Gold Crash Anniversary Day

As gold traded in the $1310 area a week ago, I said, “The door of possibility is now open to some further strength, with a short term target of about $1320 -$1325.”

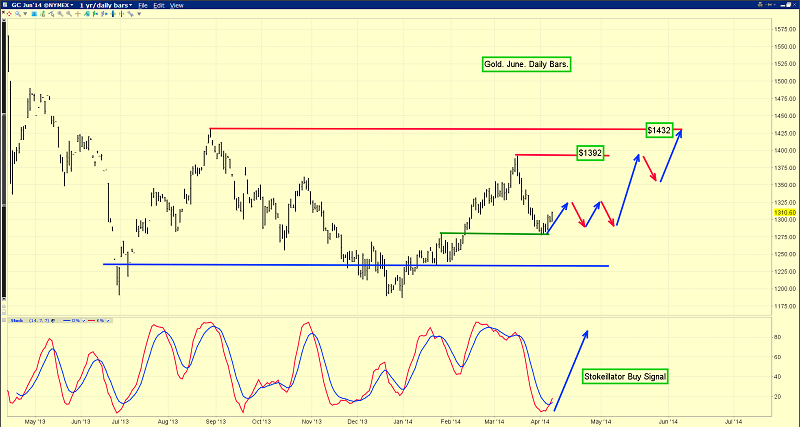

The above chart is the rough path that I laid out for gold.

Gold should continue to trade in a loose sideways pattern until the Indian election results are released in late May.

That’s the current daily gold chart. Gold is holding up reasonably well, considering that Indian buyers are so focused on the election.

Generally speaking, this is the weak season for gold. Also, the April 12 – 15 period is when the gold market crashed in 2013. Nervous participants tend to be sellers around the anniversary of such events.

Numerous bank economists expected that if the Fed began tapering, the Dow would continue modestly higher, and gold would crash again.

That hasn’t happened. In fact, the opposite scenario has played out; gold has generally rallied modestly during the taper, while the Dow has drifted sideways.

The bank economists may be getting frustrated. Rather than tempering their predictions, they seem to be becoming more aggressive with their calls for sharply lower gold prices.

Haresh Soni, chairman of the powerful GJF Indian jewellery trade association, recently stated that he believes more gold has been smuggled into India, just in the past four months, than in the previous ten years.

Whatever the actual tonnage is, that’s a gargantuan amount of gold. I don’t think most bank economists really understand the inelastic nature of Indian demand. That lack of understanding is probably why they are so bearish.

The world appears to be well on its way to transitioning from general deflation to inflation, but it can take many years for inflation to become a serious problem.

Western money managers have access to tremendous amounts of capital, and they tend to allocate a significant amount to gold bullion when they believe the financial system could be in trouble.

When they believe rising inflation is a concern, they tend to sell general equities, and buy gold stocks.

When these money managers don’t see either inflation or system risk, they allocate minimal amounts of capital to the precious metals sector.

That’s the situation now. Gold’s price is currently supported by Indian gold jewellery demand that is essentially inelastic, but temporarily muted. Most weak hands in the West are out of gold. That’s good news, but until the Indian election results are in, it’s unlikely that gold will move much higher, or fall much lower.

For a long time, silver investors have been accustomed to enduring more price volatility than gold investors have experienced.

That could be changing. I think silver is becoming a more stable market, and the price will move with less volatility.

Silver is performing better than gold is today, on a day when it normally would be sharply lower.

While today’s fifteen dollar decline in the gold price may have most bank analysts sure that their predicted crash is now beginning, I think they may be wiser to focus their energy on the US stock market.

This monthly chart compares the Dow to the US T-bond.

The bottom line is that while gold could easily experience a $30 - $50 “crash anniversary” sell-off, the fundamental headwinds facing general equity events are much more serious. Note the head and shoulder top formations on both the RSI and CCI indicators on that chart. That’s very bearish.

That’s the long term monthly chart of the Dow, compared to the HUI gold stocks index.

There are sell-signals flashing all over that chart, like a fire alarm sounding at full volume. Is it really possible that gold stocks could become the main “risk-off” trade, for Dow investors? Yes, it is. Indian gold buyers are not going anywhere, and they don’t care about gold crash anniversary day. They are going to demand ever-more gold from Western gold mines, not just for years, but for decades to come.

While India has the Western gold community’s back, here and now, who of substance has the Dow’s back? I would argue that only QE really has the Dow’s back, and the next tapering event probably comes as the “Sell in May and go away” stock market adage comes into play!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Palladium Parabola?” report. I’ll cover the monstrous breakout on the monthly chart, and the fundamentals driving this potential parabolic move that is unfolding in the palladium market!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: