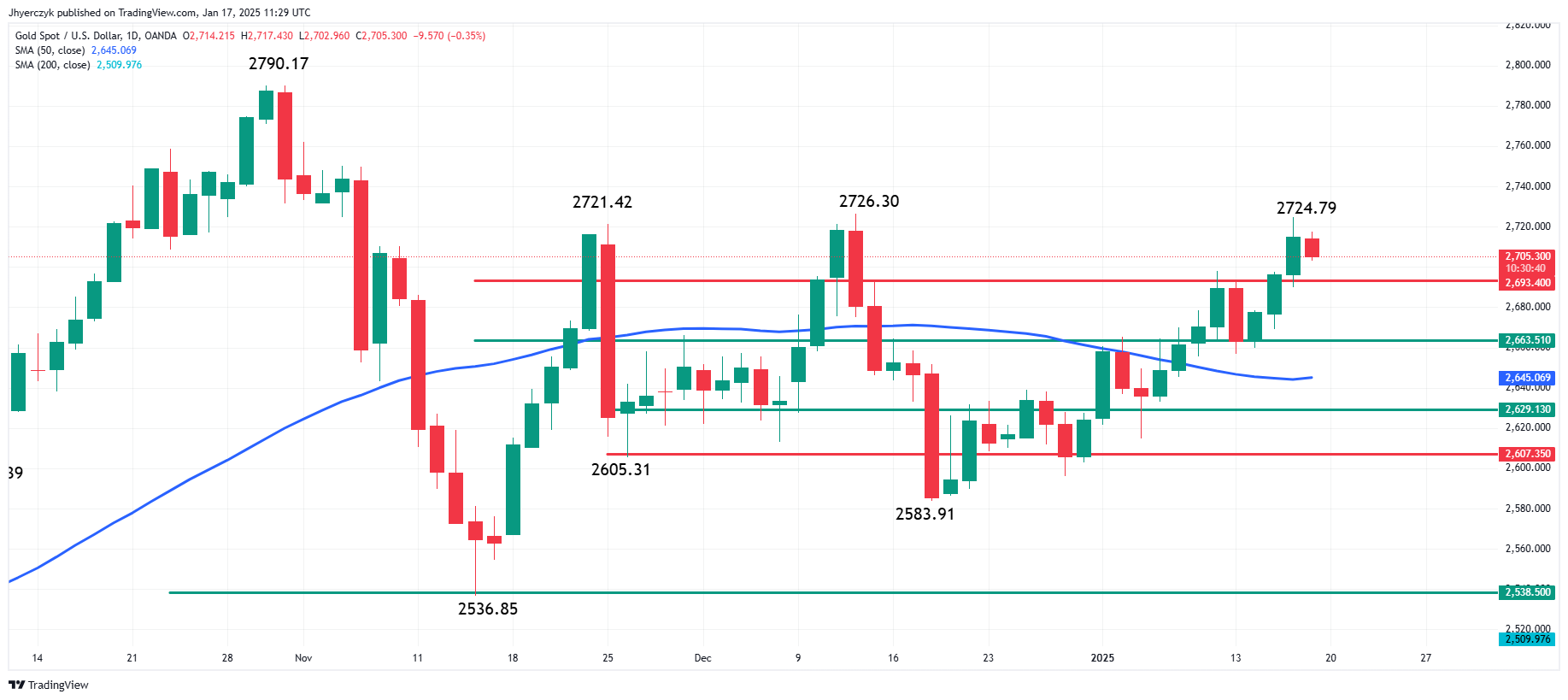

Daily Gold (XAU/USD)

Gold’s immediate resistance stands at $2726.30, a critical level for a potential breakout. A move above this threshold could pave the way to challenge the all-time high at $2790.17. On the downside, support lies at $2663.40, with the 50-day moving average at $2645.07 acting as a key benchmark for sustaining bullish sentiment.

Gold Market Forecast

Gold remains well-positioned to benefit from a dovish Federal Reserve stance and weaker economic data. Sustained support above $2645.07 would keep the bullish outlook intact, while a breakout above $2726.30 could signal further upside momentum.

Traders should closely monitor upcoming economic releases and Federal Reserve commentary for new cues to gold’s direction. The metal’s role as a hedge against uncertainty and its appeal in a low-rate environment remain strong under current conditions.

FXEmpire