Gold Dividends Focus

This could be a breathtaking week for gold investors around the world. A huge number of key financial reports and meetings are scheduled, and any one of them is probably capable of moving the gold price quite significantly.

The FOMC meeting is on Wednesday. That’s a key event for gold. I’m predicting the Fed will announce another $10 billion taper, as are most mainstream analysts.

Unlike most analysts, my view is that the Fed’s taper is not based on the US economy returning to normal economic growth. Instead, I see the taper as the Fed’s way of pre-empting a rise in inflation. That’s generally supportive for gold, and neutral to negative for the US stock market.

Inflation is likely to rise as commercial banks begin to loan out the huge amounts of cash they received during the QE program.

The stock market has performed like a wet noodle in 2014, probably because of this tapering process, but it is still relatively stable.

A new round of tapering could put some additional pressure on the Dow, as it enters the “Sell in May and go away” period of traditional weakness.

Also, the US Employment Situation report will be released on Friday. Gold has a rough general tendency to decline as that report approaches, and then rise in the days following the release of the numbers.

That’s the hourly bars chart for gold. A week ago, I suggested that sentiment had become overly bearish, and a “barbeque of the gold shorts” was possible.

That event occurred on Friday. More than 50,000 contracts changed hands, in just one hour of trading. Gold now seems to be forming an inverse head and shoulders bottom pattern, and that’s good news for bullish investors.

That’s the weekly chart. A lot of gold investors have told me they are concerned about a “break” of the $1180 area lows. Do they realize that the entire $1044 - $1260 price area is a major support zone?

That’s a longer term look at the weekly chart. All that I see on that beautiful chart is one huge layer of support after another! Investors should be confident that demand for gold is rock solid.

Another concern making the rounds amongst investors is centred on the recent WGC (World Gold Council) suggestion that about 1000 tons of Chinese gold has been used for suspect financing.

I disagree, and ANZ Bank’s chief economist for Greater China, Liu Li-Gang, weighs in on the issue this morning, with this powerful statement, “…gold loans can only be given to companies that have genuine gold demand, for example, the jewellery companies.” - China Money Network, April 29, 2014.

While the Chinese central bank may not have secretly diversified its reserves into gold, Liu Li-Gang also suggests that diversification is coming, and it will increase gold demand significantly.

Some bank economists are touting the recent decline in the yuan against the dollar as bearish for gold. The economists worry that this situation creates a decline in the gold purchasing power of Chinese citizens.

The reality is that the decline has been very minor, and China imported about 80 tons of gold in March. Bloomberg News calls that a “decline”. To view the entire Bloomberg article, please click here now.

It’s important to understand that gold had fallen from about $1800 to $1500 last March. That represented a quick $300 price sale, so imports surged to about 130 tons. 80 tons for March 2014 is a very solid number.

Together with local production, Chinese gold demand for the month is probably about 110 to 120 tons. That’s very supportive for the price.

Also, any minor decline in the Yuan may be overshadowed by a potential outright collapse of the dollar, against the Indian rupee. That’s the daily line chart, and the dollar appears to be heading towards a bit of a cliff, after stalling at significant resistance.

The rupee is the currency of the world’s most significant gold buyer class, the citizens of India. The vote count for the country’s election is only about two weeks away. This election could usher in an era of development that ultimately sees India surpass China as a financial power.

As Indians get a higher standard of living, they’re likely to buy exponentially more gold.

So, the Western gold community has very little to fear. A gold bull era is underway, and mining companies have taken significant steps to become much more profitable. For gold stock investors, that decreases risk and increases potential reward. Significant dividends could be paid by mining companies at only modestly higher gold prices. The time to lock in those potential yields is now, and I’m doing it myself with some size.

That’s the GDX daily chart. While the price isn’t soaring, it does feel very solid. $28 is my “Launchpad” number, and I think that once this week’s “economic reports mayhem” is over, gold stocks will climb towards that key area. The Stokeillator oscillator is highlighted at the bottom of the chart. It’s showing a bullish crossover, and it’s in a rising trend.

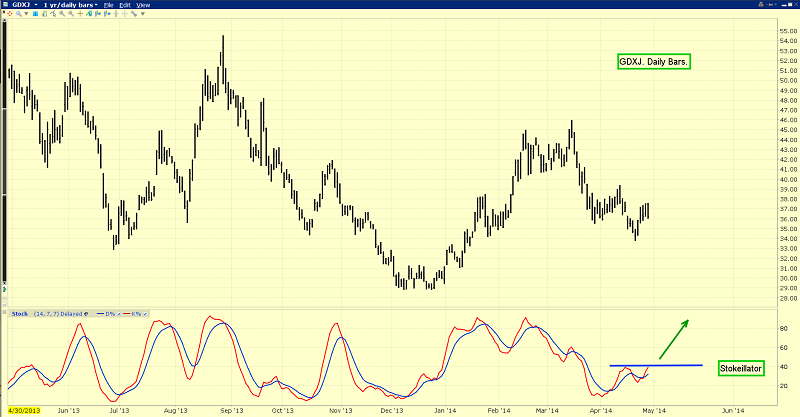

That’s the daily GDXJ chart. It also pays a decent dividend. If payouts are increased later, as prices rise, that could significantly increase the yield on purchases made now. Watch the 40 area on the Stokeillator at the bottom of the chart. After the jobs report is released on Friday, a major upside breakout could come into play!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Big Base Metals” report! I’m expecting a powerful upturn in the Chinese economy to shock analysts, and create a surge in base metal stocks. I’ll show the stocks I’m focused on, to profit from this event!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: