Gold Market Fear Is Unnecessary

Since the start of this year, gold has performed extremely well. This daily chart shows the shiny metal moving steadily higher, in a bullish channel

The current minor trend sell-off in gold is technically healthy.

Also, this price correction should not come as a surprise to any fundamentally-oriented investor; the Crimean crisis seems to be factored into the price now, and there is a key FOMC meeting tomorrow.

As a result, the price has backed off a bit over the past few days. There is decent minor trend support at $1355 and $1332.

Price discovery in gold mainly results from the fundamentally-oriented liquidity flows of institutions and gold dealers. Unfortunately, amateur chartists don’t seem to pay much attention to key economic events.

Thus, an investor who is armed only with technical analysis and a US debt clock may find it’s quite difficult to prosper in the gold market.

The good news is that compared to last year, the current institutional liquidity flows situation in gold is very solid. This snapshot of the world’s largest gold ETF (GLD-NYSE) shows the change in tonnage held by the fund during the first eleven weeks of the 2013 calendar year.

From the start of January to March 17, 2013, there was clearly enormous selling. The fund’s holdings fell from about 1350 tons, to about 1219. The bottom line is that about 131 tons of supply hit the market, in less than eleven weeks.

That’s a snapshot of the change in tonnage for roughly the same time frame this year. There’s been a rise of about 18 tons.

The key point here is that while Western buying is not wildly bullish for gold, it’s not bearish.

In December of 2012, Shinzo Abe was elected as Prime Minister of Japan. I’ve argued that the vast Japanese QE program that he has endorsed would begin to create serious inflationary concerns amongst institutional money managers within just 18 months. On that note, please note the following important news being now carried by Bloomberg:

The Bank of Japan can double its annual pace of bond accumulation to 100 trillion yen ($985 billion) to give fresh impetus to the economy after next month’s sales-tax increase, said an aide to Prime Minister Shinzo Abe…. Hamada said the central bank should add stimulus as soon as May should indicators show the 3 percentage-point tax rise is seriously damaging the economy. He said annualized growth of 0.7 percent in the final quarter of 2013 showed that “Abenomics isn’t strong enough.” “It would be too late if the BOJ waits for April-June GDP data” due in August, Hamada said. –Bloomberg News, March 15, 2014.

A substantial part of the American QE program was directed at OTC derivatives that were arguably worthless. That’s not inflationary, unless it creates a surge in the velocity of the money supply.

That’s not the case in Japan. On a percentage basis, the Japanese program is already much bigger than American QE was at its peak. As big as Japanese QE already is, it could become vastly bigger!

Unlike their government, Japanese citizens are tremendous savers who shun debt. If Abe/Kuroda ramp up QE significantly, they could begin to buy substantial amounts of gold, effectively giving these wise citizens a key seat at the gold price discovery table.

It’s possible that a fair amount of the gold being imported into China is being re-routed to India. The World Gold Council has estimated that Indian smuggling in 2013 was about 200 tons. That’s close to 20 tons a month, and probably closer to 40 tons a month, given that the government restrictions were not fully in place until the halfway mark of the year.

The Indian economy is growing, and gold prices are relatively low. It would be reasonable to assume that real demand in 2014 in India is at least as high as it was in 2013.

From the $1180 area lows to the recent $1192 area highs, gold has risen about $210, and done so in a “steady as she goes” plodding uptrend. When the price rises in this manner, demand from gold jewellery buyers in China tends to be relatively inelastic.

The Crimean situation has caused gold to rise only a little bit more rapidly. As a result, dealers in both China and India are probably lightening their bids, but not killing them. That’s creating a modest and healthy retraction in the price. An end to the Crimea crisis could push gold down to the $1300 area, but that would probably cause large dealer buying.

Industrialization in China will continue for decades. In good times, gold demand there should grow at least as fast as GDP. Citizens in China don’t really trust the government or the banks, and with good reason. Current threats to the Chinese banking system could drop GDP growth by maybe a point or two, but those threats could also create a Chinese citizen surge into

gold.

All fundamental lights for gold demand are green. Gold is not easy to mine. Most oil drilling programs succeed. In contrast, most gold exploration programs fail. Technically, gold is overbought and it’s risen about $212 without a significant correction. The bottom line: If this sell-off intensifies a bit, I don’t see anything for anyone in the Western gold community to be concerned about.

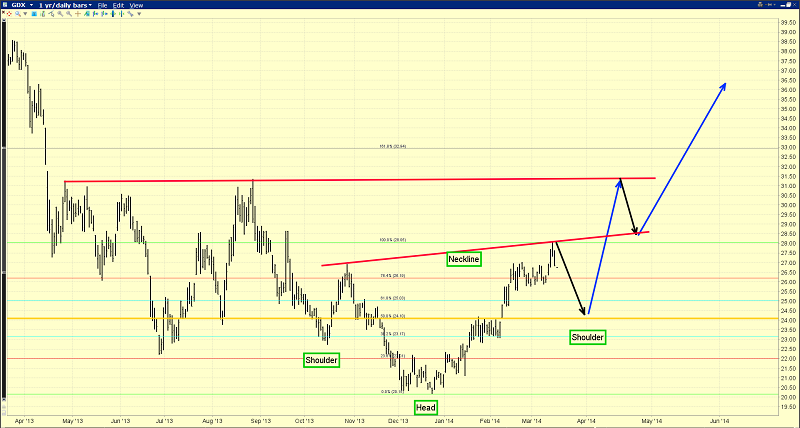

That’s the GDX daily chart. It’s unknown whether the current minor trend sell-off will end after the FOMC meeting. Gold stocks do tend to move much more than gold does. Using Friday’s high near $28 as a marker, a 50% retracement of the current rally would put GDX in the $24 area. I’ll be a buyer there, if it happens.

From a technical perspective, I’d like to see that move occur. That’s another look at the GDX daily chart. A substantial inverse head and shoulders bottom pattern could be formed, if gold corrected towards the $24 area now. That’s bullish!

The cycle of deflation appears to be ending. Japanese QE and Chindian jewellery demand suggest that the gold investor of the twenty-first century doesn’t need to be afraid of price corrections anymore. Western gold stock shareholders have the opportunity to participate in a historic “gold bull era”, in a very profitable way!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Ultra Juniors” report! While these stocks are ultra-risky, some of the smallest junior gold stocks have already scored “ten bagger” gains in just two months. I’ll show you five more that could be poised to do the same thing, if gold moves above $1400!

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: